What a brutal six months it’s been for Torrid. The stock has dropped 31% and now trades at $4.86, rattling many shareholders. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Torrid, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.Despite the more favorable entry price, we're swiping left on Torrid for now. Here are three reasons why you should be careful with CURV and a stock we'd rather own.

Why Do We Think Torrid Will Underperform?

Promoting a message of body positivity and inclusiveness, Torrid Holdings (NYSE: CURV) is a plus-size women’s apparel and accessories retailer.

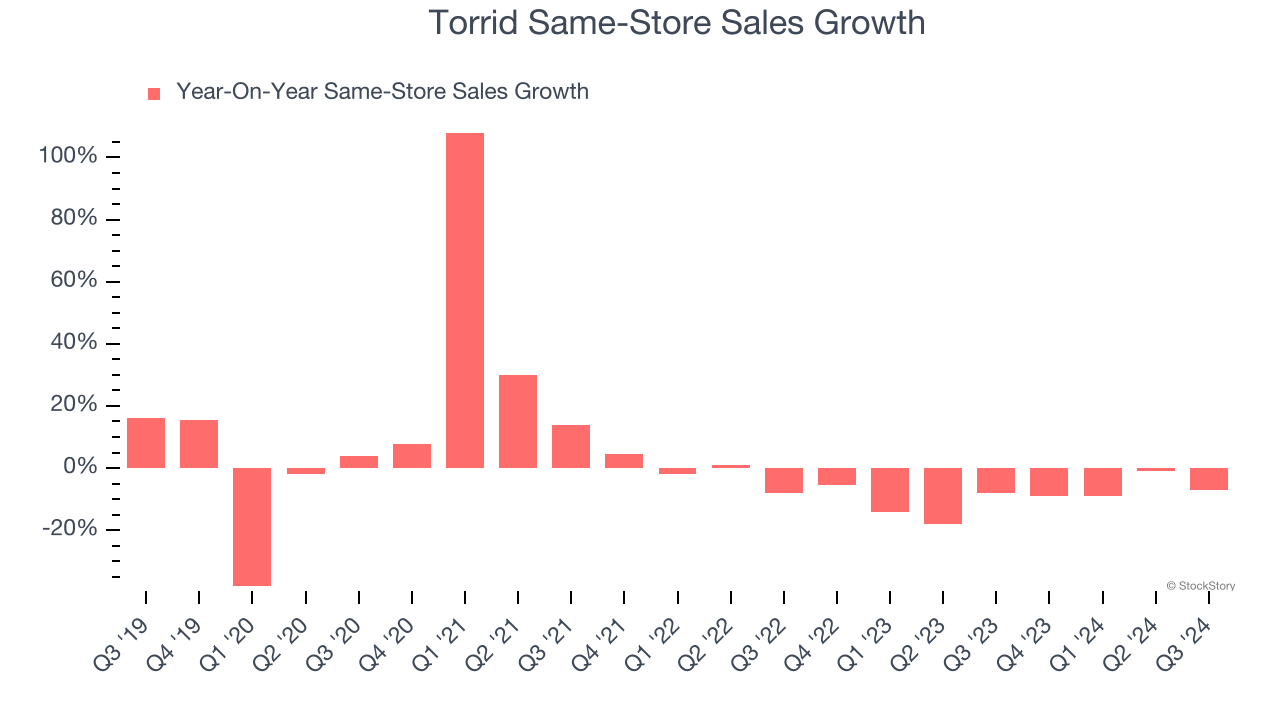

1. Shrinking Same-Store Sales Indicate Waning Demand

Same-store sales is a key performance indicator used to measure organic growth at brick-and-mortar shops for at least a year.

Torrid’s demand has been shrinking over the last two years as its same-store sales have averaged 8.9% annual declines.

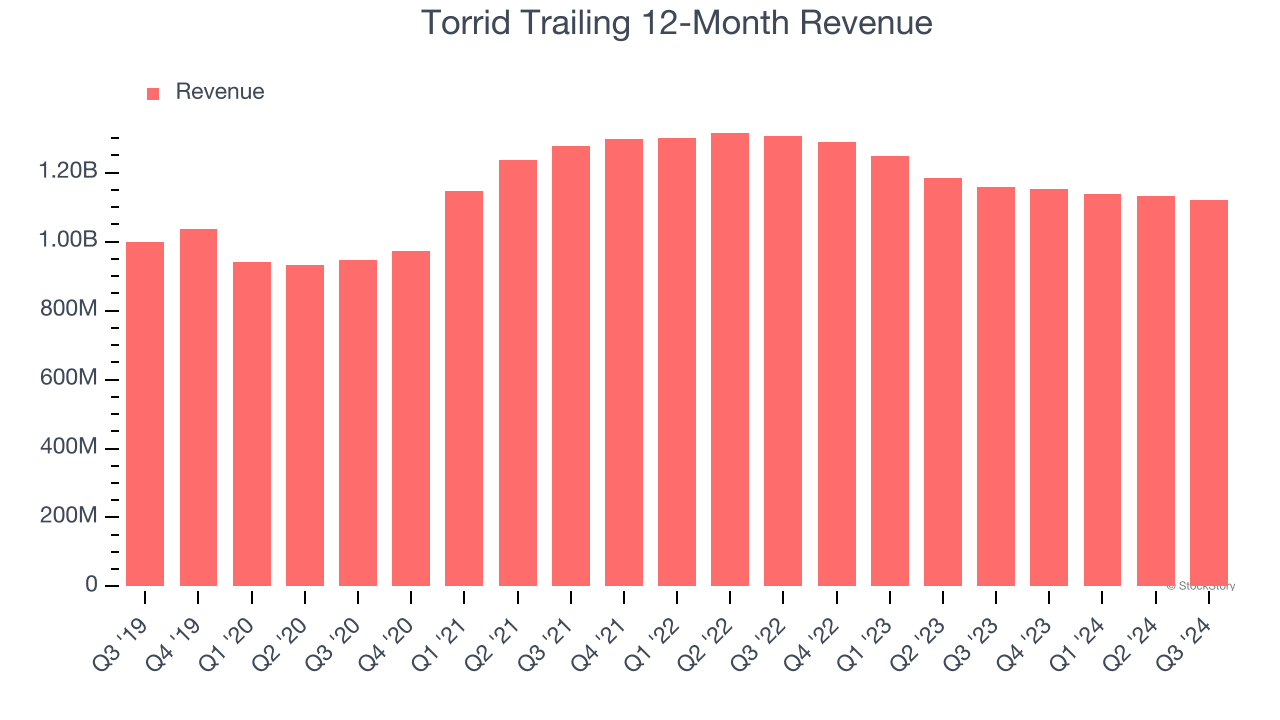

2. Less Negotiating Power with Suppliers

Torrid is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage.

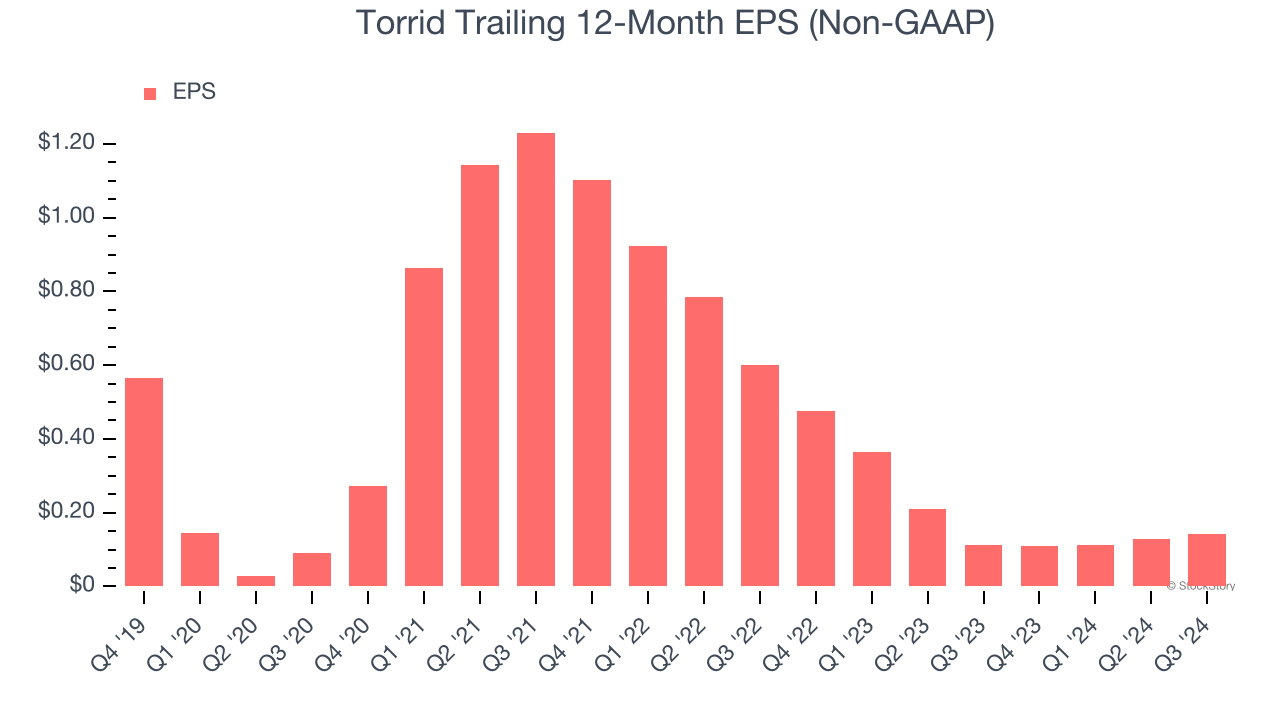

3. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Torrid, its EPS declined by 19.3% annually over the last five years while its revenue grew by 2.3%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Torrid doesn’t pass our quality test. Following the recent decline, the stock trades at 18.3× forward price-to-earnings (or $4.86 per share). At this valuation, there’s a lot of good news priced in - you can find better investment opportunities elsewhere. Let us point you toward Meta, a top digital advertising platform riding the creator economy.

Stocks We Like More Than Torrid

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.