Vertex Pharmaceuticals Incorporated (VRTX), based in Boston, Massachusetts, is a prominent biotech firm specializing in the discovery, development, and commercialization of innovative small-molecule drugs targeting serious diseases. Its core focus includes genetic disorders such as cystic fibrosis (CF) and sickle cell disease.

The company operates globally with extensive R&D and commercial sites, driving advancements through substantial investment in research, a strong manufacturing base, and efficient worldwide distribution to deliver transformative therapies to patients. Vertex has a market capitalization of $109.65 billion, which classifies it as a “large-cap” stock.

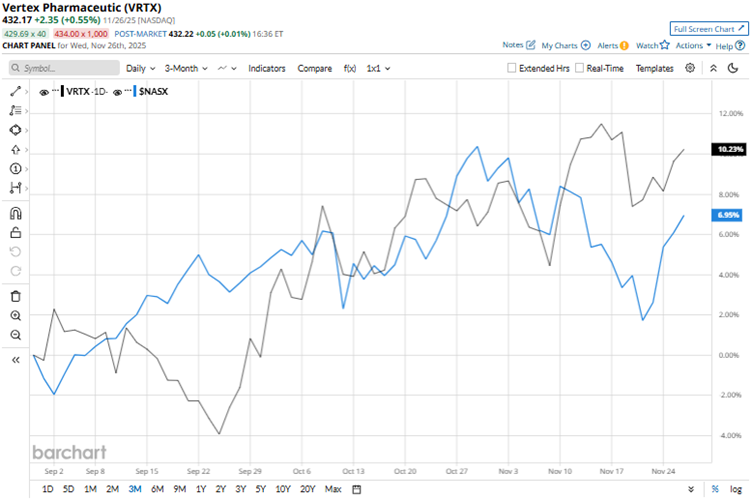

Vertex’s stock reached a 52-week high of $519.68 back in March, but is down 16.8% from that level. Based on positive investor sentiment surrounding the stock, likely driven by Vertex’s robust pipeline of genetic therapies, it has surged 11.6% over the past three months. On the other hand, the Nasdaq Composite ($NASX) index gained 7.8% over the same period.

However, over the longer term, the stock’s performance has been lackluster. Over the past 52 weeks, Vertex’s shares have dropped 7.5%, while it has been down marginally over the past six months. On the other hand, the Nasdaq Composite has gained 21.1% and 23.9% over the same periods, respectively. Vertex has been trading below its 200-day moving average since early August, but trading above its 50-day moving average since early October.

On Nov. 3, Vertex reported its third-quarter financials for fiscal 2025. The company’s revenues increased by 11% year-over-year (YOY) to $3.08 billion, exceeding the $3.04 billion expected by Wall Street analysts. This was primarily based on a 2.7% YOY increase in sales of its flagship CF drug, Trikafta/Kaftrio. The topline growth was also significantly helped by the addition of $247 million in sales from the newly approved CF drug Alyftrek.

Vertex’s non-GAAP EPS also increased by 9.6% annually to $4.80, higher than the expected $4.55. Despite these solid results, Vertex’s stock dropped 1% intraday on Nov. 4. The company also refined the full-year revenue outlook from a range of $11.85 billion - $12 billion to a range of $11.90 billion - $12 billion.

We compare Vertex’s performance with that of another biotech giant, Alnylam Pharmaceuticals, Inc. (ALNY), which has gained 75.7% over the past 52 weeks and 53.5% over the past six months. Therefore, Vertex has been the clear underperformer over these periods.

Wall Street analysts are moderately bullish on Vertex’s stock. The stock has a consensus rating of “Moderate Buy” from the 33 analysts covering it. The mean price target of $489.20 indicates a 13.2% upside compared to current levels. The Street-high price target of $604 indicates a 39.8% upside.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart