With a market cap of $71.9 billion, Airbnb, Inc. (ABNB) operates a global platform that allows hosts to offer stays and unique experiences to guests. Its marketplace connects people through web and mobile apps, making it easy to book accommodations and activities.

Companies valued over $10 billion are generally described as “large-cap” stocks, and Airbnb fits right into that category. The company also provides gift cards for use on its platform.

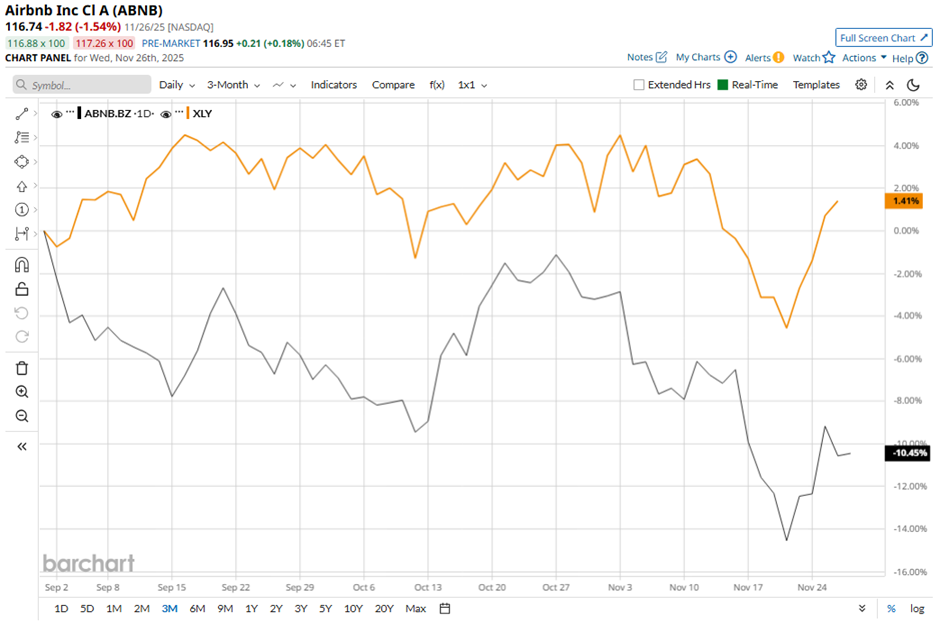

Shares of the San Francisco, California-based company have pulled back 28.8% from its 52-week high of $163.93. Airbnb’s shares have decreased 8% over the past three months, lagging behind the Consumer Discretionary Select Sector SPDR Fund’s (XLY) marginal rise over the same time frame.

Longer term, ABNB stock is down 11.2% on a YTD basis, underperforming XLY’s 4.8% return. Moreover, shares of the company have fallen 16.4% over the past 52 weeks, compared to XLY’s 6.3% gain over the same time frame.

The stock has been trading below its 50-day and 200-day moving averages since August.

Shares of ABNB recovered marginally following its strong Q3 2025 results on Nov. 6, with revenue up 10% year-over-year to $4.1 billion and record adjusted EBITDA of $2.1 billion at a 50% margin. Key business metrics also exceeded expectations, GBV rose 14% to $22.9 billion and Nights and Seats Booked grew 9%, driven by strong U.S. demand and new features like Reserve Now, Pay Later. Additionally, management issued a solid Q4 outlook, expecting $2.66 billion - $2.72 billion in revenue and low-double-digit GBV growth.

In comparison, rival Booking Holdings Inc. (BKNG) has shown a less pronounced decline than ABNB stock. Shares of Booking Holdings have dropped 5.8% over the past 52 weeks and 1.1% on a YTD basis.

Due to the stock’s weak performance, analysts remain cautious about its prospects. ABNB stock has a consensus rating of “Hold” from 41 analysts in coverage, and the mean price target of $142.06 is a premium of 21.7% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Argus Just Slashed Its Earnings Estimates for Coinbase. Should You Dump COIN Stock Here?

- Big Money is Betting on Natural Gas Prices to Break Out. Here’s the Setup.

- Is This Under-the-Radar High-Yield AI Stock a Buy Now?

- Wall Street Likes Server Stocks After Nvidia’s Q3. Is DELL or HPE Stock a Better Buy Here?