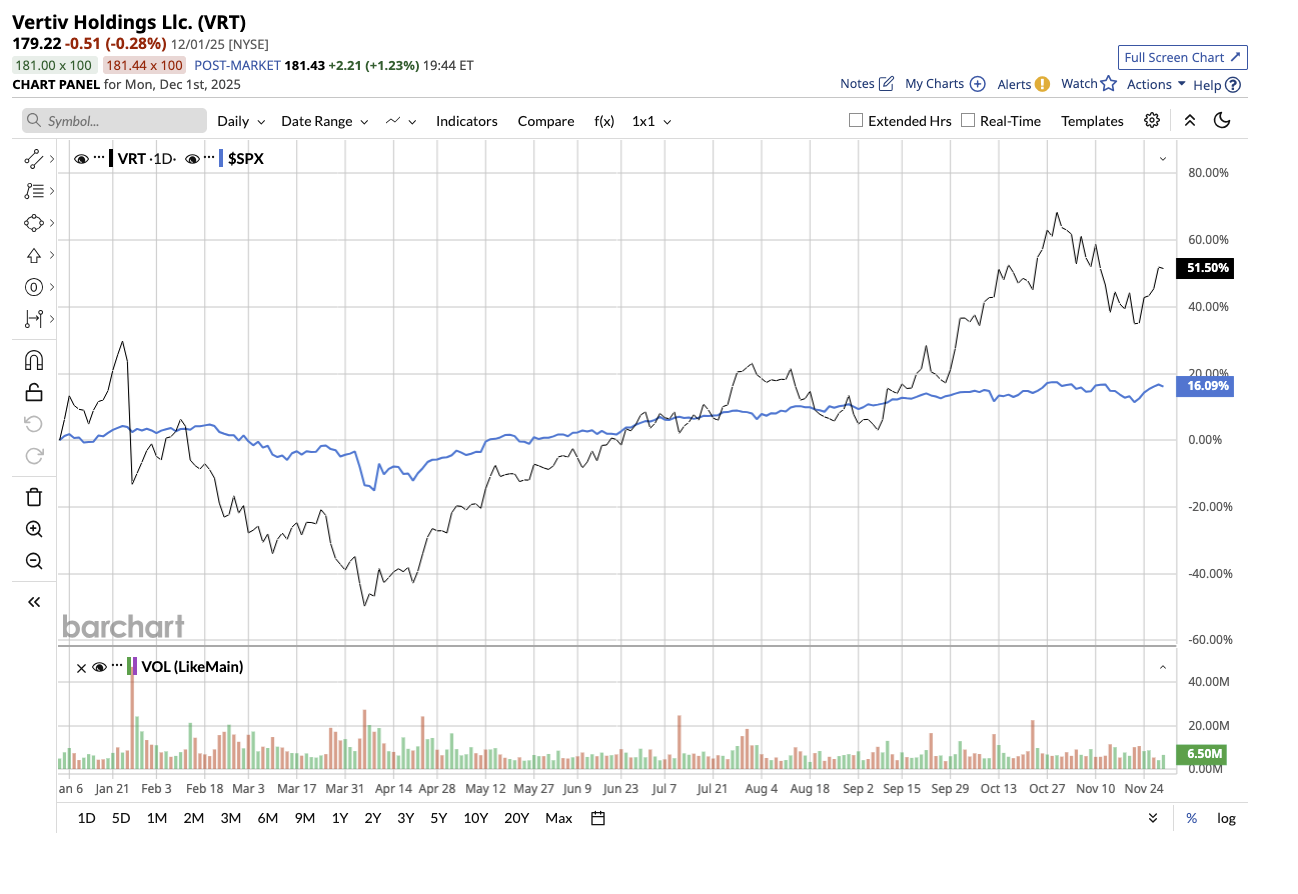

As 2025 comes to an end, just a few growth stocks have stood out. One of them is Vertiv Holdings (VRT), a key supplier of the power, cooling, and infrastructure systems that keep data centers running, especially the massive new artifical intelligence (AI) data centers being built worldwide. Vertiv stock has surged 52% year-to-date, surpassing most tech heavyweights and the overall market. With record orders, surging demand, and a growing technology moat, Vertiv’s best years may still be ahead, which is likely why Wall Street rates the stock a “Strong Buy.” Let’s find out if this is the right time to grab this AI stock before 2025 ends.

A Quarter That ‘Blew the Doors Off’ Expectations

In the third quarter, management boasted that Vertiv's revenue, margins, cash flow, and earnings all exceeded expectations. This performance was fueled by years of disciplined investment in R&D, operational excellence, and deeper customer relationships. The company's early investments in technology, capacity, and services are finally paying off, creating a sustainable competitive edge that the company believes will last for years.

In Q3, organic sales jumped 29% year-over-year to $2.6 billion, fueled by 43% growth in the Americas market and 20% growth in APAC. While sales in EMEA declined by 4%, the company expects a re-acceleration in late 2026 as AI investments ramp up. The book-to-bill ratio, a key predictor of future demand, stood at 1.4x. Similarly, backlog grew to $9.5 billion, up 30% from the year-ago quarter, presenting a clear picture of revenue in 2026. Adjusted earnings per share (EPS) increased 63% to $1.24. Management stated that the company is continuing to gain traction in the hottest parts of the data center ecosystem, notably in AI-driven deployment.

Vertiv is also aggressively growing its technical footprint, focusing on thermal management, high-density racks, power infrastructure, and advanced services. To stay ahead of many upcoming GPU generations, the company plans to increase R&D spending by more than 20% in 2026, ensuring that its cooling and power solutions keep up with increasingly complicated AI hardware. Vertiv is positioning itself as a crucial partner for the next wave of power-intensive AI infrastructure through extensive collaboration with Nvidia (NVDA), including an 800-volt DC power portfolio slated for the Rubin Ultra platform in 2027. Despite the significant investments, Vertiv generated $462 million in free cash flow and ended the quarter with a cash position of $1.9 billion (cash, equivalents, and short-term investments).

As AI workloads grow and data consumption accelerates, Vertiv's power and cooling solutions are at the heart of an ongoing global data center expansion. The company anticipates Q4 to be another strong quarter, with strong organic and earnings per share (EPS) growth. Given the momentum, Vertiv updated its full-year forecast, projecting a 44% increase in earnings to $4.10 per share and a 27% organic sales growth of $10.2 billion. The company also plans to generate $1.5 billion in free cash flow. Management believes Vertiv is still in the early stages of a robust data center supercycle.

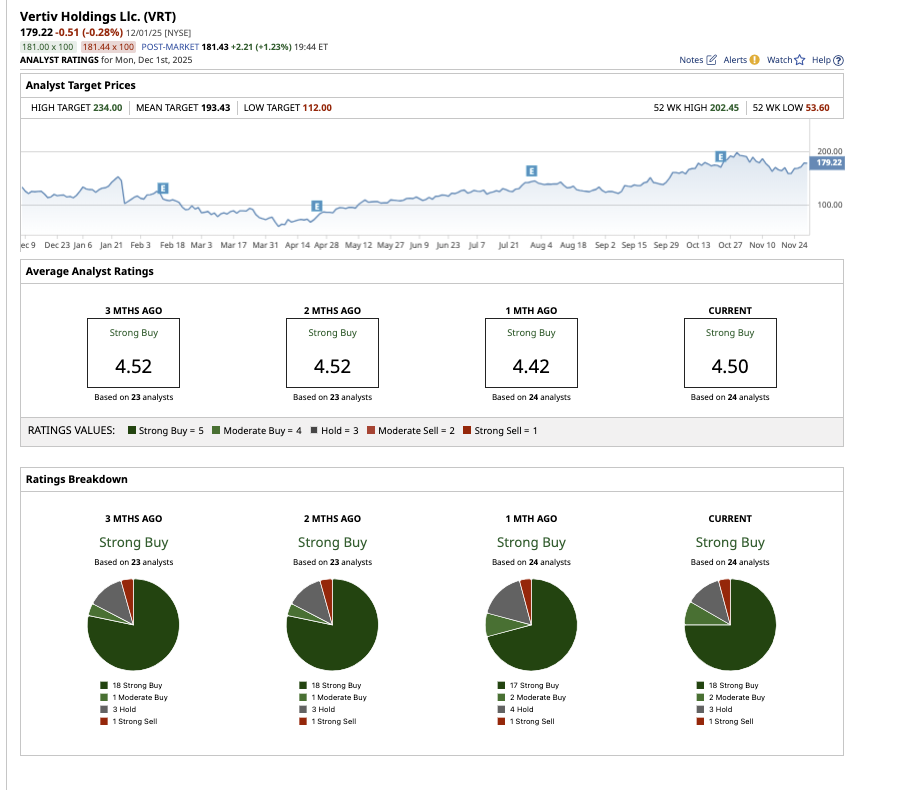

Additionally, Wall Street also remains highly optimistic about Vertiv’s long-term prospects. Over the last three months, analysts covering Vertiv have raised earnings estimates 22 times, indicating that sentiment is very favorable. Analysts now believe the company will earn more than originally anticipated. Similarly, revenue predictions have been revised upwards 21 times over the same period.

For the full year, analysts now expect earnings to increase by 44.8% in 2025, followed by 27.1% in 2026 and 24% in 2027. For investors who believe in the long-term AI infrastructure story, Vertiv offers a compelling blend of growth, profitability, and strategic momentum. Valued at 34 times forward earnings, Vertiv stock, while expensive, reflects the optimism around its long-term prospects. However, risk-averse investors may wish to accumulate shares at $166 to invest with a margin of safety.

What Is the Target Price for Vertiv Stock?

Out of the 24 analysts that cover VRT stock, 18 rate it a “Strong Buy,” two say it is a “Moderate Buy,” three rate it a “Hold,” and one says it is a “Strong Sell.” The average target price for VRT stock is $193.43, representing a potential upside of 8% from its current levels. The high price estimate of $234 suggests the stock can rally as much as 30.5% this year.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart