After-tax NPV8 of US$1.1B based on Mineral Reserves

TORONTO, ON / ACCESS Newswire / November 6, 2025 / Aclara Resources Inc. ("Aclara" or the "Company") (TSX:ARA) is pleased to announce the filing and results of the pre-feasibility study (the "PFS") of the Company's flagship asset, the Carina Project ("Carina" or the "Project") based on Mineral Reserves. The PFS, titled "NI 43-101 Technical Report & Pre-feasiblity Study on the Carina Project, Goiás, Brazil" with an effective date of October 22, 2025, was prepared and consolidated in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") by by Hatch Consultoria em Projetos Ltda. ("Hatch"). Other engineering companies that participated in the preparation of the PFS include L&M Geociencias SpA, Promet 101 Consulting Pty Ltd, Abelco Consulting SpA, LOM Consultoria em Mineração Ltda, F&Z Consultoria e Projetos, ERM Consultants Canada Ltd and Argus Media Ltd ("Argus Media").

There are no differences between the mineral resources described in the PFS and those previously disclosed in the Mineral Resource Statement press release issued by the Company on October 1, 2025. The terms "Mineral Resource," "Inferred Mineral Resource," "Indicated Mineral Resource," "Measured Mineral Resource," "Mineral Reserve," "Probable Mineral Reserve," and "Proven Mineral Reserve" referenced in this news release, have the meanings given to them in NI 43-101 by reference to the "Definition Standards for Mineral Resources and Mineral Reserves" (2014) of the Canadian Institute of Mining and Metallurgy.

The PFS has been filed and can be found under the Company's profile on SEDAR+ ( www.sedarplus.ca ) and on Aclara's website ( www.aclara-re.com ).

Aclara's COO, Hugh Broadhurst, commented:

"The results of this Pre-Feasibility Study mark a defining milestone for Aclara, we are the first company in the world to publish heavy rare earth Mineral Reserves from ionic clays in accordance with NI 43-101. The depth of data, quality of engineering, and validation through pilot-scale operations give us strong confidence as we move into the feasibility stage and prepare for early works in H1 2026. Carina's proven process, high-purity product, and sustainable design position us to deliver one of the most responsible and competitive sources of heavy rare earths globally, supporting Aclara's integrated mine-to-magnet proposal."

Highlights

Strong Economics

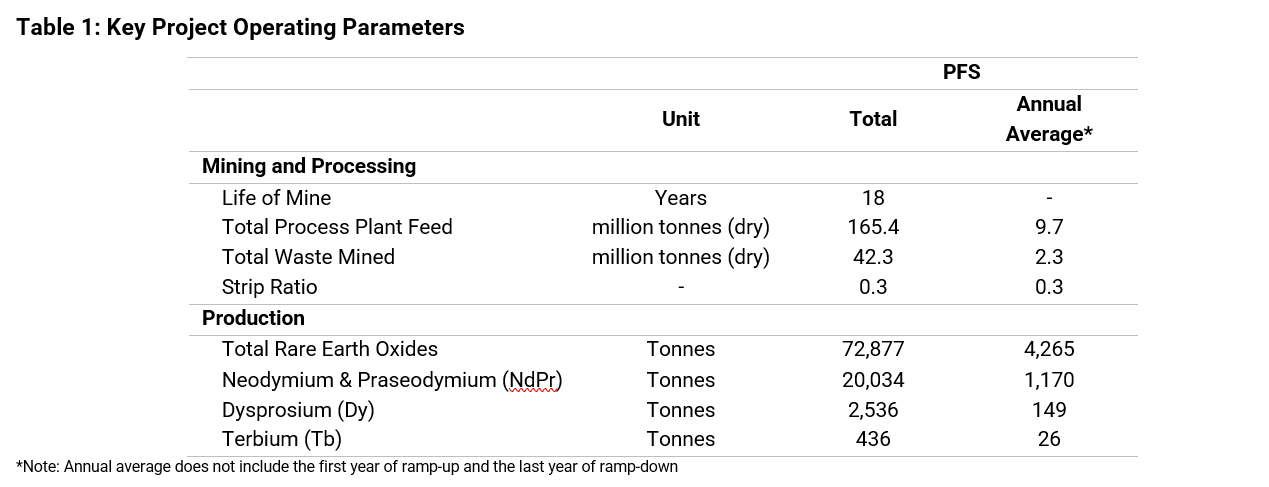

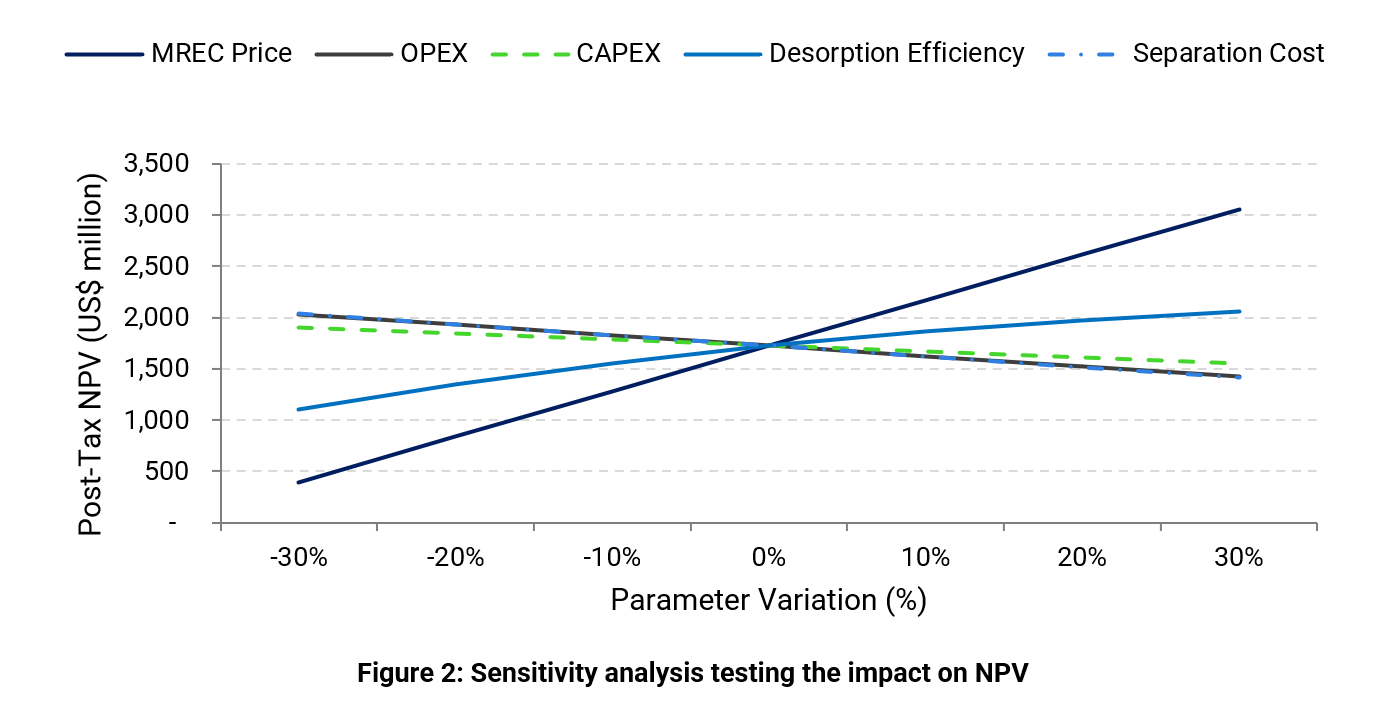

After-tax Net Present Value ("NPV") of approximately US$1.1 billion, using an 8% discount rate and price forecasts provided by Argus Media.

Internal Rate of Return ("IRR") of 22% over an 18-year Life of Mine ("LOM"), with a payback period of 4.5 years.

Initial capital cost ("Construction Capex") of US$548.3 million, plus a US$132.2 million contingency, for an aggregate of US$680.5 million. This figure includes US$64.3 million in local taxes and generates US$51.2 million in tax credits, which are fully recovered in the first year of operation.

An average annual commercial [1] discount of US$196 million - equivalent to 29% of the annual gross revenue - has been applied to account for the full separation of the Carina Project's mixed rare earth carbonate ("MREC"). Aclara's plans consist of paying this separation fee to its separation project in Louisiana. The NPV associated with Aclara's future separation facility in Louisiana is not included in the PFS.

Average annual net revenue 1 of US$487 million and average annual earnings before interest, depreciation, and amortization ("EBITDA") 1 of approximately US$352 million.

High average Net Smelter Return (NSR) of US$49.5 per tonne processed, against a low average production cost of US$13.0 per tonne processed.

The price forecast scenario developed by Argus Media is based on the European price index (excluding China).

Significant Production of HREEs and Light Rare Earths (LREEs)

Average annual production 1 of 4,265 tonnes rare earth oxides ("REO") contained in an MREC product with very high content of DyTb and NdPr of 4.1% and 27.5%, respectively.

-

Average annual production 1 of magnetic elements as well as other strategic HREEs contained in the MREC product:

149 tonnes Dysprosium (Dy) and 25 tonnes of Terbium (Tb);

1,170 tonnes Neodymium and Praseodymium (NdPr); and

Other strategic HREE: 170 tonnes of Samarium (Sm), 171 tonnes of Gadolinium (Gd), 10 tonnes of Lutetium (Lu) and 1,098 tonnes of Yttrium (Y).

Carina's future production of DyTb will represent 11% of China's 2024 official DyTb production [2].

High Confidence in the Production Forecast, the Process Flowsheet and the Product Quality

High geological confidence supported by 24,564 meters (m) of drilling across 1,682 drillholes, representing approximately a 500% increase in drilling compared to the previously reported Inferred Mineral Resource statement on August 6, 2024. Carina has become the first ionic clay project to declare Mineral Reserves in accordance with NI 43-101.

Successful completion of the Project's representative pilot campaign at its semi-industrial scale facility in Goiânia, Brazil. This marks the third pilot campaign conducted by Aclara over the past three years, focused on optimizing OPEX and CAPEX, and validating the process parameters and robustness of its proprietary Circular Mineral Harvesting process.

Increased the quality of Carina's MREC from 91.9% to over 95.0% purity (97.7% according to the design mass balance) [3] supported by samples produced at semi-industrial scale plant.

Circular Mineral Harvesting process designed to minimize environmental impact: it does not use explosives; there is no crushing nor milling; approximately 95% of the water used is recirculated; the main reagent is a common fertilizer and is recirculated with 99% efficiency; and no requirement for a tailings dam.

Minimal carbon footprint is supported by a combination of low energy consumption, elimination of explosives, crushing, grinding and milling and a high percentage of renewable energy within the Brazilian power grid.

Expedited Path to Early Production

A Memorandum of Understanding dated August 19, 2024 has been signed with the State of Goiás and Nova Roma Municipality in Brazil to accelerate the implementation of the Project.

The Project's environmental license (or Previous License, as it is known in Brazil) was submitted in May and is currently under evaluation by the State of Goiás.

The Company plans to start early works on site by mid-2026 as part of the Construction Capex. These include camp construction, roads improvements and certain ancillary infrastructure to prepare the site for full fast-track construction in 2027.

Commissioning is estimated to commence in H2 2028 with initial production and ramp-up through 2029. The Company is evaluating the possibility of expediting the schedule to begin initial production by mid-2028 depending on offtake agreements and access to financing.

Mine to Magnet Solution: Strong Bedrock for Integration with Aclara's Processing Hub in Louisiana

The Project's high-purity MREC has been designed to facilitate further processing into individual rare earth oxides at Aclara's future separation facility in Louisiana.

Aclara, through Aclara Metals' (a subsidiary of the Company) 50/50% joint venture with CAP S.A. ("CAP"), plans to convert the resulting Dy, Tb and NdPr high-purity oxides to metals and alloys under the specifications of magnet manufacturers.

Downstream processing is complemented by a strategic alliance with permanent magnet manufacturer Vacuumschmelze ("VAC") aimed at developing a complete mine to magnet solution.

Strong Financial Backing

Key shareholders Hochschild Group and CAP provide significant operational experience and financial support to continue advancing the Project.

U.S. International Development Finance Corporation ("DFC") has committed up to US$5 million in project development funding for the Project's feasibility study and has a preferential option to further invest in the Project when the Company seeks to raise additional financing of more than US$50 million in a single transaction, or US$75 million or more in multiple financing events within a period of twelve (12) months.

Key Project Parameters

Table 1 and Table 2 summarize the relevant parameters associated with the PFS operating and financial metrics:

The PFS is based on Mineral Reserves.

The after-tax NPV is estimated at US$1.1 billion, using an 8% discount rate.

-

The REE price forecast provided by Argus Media based on European prices (excluding China) aligns well with market environment of export restrictions from China on HREEs [1] and future supply/demand dynamics.

LOM average realized prices were assumed at US$3,941/kg for Tb, US$2,054/kg for Dy, and US$118.7/kg for NdPr.

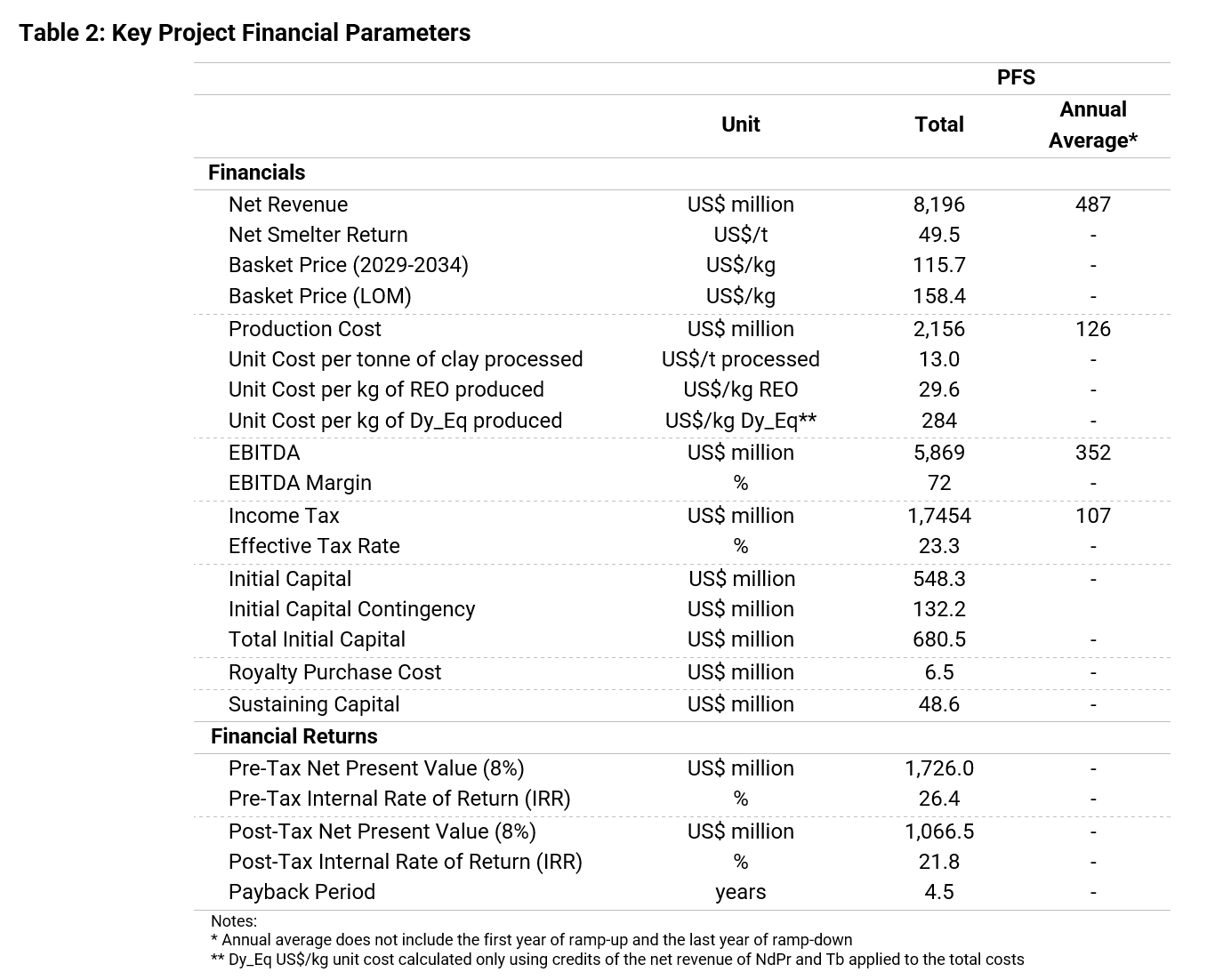

Post-Tax Free Cash Flow

Figure 1 demonstrates the yearly and cumulative post-tax free cash flow generated through the LOM.

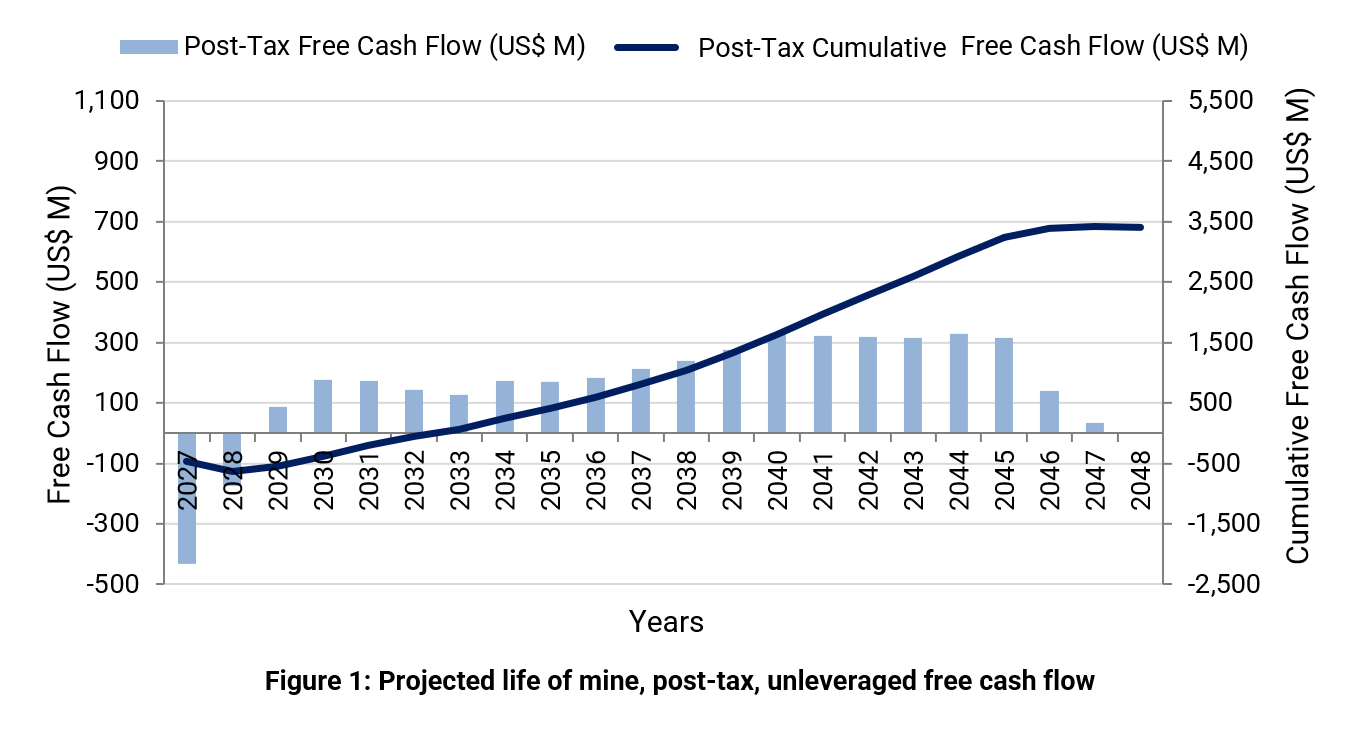

Sensitivity Analysis

A sensitivity analysis was undertaken to evaluate the impact on after-tax NPV, considering a variation of ±30% for five key input variables: MREC sale price, Separation Cost, Desorption Efficiency, OPEX and CAPEX (Figure 2).

The economic analysis of the estimated cashflows for the Project indicates the potential for an economic project across a broad range of input assumptions. The NPV calculated at an 8% discount rate is positive, and the Internal Rate of Return calculated for the project is within a favourable range.

The primary commercial risks include:

The applied REE price forecast could be significantly different than modeled. The applied European price forecast developed by Argus Media assumes an independent supply chain outside of China. The supply chain outside of China is not yet fully developed and China could influence the market through government intervention which could significantly lower prices relative to those applied in the economic analysis.

The applied separation cost is based on an incentive price estimate for Aclara's separation project in the United States, calculated based on FEL1-level engineering capital and operation costs. There is a risk that these capital and operating costs will increase as the separation project is completed, which will increase the separation cost charged to the Project.

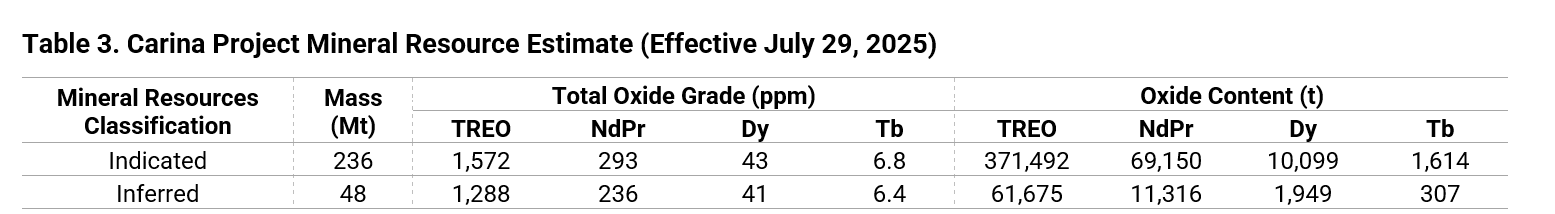

Mineral Resource Statement

The Project's Mineral Resources have been estimated using the results obtained from 24,564 meters (m) of drilling across 1,682 drillholes and 14,001 samples. The MRE is reported in accordance with the requirements of NI 43-101.

Notes:

Mass is expressed in million tonnes (dry, metric).

TREO means total rare earth oxides (La2O3, CeO2, Pr6O11, Nd2O3, Sm2O3, Eu2O3, Gd2O3, Tb4O7, Dy2O3, Ho2O3, Er2O3, Tm2O3, Yb2O3, Lu2O3, and Y2O3).

NdPr means neodymium and praseodymium (Nd2O3 and Pr6O11).

Dy means dysprosium (Dy2O3) and Tb means terbium (Tb4O7).

Mineral Resources were reported at a Net Smelter Return (NSR) cut-off of 10.0 US$/t, constrained within a conceptual pit shell using average long term metal prices and metallurgical recoveries, both outlined in Chapter 14.

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Mineral Resources are reported inclusive of Mineral Reserves. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing or other relevant issues.

The PFS Mineral Resource estimate was prepared by Andres Beluzan, Member of Chilean Mining Commission, an independent Qualified Person as defined by NI 43-101.

Totals may not be balanced due to rounding of figures.

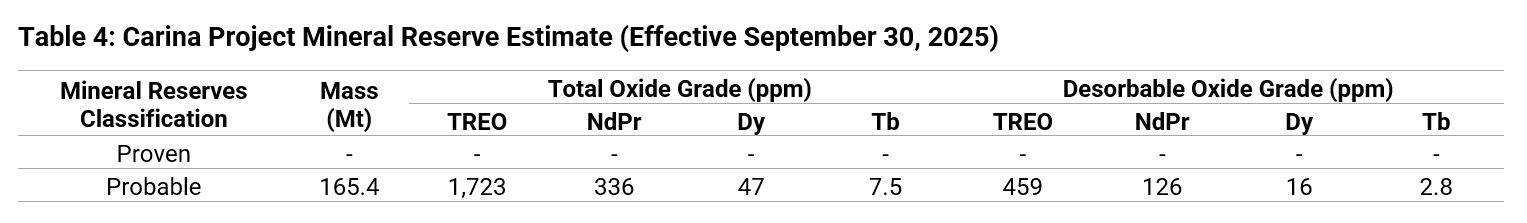

Mineral Reserves Statement

Mineral Reserves, which include the identified economic portion of the Indicated Mineral Resources, were estimated by LOM Consultoria em Mineração Ltda ("LOMC") for the Project as part of the PFS. At this stage, Measured Mineral Resources are not classified in the resource model.

To convert Mineral Resources to Mineral Reserves, consideration was given to forecasts and estimates of REE prices, metallurgical recovery, mining dilution and ore loss factors, royalties and costs associated with mining, processing, overheads, and logistics. These parameters were used to derive economic cut-offs and create a feasible pit design based on geotechnical assumptions, a production schedule and a financial model. It is LOMC's opinion that the Mineral Reserve estimation is compliant with NI 43-101.

Notes

The REE prices assumed are: US$96.00/kg Pr oxide, US$96.00/kg Nd oxide, US$3,056.00/kg Tb oxide, US$829.00/kg Dy oxide.

An exchange rate of R$5.75 to US$1.00 is assumed.

Mineral Reserves are based on Indicated Mineral Resources only. At this stage, Measured Mineral Resources are not classified in the model.

The economic cut-off was calculated cell-by-cell as ore/waste mining costs vary with haul distances. For equal haul distance, the economic NSR cut-off is US$9.27/t.

2% dilution and 98% mining recovery factors were applied to grades and tonnages, respectively.

The mineral Reserve is included in the mineral Resource.

The economic model demonstrates that, under the metal prices assumed for the pit optimization, the Project provides a positive NPV which confirms the economic viability of the Mineral Reserves.

Project Description

The Project is based on standard open pit extraction techniques using 95-tonne hydraulic excavators and 75-tonne payload haulage trucks to extract and deliver the clays to the process plant. The process plant has been located close to the center of mass of the mining operation to minimize the total haulage distance over the LOM. Given the friable nature of the clays and the shallow depth of the extraction zones, no aggressive nor energy-intensive techniques such as drilling and blasting are required to extract the clays from the pits.

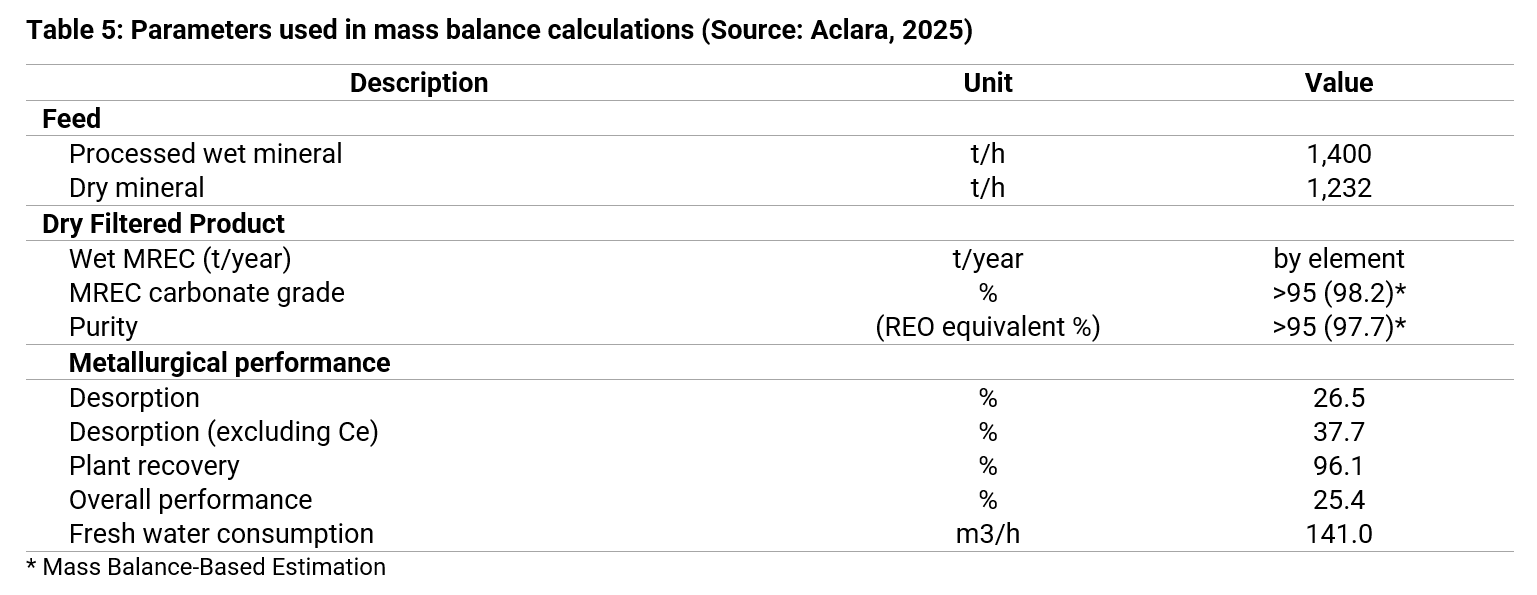

Once the clay is delivered to the process plant, it will be washed using an ammonium sulfate solution to extract the REEs from the clay surfaces. No crushing, grinding nor milling is needed to free the REEs from the clays as they are extracted through a non-invasive ion-exchange process whereby ammonium sulfate ions replace REE ions on the surface of the clay thereby liberating the REEs into solution. The REEs in solution are then isolated through a pH-adjusted precipitation process and then passed through a high-pressure filter to remove any remaining liquids. This results in the production of a high-purity REE carbonate ready for shipment to our separation facility in Louisiana. The process plant will have an average production rate [1] of 4,265 t/year of REO within the MREC at 90% availability.

Any unwanted impurities such as aluminum and calcium extracted from the clays during the ion exchange process are removed through a precipitation process and subsequently recombined with the washed clays before being transported to a deposition zone which is a filter-stack storage facility.

An integrated water recovery system cleans and regenerates the remaining process liquors so they can be reintroduced into the feed. The treated water is recycled in a closed circuit to reduce water consumption. This allows the process plant to operate with minimum make-up water and for the main reagents to be regenerated and reused within the process plant.

Before the clays exit the process plant, they are washed with clean water within standard plate-and-frame membrane filter presses. The wash removes any residual ammonium sulfate from the clays before they are returned to the deposition zone or used to back-fill the extraction zones for revegetation. Table 5 lists the key process design criteria used in the mass balance calculations.

The Project includes the necessary infrastructure to provide make-up water for the process plant, supply power to the site, and provide a road network to service the operation, amongst others.

Electrical power for the processing plant, truck shop, administration offices, and other facilities will be supplied by a dedicated transmission line designed to ensure stable and efficient energy delivery. This line operates at a nominal voltage of 230 kV and is fed from a sub-station located approximately 100 km from the project site.

Work on environmental and social studies will continue to assist in further defining mitigations which will be integrated into the Project engineering design and throughout life of mine. The studies underway are consistent with Brazilian regulations and International leading sustainability principles. Engagement with local communities and residents in the vicinity of the Project is underway to establish working relationships and to collaboratively understand local conditions which will inform the development and implementation of programs and mitigations.

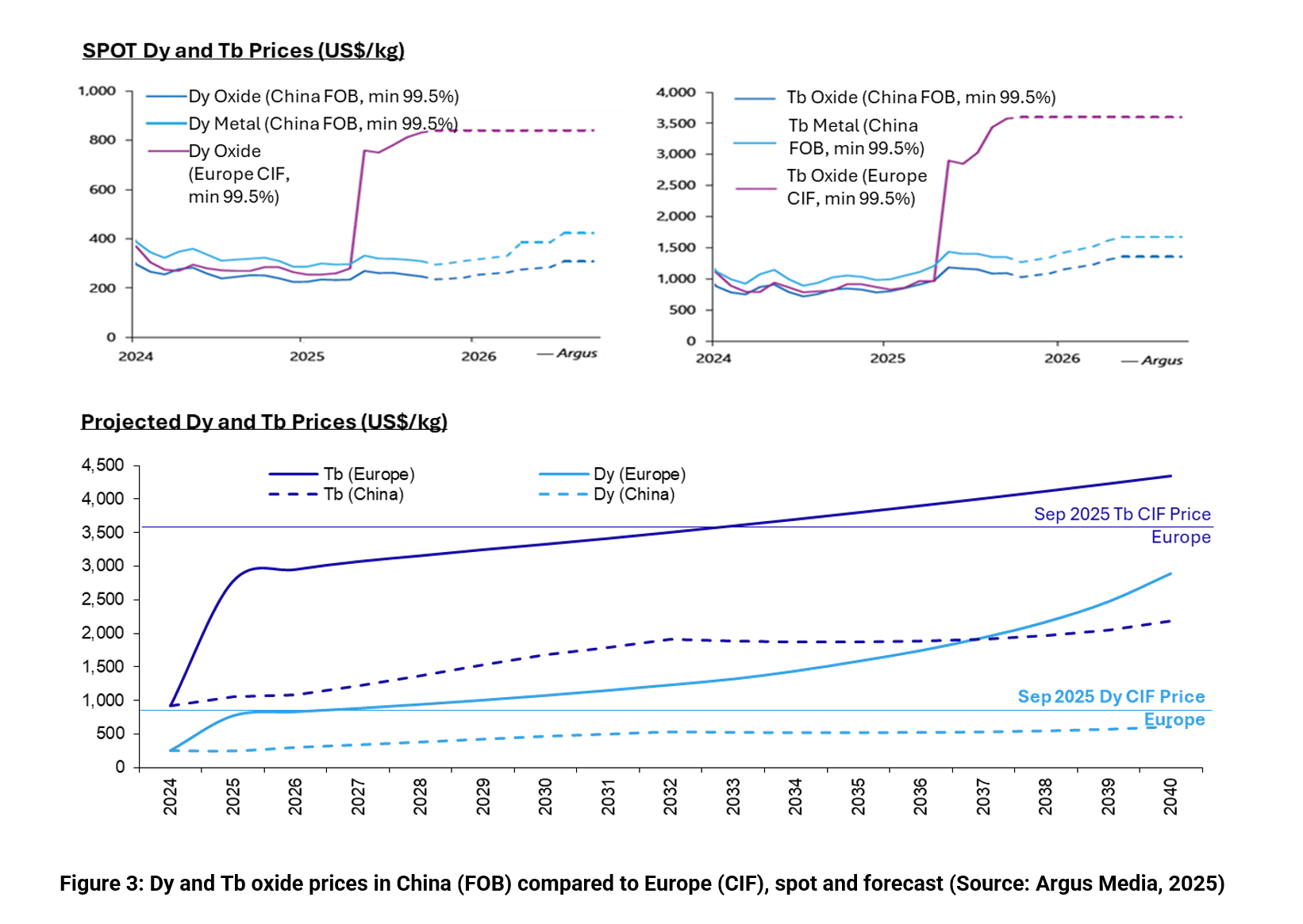

REE Market Outlook and Pricing (Source: Argus Media)

Based on the work of Argus Media [1] , vehicle electrification and the transition to renewable energy will continue to drive the REE market in terms of volume and (especially) value. Demand will increase for the REEs used in permanent magnets (REE PMs): neodymium (Nd), praseodymium (Pr), dysprosium (Dy), and terbium (Tb) oxides. When growth in the electric vehicle and renewable energy industries begins to plateau, the industrial and humanoid robotics sector and drone technology are likely to continue boosting REE PM demand in the long term.

The supply of the LREEs, Nd (primarily) and Pr (to a lesser extent), from existing producers and new projects appears to be sufficient to satisfy demand until at least the end of the decade. However, the supply of the HREEs, Dy and Tb, as well as the HREEs gadolinium (Gd) and yttrium (Y) is more problematic as far fewer projects target HREE deposits. The market will likely have to rely on China and Myanmar/Laos in the short to medium term for supply of HREE feedstocks, although production of ion-adsorption REE ores in southern China is declining.

In early April, China extended its export control scheme to include Dy, Tb, Gd, Y, lutetium (Lu), samarium (Sm), and scandium (Sc), likely in retaliation against the reciprocal tariffs announced by the United States president on April 2, 2025. The effect on European REE prices was immediate: Argus Media's European assessments for Dy, Tb, and Y prices rose to nearly 3, 2.5, and 7 times higher than Chinese prices, respectively. At the end of July 2025, Dy prices had reached US$750-860/kg (compared to US$225/kg in China), and Tb prices were US$2,800-3,500/kg (compared to US$985/kg in China). Y prices soared to US$60/kg-nearly 9 times higher than domestic Chinese prices.

Nd prices in Europe have continued to track the Chinese free on board (FOB [2] ) prices because Nd was not a product subject to export controls. However, the 10-year Nd floor price of US$110/kg agreed between the United States Department of War (DOW; formerly the Department of Defense) and the American REE producer MP Materials is likely to raise European Nd prices to these levels as the European Union Critical Rare Materials Act begins to take effect towards the end of the decade. REE prices in Europe are likely to remain high, at least in the short term, given the uncertainty surrounding Chinese exports.

Argus Media has assessed European prices for Nd and Ce oxides and metals since 2012 and Dy, Tb, and Er oxides since 2015. In July 2025, it introduced prices for Pr and NdPr oxides to complete the suite of REE PM materials. Historically, European prices have tracked Chinese FOB prices (with the addition of shipping to reflect the CIF [3] Rotterdam assessment) because most of the material traded in Europe would be of Chinese origin. In the future, it is likely that European prices will decouple from Chinese prices as the supply chains not reliant on China are created and are based on the costs curve for non-Chinese production of REEs. Figure 3 shows the comparison between Chinese FOB prices and European CIF prices for Dy and Tb.

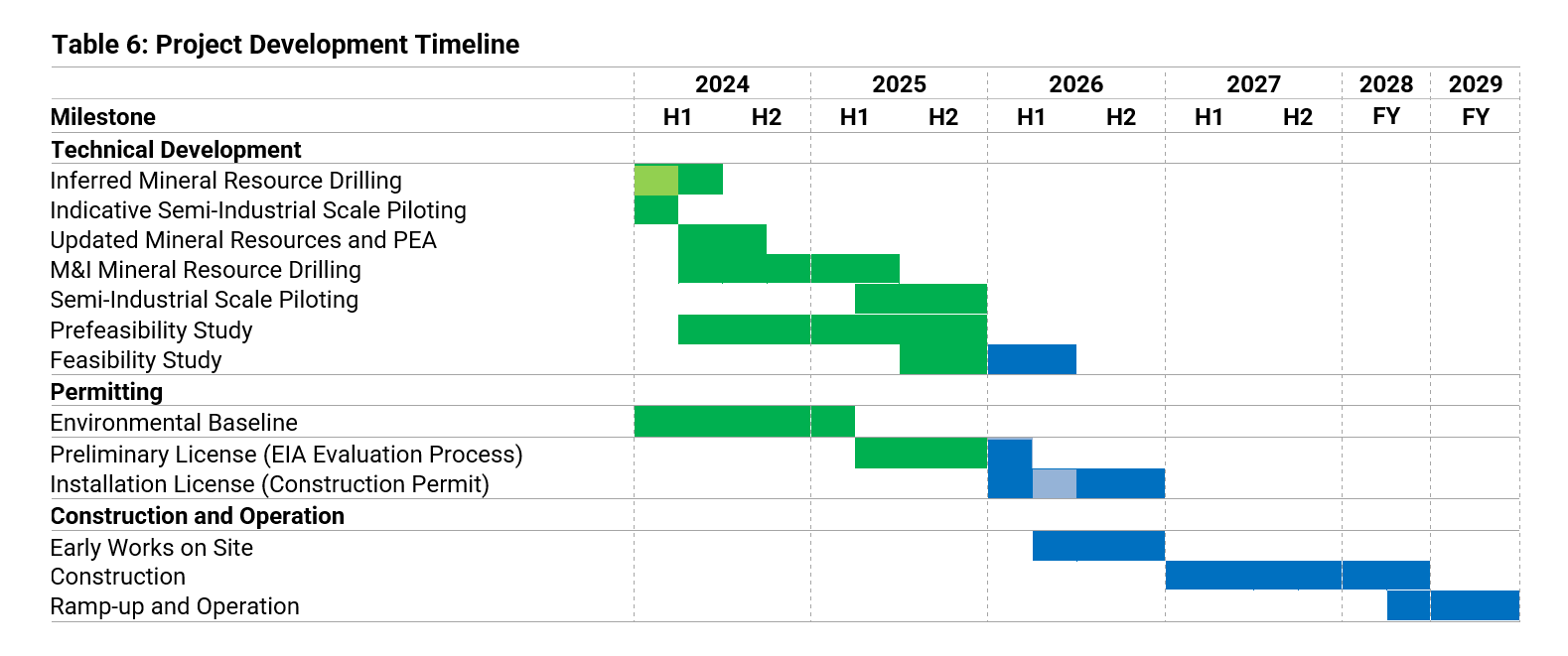

Targeted Development Timeline

The permitting process is currently underway and the technical development is in progress with a feasibility study scheduled to be delivered in Q2 2026 and commencement of operations projected to begin at the end of 2028 (Table 6). The Company is evaluating the possibility to expedite the production schedule to begin by mid-2028.

Proposed Next Steps

Approval of the Preliminary License in Q1 2026

Continuation of the feasibility study aimed to be completed by Q2 2026

Start-up of early works in Q2 2026

Approval of the Installation License between Q3 and Q4 2026

Commencement of construction between Q4 2026 and Q1 2027

Data Verification

Data verification was conducted both internally by Aclara and externally by an independent Qualified Person ("QP"), in accordance with NI 43-101 standards, as described in the PFS.

Qualified Persons

All QPs are independent of Aclara. The scientific and technical information included in this news release and pertaining to the following chapters and sections of the PFS has been reviewed and approved as follows:

Chapters and sections 1.1, 1.2, 1.3, 1.15, 1.17, 2, 3, 4, 5, 6, 18.1 (except 18.1.1), 18.2 (except 18.2.4-5), 18.6 (except 18.6.10), 21.1, 21.2 (except 21.2.1), 25.6, 26.6, 26.7, 27: reviewed and approved by Mr. Tyler Wilson, P.Eng. (Reg. #64321), registered with the Association of Professional Engineers and Geoscientists of the Province of British Columbia (APEGBC), employee of Hatch Ltd. The following sections are excluded from Mr. Wilson's responsibility: 18.1.1, 18.2.4-18.2.5, 18.6.10, and 21.2.1.

Chapters and sections 1.4, 1.5, 1.6, 1.7, 1.8, 1.9, 7, 8, 9, 10, 11, 12, 25.1, 26.1: reviewed and approved by Mr. Luis Oviedo, PC-RR (Reg. #013), registered with the Comisión Calificadora de Competencias en Recursos y Reservas Mineras (Chile), employee of L&M Geociencias SpA.

Chapters and sections 1.10, 1.14, 13, 17, 25.5, 26.5: reviewed and approved by Mr. Stuart Saich, Fellow of the Australasian Institute of Mining and Metallurgy (FAusIMM #222028), employee of Promet 101 Consulting Pty Ltd.

Chapter and sections 1.11, 14, 25.2, 26.2: reviewed and approved by Mr. Andres Beluzan, PC-RR (Reg. #215), registered with the Comisión Calificadora de Competencias en Recursos y Reservas Mineras (Chile), employee of Abelco Consulting SpA.

Chapters and sections 1.12-13, 15, 16, 25.3, 26.3: reviewed and approved by Mr. Paulo Laymen, BEng, MEng (Mining), Fellow of the Australasian Institute of Mining and Metallurgy (FAusIMM #320977), employee of LOM Consultoria em Mineração Ltda.

Chapters and sections 1.15, 1.17, 18.1.1, 18.2.4, 18.2.5, 18.3, 18.4, 18.5, 18.6.10, 21.2.1, 24.4, 25.6, 26.7, 26.4, 26.6: reviewed and approved by Mr. Paulo Franca, Member of the Australasian Institute of Mining and Metallurgy (AusIMM #311775), employee of F&Z Consultoria e Projetos.

Chapters and sections 1.18, 19, 22, 25.9, 26.8: reviewed and approved by Mr. Stefan Hlouschko, P.Eng. (#100185757), registered with the Professional Engineers of Ontario (PEO), employee of Hatch Ltd.

Chapters and sections 1.16, 20, 25.8, 26.7: reviewed and approved by Mr. Rolf Schmitt, Member of the Association of Professional Engineers and Geoscientists of British Columbia (#19824), employee of ERM Consultants Canada Ltd.

About Aclara

Aclara Resources Inc. (TSX: ARA), a Toronto Stock Exchange listed company, is focused on building a vertically integrated supply chain for rare earths alloys used in permanent magnets. This strategy is supported by Aclara's development of rare earth mineral resources hosted in ionic clay deposits, which contain high concentrations of the scarce heavy rare earths, providing the Company with a long-term, reliable source of these critical materials. The Company's rare earth mineral resource development projects include the Carina Project in the State of Goiás, Brazil as its flagship project and the Penco Module in the Biobío Region of Chile. Both projects feature Aclara's patented technology named Circular Mineral Harvesting, which offers a sustainable and energy-efficient extraction process for rare earths from ionic clay deposits. The Circular Mineral Harvesting process has been designed to minimize the water consumption and overall environmental impact through recycling and circular economy principles. Through its wholly-owned subsidiary, Aclara Technologies Inc., the Company is further enhancing its product value by developing a rare earths separation plant in the United States. This facility will process mixed rare earth carbonates sourced from Aclara's mineral resource projects, separating them into pure individual rare earth oxides. Additionally, Aclara through a joint venture with CAP, is advancing its alloy-making capabilities to convert these refined oxides into the alloys needed for fabricating permanent magnets. This joint venture leverages CAP's extensive expertise in metal refining and special ferro-alloyed steels. Beyond the Carina Project and the Penco Module, Aclara is committed to expanding its mineral resource portfolio by exploring greenfield opportunities and further developing projects within its existing concessions in Brazil, and Chile, aiming to increase future production of heavy rare earths.

Forward-Looking Statements

This news release contains "forward-looking information" within the meaning of applicable securities legislation, which reflects the Company's current expectations regarding future events, including statements with regard to: mineral continuity, grade, metallurgical recoveries, methodology, production timing and upside at the Project, the Company's exploration plan, drilling campaigns and activities in Brazil and the expectations of the Company's management as to the timing, cost, scope and results of such exploration works and drilling activities in Brazil, the timing and obtaining of environmental and other Project licenses, the timing and planning of construction works and production schedules, the results and interpretation of the PFS, the expected timing of the filing of a feasibility study for the Project, management's expectations as to production forecasts and product quality for the Project, the continued support and investment of the Company's shareholders and other strategic partnerships, management of the Company's expectations as to market outlook and pricing for REE, the expected timing of approval of the EIA and the expected timing and approval process of the permitting process of the Project. Forward-looking information is based on a number of assumptions and is subject to a number of risks and uncertainties, many of which are beyond the Company's control. Such risks and uncertainties include, but are not limited to risks related to operating in a foreign jurisdiction, including political and economic problems in Brazil; risks related to changes to mining laws and regulations and the termination or non-renewal of mining rights by governmental authorities; risks related to failure to comply with the law or obtain necessary permits and licenses or renew them; compliance with environmental regulations can be costly; actual production, capital and operating costs may be different than those anticipated; the Company may be not able to successfully complete the development, construction and start-up of mines and new development projects; risks related to mining operations; and dependence on the Carina Project. Aclara cautions that the foregoing list of factors is not exhaustive. For a detailed discussion of the foregoing factors, among others, please refer to the risk factors discussed under "Risk Factors" in the Company's annual information form dated as of March 20, 2025, filed on the Company's SEDAR+ profile. Actual results and timing could differ materially from those projected herein. Unless otherwise noted or the context otherwise indicates, the forward-looking information contained in this press release is provided as of the date of this press release and the Company does not undertake any obligation to update such forward-looking information, whether as a result of new information, future events or otherwise, except as expressly required under applicable securities laws.

For further information, please contact:

Ramón Barúa Costa

Chief Executive Officer

investorrelations@aclara-re.com

[1] Annual average does not consider the first year of ramp-up and the last year of ramp-down.

[2] Estimate of China's official production of Dy and Tb in 2024 based on quotas published that year by the Ministry of Industry and Information Technology of the People's Republic of China

[3] Purity is expressed as REO equivalent.

[4] China has reached to an agreement with the United States to remove export restriction on all REE for one year until November 2026.

[5] Annual average does not consider the first year of ramp-up and the last year of ramp-down.

[6] Argus Media is an independent price reporting agency and market intelligence provider specializing in energy and critical minerals. With over 15 years of rare earths market, Argus Media delivers transparent benchmark pricing, supply-demand analysis, and long-term forecasts. Argus Media' independent data and expertise support accurate market assessments for project evaluations.

[7] Free on board (FOB) prices are associated with a seller who is responsible for the goods until they are loaded onto the ship or other transport vehicle at a specific location.

[8] Cost, Insurance, Freight (CIF): Under CIF terms, the seller arranges and pays for the cost of transporting the goods to the named port of destination, including insurance and freight charges. However, the risk of loss or damage to the goods transfers from the seller to the buyer once the goods are loaded onto the vessel at the port of shipment.

SOURCE: Aclara Resources Inc.

View the original press release on ACCESS Newswire