In a fresh bullish call on Carvana (CVNA), Wedbush Securities is urging investors to “take advantage” of the recent weakness, upgrading CVNA stock from “Neutral” to “Outperform” and raising the 12-month price target to $400. Analyst Scott Devitt says the selloff — driven by CarMax’s (KMX) soft results and broader credit-market concerns — has pushed CVNA’s valuation near the low end of its two-year range.

With management delivering several quarters of strong growth, Wedbush believes Carvana will surpass CarMax in used-car unit volume sooner than expected, reach 3 million annual retail sales by 2033, and expand adjusted EBITDA margins to 12% by 2027.

Carvana’s recent quarter saw record revenue and a 44% surge in vehicles sold, but margin pressure temporarily sent shares lower. With that in mind, let’s explore whether this former “meme stock” could be ready to reassert itself as a major player — possibly even overtaking rivals — and whether this is a real “buy the dip” opportunity.

About Carvana Stock

Carvana is an e-commerce company that operates as a fully online used-car retailer. Headquartered in Tempe, Arizona, Carvana enables customers to browse, finance, purchase, trade in, and arrange delivery or pickup of used cars via its website or app, bypassing traditional dealership infrastructure.

Originally founded in 2012, Carvana has transformed the used-car market through innovations such as its famous car “vending machines,” 360° virtual vehicle tours, and an integrated logistics, inspection and reconditioning network. Carvana’s market capitalization stands at $86.7 billion.

2025 has been a wild ride for Carvana. After hitting a 52-week high of $413.33 in late July, CVNA stock has since pulled back. Today’s price sits 4% below that peak, although comfortably above the 52-week low of $148.25.

Over the course of the year, CVNA has delivered a strong comeback and handed sharp gains to early 2025 investors — a reflection of renewed optimism in its business model.

Much of the recent volatility can be traced to the broader tremors in the used-car and auto-credit markets. Investors initially cheered Carvana’s record vehicle-sales figure and improving reconditioning and logistics capabilities, a sign that its online-first used-car retail model is gaining momentum.

But profit-margin pressure, concerns over auto-loan delinquency rates, and cautious forward guidance triggered some profit-taking after earnings, dragging shares from their highs. However, CVNA stock is still up 53% over the past year and a solid 96% year-to-date (YTD).

Yet, CVNA still carries the aura of a former “meme stock.” It once drew speculative fervor during hype cycles, soared on sentiment, fell hard when fundamentals failed to match expectations, and now appears to be straddling the line between growth-stock exuberance and a more mature, execution-driven business. That legacy of volatility and drama seems to remain a part of its appeal.

Despite the slump from its highs, CVNA stock is currently trading at a premium compared to industry peers at 78 times earnings.

Record Topline Numbers

In the quarter ended Sept. 30, Carvana posted one of its strongest quarters ever. The company sold 155,941 retail units, up 44% year-over-year (YOY), and generated $5.6 billion in revenue, a 55% increase compared to the same period last year. Both of these were all-time quarterly records.

Net income came in at $263 million (4.7% margin) and adjusted EBITDA hit $637 million (11.3% margin), again marking record profitability for the business, compared to $148 million in net income and $429 million in adjusted EBITDA. Carvana has now surpassed a $20 billion revenue run-rate, underlining the scale of its operations.

Beyond the headline numbers, there were several strategic developments in Q3 that stood out. For one, Carvana appears to be scaling its operational infrastructure. Its reconditioning capacity and logistics throughput were expanded, which likely supported the sharp rise in deliveries and helped fuel the record retail-unit volume.

On the customer-facing side, Carvana is doubling down on convenience as the company has accelerated its delivery infrastructure, including same-day or next-day delivery in markets such as Phoenix, which enhances its value proposition compared to traditional dealerships.

That said, the quarter was not without caveats. While revenue and unit sales exceeded expectations, adjusted EBITDA margin slipped slightly from 11.7% a year ago to 11.3%.

EPS came in at $1.03 — up from $0.64 in Q3 2024 but below the analyst estimate. That shortfall triggered some market disappointment and a 14% share-price retreat on Oct. 30.

Carvana offered guidance that is cautiously optimistic. For the fourth quarter, management expects retail units sold to stay above 150,000. For full-year 2025, management reaffirmed adjusted EBITDA at or above the top end of their previous $2 billion to $2.2 billion range.

Analysts remain optimistic, as they predict EPS to be around $4.85 for fiscal 2025, up 375% YOY, before surging by another 52% annually to $7.39 in fiscal 2026.

What Do Analysts Expect for Carvana Stock?

Analysts’ sentiments are turning bullish for Carvana. Apart from Wedbush analysts, Jefferies reaffirmed a “Buy” rating on Carvana with a $475 price target. Jefferies noted steady retail unit growth. The firm believes that if momentum holds through November and December, Carvana’s Q4 retail unit growth could reach 42%.

Citizens also reaffirmed a “Market Outperform” rating and $460 price target on Carvana after touring the company’s Haines City, Florida reconditioning center. Citizens also pointed to Carvana’s improving profitability, strong customer experience, and scale advantages, including faster turn times and same-day delivery, which support robust returns on equity and invested capital as well as strengthen the retailer’s long-term competitive edge.

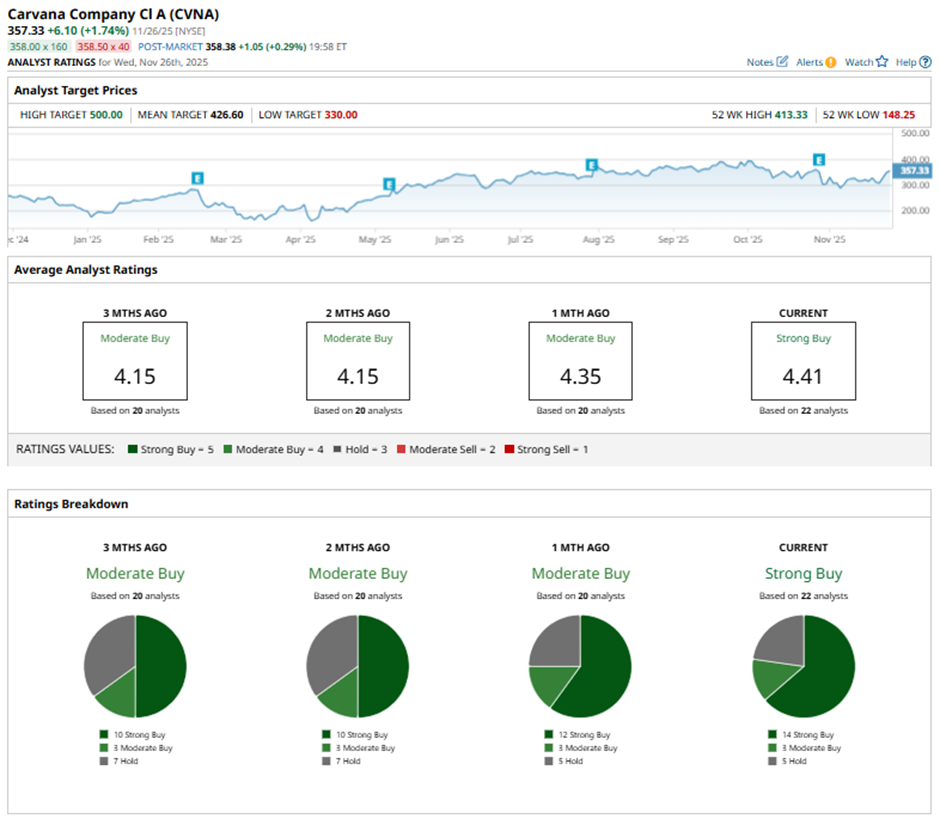

Wall Street is majorly bullish on CVNA. Overall, CVNA stock has a consensus “Strong Buy” rating. Of the 23 analysts covering the stock, 15 advise a “Strong Buy,” three suggest a “Moderate Buy,” and the remaining five analysts are on the sidelines with a “Hold” rating.

The average analyst price target for CVNA is $427.71, indicating potential upside of 7%. The Street-high target price of $500 suggests that the stock could rally as much as 25%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Former Penny Stock Just Doubled for the Second Time This Week. Should You Chase the Rally Here?

- 3 High-Yield Stocks to Invest in Oracle’s AI Growth with Less Volatility

- iPhone Revenue Just Jumped 40%. Should You Buy AAPL Stock Here?

- Google Is Riding the AI Wave Higher, but the Real Winner of Gemini 3 Is This Stock