Let’s dig into the relative performance of Synchrony Financial (NYSE: SYF) and its peers as we unravel the now-completed Q3 credit card earnings season.

Credit card companies facilitate electronic payments and extend revolving credit to consumers. Growth comes from increasing digital payment adoption, cross-border transaction growth, and value-added services for cardholders and merchants. Challenges include regulatory scrutiny of fees and practices, competition from alternative payment methods, and potential credit losses during economic downturns.

The 6 credit card stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 1.4%.

In light of this news, share prices of the companies have held steady as they are up 2.4% on average since the latest earnings results.

Synchrony Financial (NYSE: SYF)

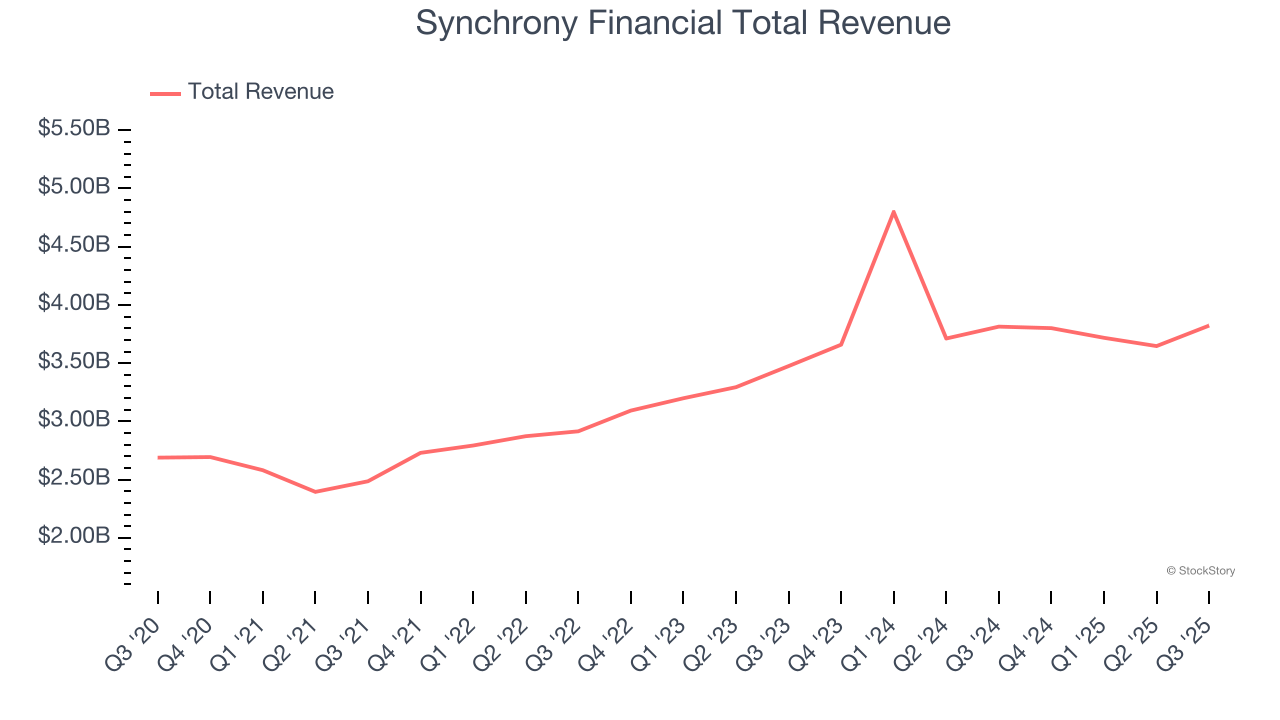

Powering over 73 million active accounts and partnerships with major brands like Amazon, PayPal, and Lowe's, Synchrony Financial (NYSE: SYF) provides credit cards, installment loans, and banking products through partnerships with retailers, healthcare providers, and digital platforms.

Synchrony Financial reported revenues of $3.82 billion, flat year on year. This print exceeded analysts’ expectations by 0.9%. Overall, it was a very strong quarter for the company with a beat of analysts’ EPS estimates and a solid beat of analysts’ net interest margin estimates.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $73.50.

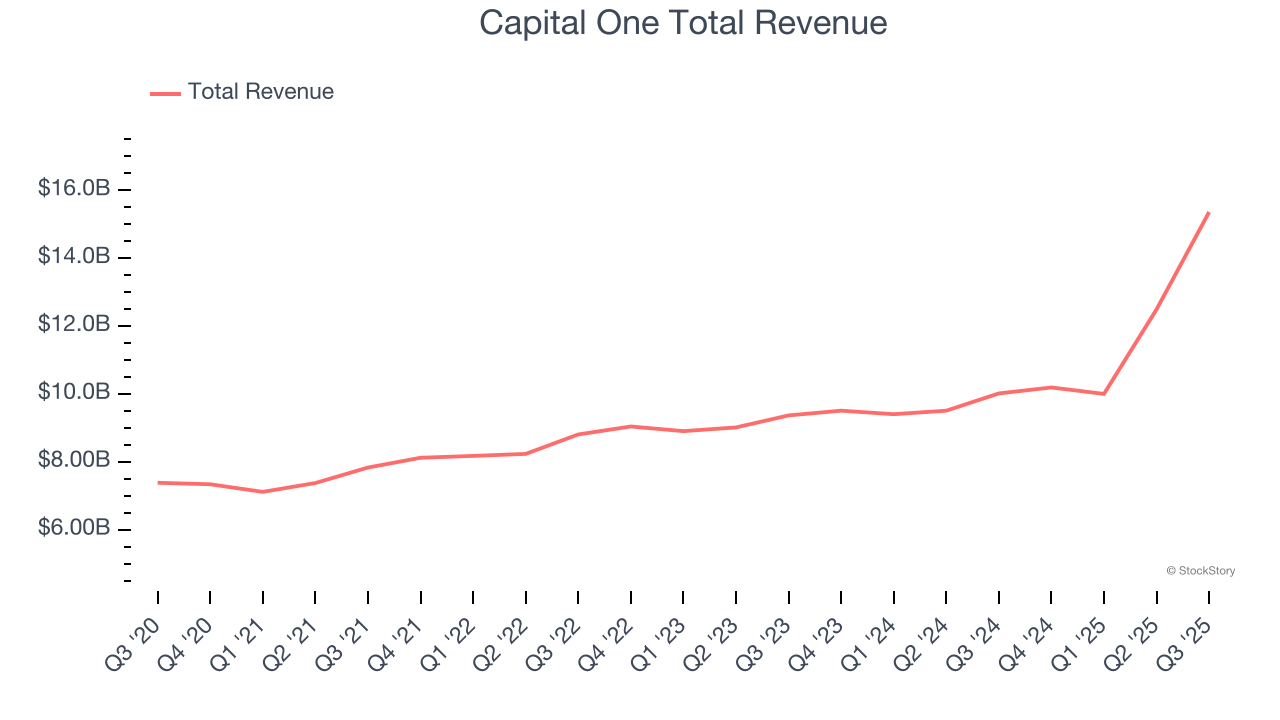

Best Q3: Capital One (NYSE: COF)

Starting as a credit card company in 1988 before expanding into a full-service bank, Capital One (NYSE: COF) is a financial services company that offers credit cards, auto loans, banking services, and commercial lending to consumers and businesses.

Capital One reported revenues of $15.36 billion, up 53.4% year on year, outperforming analysts’ expectations by 2.2%. The business had an exceptional quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ net interest margin estimates.

Capital One scored the fastest revenue growth among its peers. The market seems content with the results as the stock is up 1.7% since reporting. It currently trades at $221.01.

Is now the time to buy Capital One? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Visa (NYSE: V)

Processing over 829 million transactions daily and connecting billions of cards to 150 million merchant locations worldwide, Visa (NYSE: V) operates one of the world's largest electronic payments networks, facilitating secure money movement across more than 200 countries through its VisaNet processing platform.

Visa reported revenues of $10.72 billion, up 11.5% year on year, exceeding analysts’ expectations by 1.1%. Still, it was a mixed quarter due to its lackluster performance in other areas of the business.

As expected, the stock is down 2.9% since the results and currently trades at $336.90.

Read our full analysis of Visa’s results here.

American Express (NYSE: AXP)

Recognizable by its iconic green logo and the slogan "Don't leave home without it," American Express (NYSE: AXP) is a global payments company that issues credit and charge cards, processes merchant transactions, and offers travel and lifestyle benefits to consumers and businesses.

American Express reported revenues of $13.82 billion, up 10.8% year on year. This result surpassed analysts’ expectations by 2.8%. It was a strong quarter as it also recorded an impressive beat of analysts’ transaction volumes estimates and a decent beat of analysts’ revenue estimates.

American Express scored the biggest analyst estimates beat among its peers. The stock is up 11.7% since reporting and currently trades at $361.10.

Read our full, actionable report on American Express here, it’s free for active Edge members.

Bread Financial (NYSE: BFH)

Formerly known as Alliance Data Systems until its 2022 rebranding, Bread Financial (NYSE: BFH) provides credit cards, installment loans, and savings products to consumers while powering branded payment solutions for retailers and merchants.

Bread Financial reported revenues of $971 million, down 1.2% year on year. This print was in line with analysts’ expectations. Overall, it was a very strong quarter as it also put up a beat of analysts’ EPS estimates and an impressive beat of analysts’ net interest margin estimates.

Bread Financial had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is up 5% since reporting and currently trades at $63.60.

Read our full, actionable report on Bread Financial here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.