General Mills, Inc. (GIS), headquartered in Minneapolis, Minnesota, manufactures and markets branded consumer foods sold through retail stores. With a market cap of $24.6 billion, the company offers grain, ready-to-eat cereals, refrigerated yogurt, soup, meal kits, refrigerated and frozen dough products, dessert and baking mixes, among others.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and GIS perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the packaged foods industry. General Mills’ strength lies in its iconic brands, such as Cheerios and Nature Valley, built on 150+ years of quality and trust. This drives premium pricing power and consumer loyalty. Its efficient supply chain, innovative products, and strategic joint ventures expand its global reach. Its grain merchandising operations help manage costs and ensure quality.

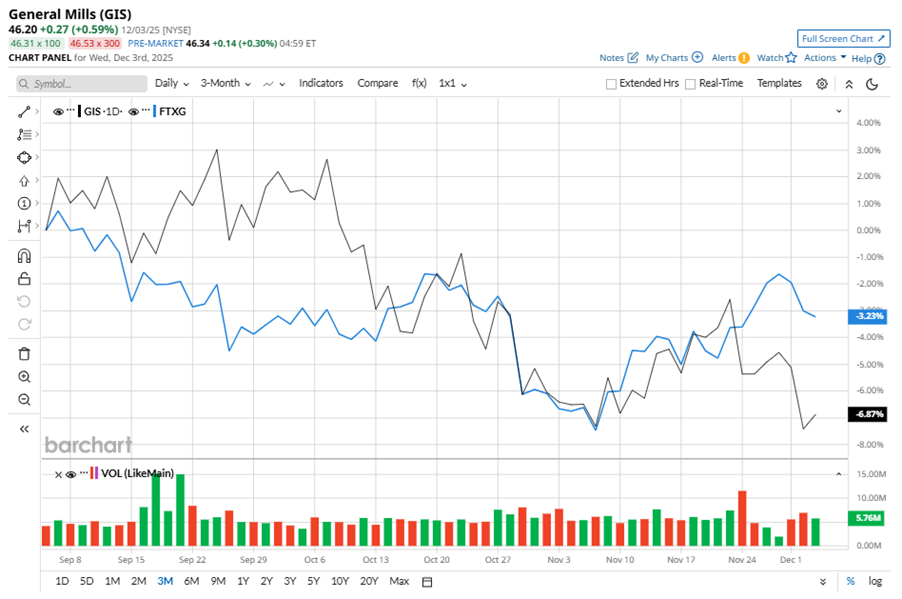

Despite its notable strength, GIS slipped 31.5% from its 52-week high of $67.40, achieved on Dec. 2, 2024. Over the past three months, GIS stock declined 7.1%, underperforming the First Trust Nasdaq Food & Beverage ETF’s (FTXG) 3.5% dip during the same time frame.

In the longer term, shares of GIS fell 14.9% on a six-month basis and dipped 30.3% over the past 52 weeks, underperforming FTXG’s six-month dip of 5% and 12.3% losses over the last year.

To confirm the bearish trend, GIS has been consistently trading below its 50-day and 200-day moving averages over the past year, with slight fluctuations.

GIS is struggling with declining sales, government scrutiny of pricing, and shifting consumer preferences toward private-label alternatives. Sales are expected to drop 3.3% over the next 12 months, driven by falling volumes in core categories such as cereals and snacks. This has investors worried, causing the stock to underperform.

On Sep. 17, GIS shares closed down marginally after reporting its Q1 results. Its adjusted EPS of $0.86 surpassed Wall Street expectations of $0.81. The company’s revenue was $4.52 billion, exceeding Wall Street's $4.50 billion forecast.

In the competitive arena of packaged foods, Kellanova (K) has taken the lead over GIS, showing resilience with a 1.6% uptick on a six-month basis and 3.2% gains over the past 52 weeks.

Wall Street analysts are cautious on GIS’ prospects. The stock has a consensus “Hold” rating from the 19 analysts covering it, and the mean price target of $53.79 suggests a potential upside of 16.4% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart