Medical technology company iRhythm Technologies (NASDAQ:IRTC) reported Q4 CY2024 results topping the market’s revenue expectations, with sales up 24% year on year to $164.3 million. The company expects the full year’s revenue to be around $680 million, close to analysts’ estimates. Its non-GAAP profit of $0.01 per share was significantly above analysts’ consensus estimates.

Is now the time to buy iRhythm? Find out by accessing our full research report, it’s free.

iRhythm (IRTC) Q4 CY2024 Highlights:

- Revenue: $164.3 million vs analyst estimates of $158.2 million (24% year-on-year growth, 3.9% beat)

- Adjusted EPS: $0.01 vs analyst estimates of -$0.24 (significant beat)

- Adjusted EBITDA: $19.27 million vs analyst estimates of $12.74 million (11.7% margin, 51.2% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $680 million at the midpoint, in line with analyst expectations and implying 14.9% growth (vs 20% in FY2024)

- Operating Margin: -2.5%, up from -29.6% in the same quarter last year

- Market Capitalization: $3.54 billion

"Our fourth quarter capped a transformative year for iRhythm, marked by 24% revenue growth and significant operational achievements," said Quentin Blackford, President and CEO of iRhythm.

Company Overview

Founded in 2006, iRhythm Technologies (NASDAQ:IRTC) develops and markets wearable cardiac monitoring devices, focusing on diagnosing and managing heart arrhythmias (irregular heartbeats).

Patient Monitoring

Patient monitoring companies within the healthcare equipment industry offer devices and technologies that track chronic conditions and support real-time health management, such as continuous glucose monitors (CGMs) and sleep apnea machines. These businesses benefit from recurring revenue from consumables and software subscriptions tied to device sales (razor, razor blade model). The rising prevalence of chronic diseases like diabetes and respiratory disorders due to an aging population as well as growing adoption of digitization are good for the industry. However, these companies face challenges from high R&D costs and reliance on regulatory approvals. Looking ahead, the sector is positioned for growth due to tailwinds like the rising burden of chronic diseases from an aging population, the shift toward value-based care, and increased adoption of digital health solutions. Innovations in AI and machine learning are expected to enhance device accuracy and functionality, improving patient outcomes and driving demand. However, there are headwinds such as pricing pressures as healthcare costs are a key focus, especially in the US. An evolving regulatory landscape and competition from more tech-forward new entrants could present additional challenges.

Sales Growth

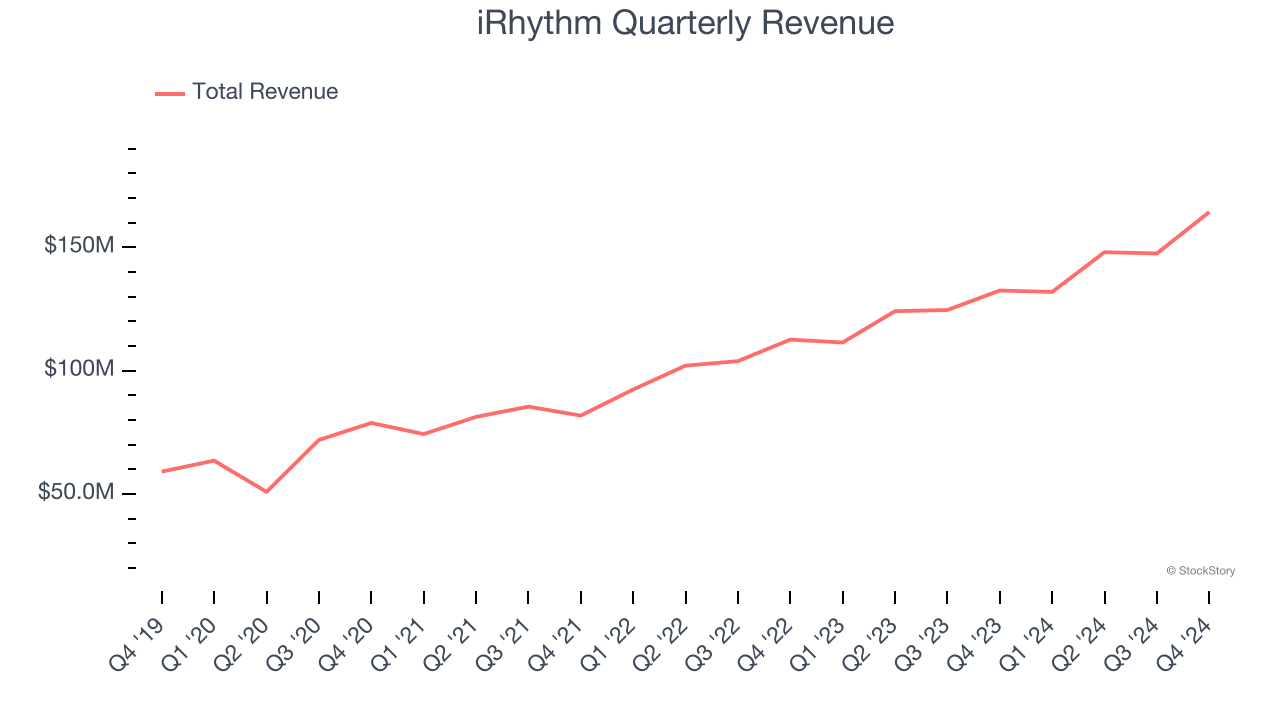

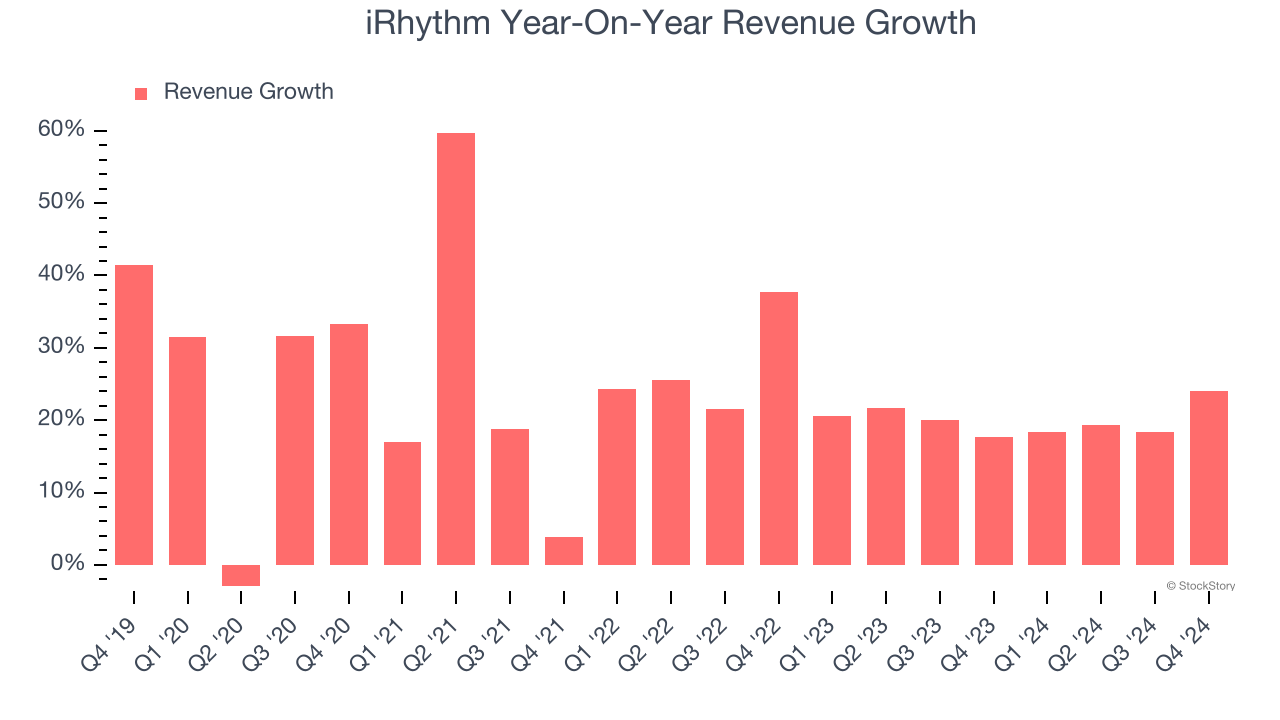

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, iRhythm’s 22.5% annualized revenue growth over the last five years was excellent. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. iRhythm’s annualized revenue growth of 20% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

This quarter, iRhythm reported robust year-on-year revenue growth of 24%, and its $164.3 million of revenue topped Wall Street estimates by 3.9%.

Looking ahead, sell-side analysts expect revenue to grow 14.9% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is noteworthy and indicates the market is factoring in success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

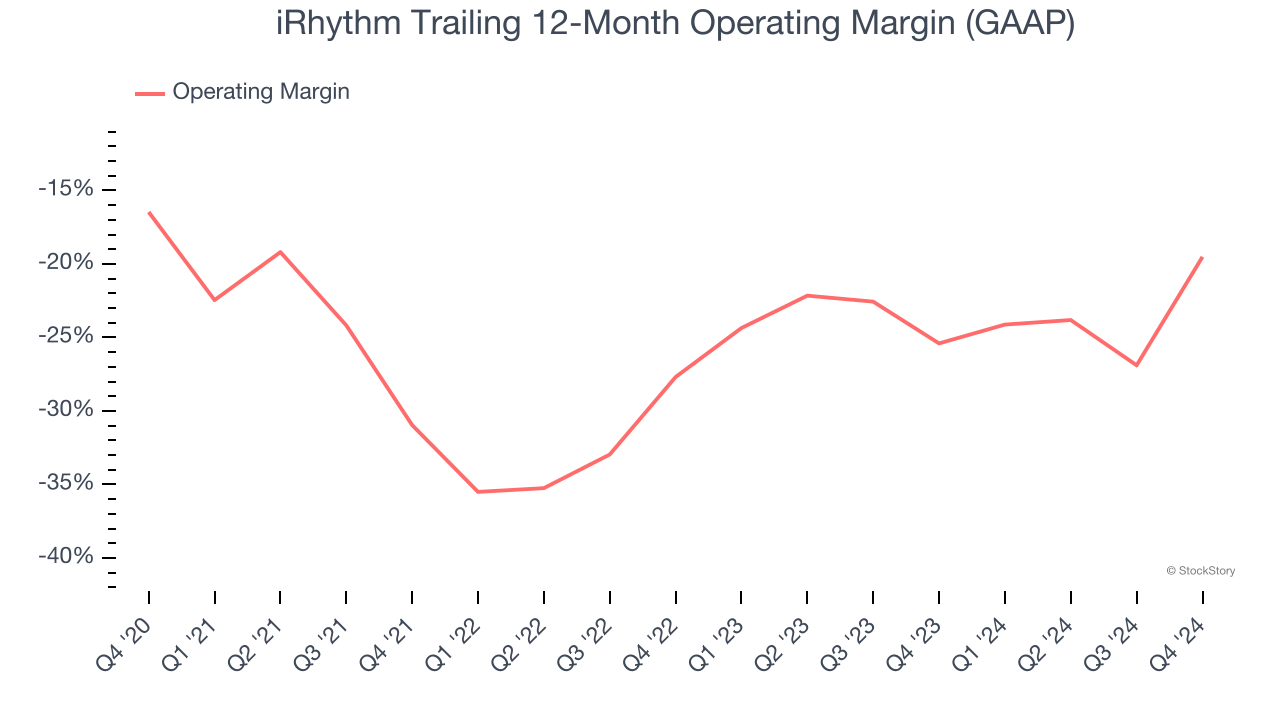

iRhythm’s high expenses have contributed to an average operating margin of negative 23.9% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, iRhythm’s operating margin decreased by 3 percentage points over the last five years, but it rose by 8.2 percentage points on a two-year basis. Still, shareholders will want to see iRhythm become more profitable in the future.

iRhythm’s operating margin was negative 2.5% this quarter. The company's consistent lack of profits raise a flag.

Earnings Per Share

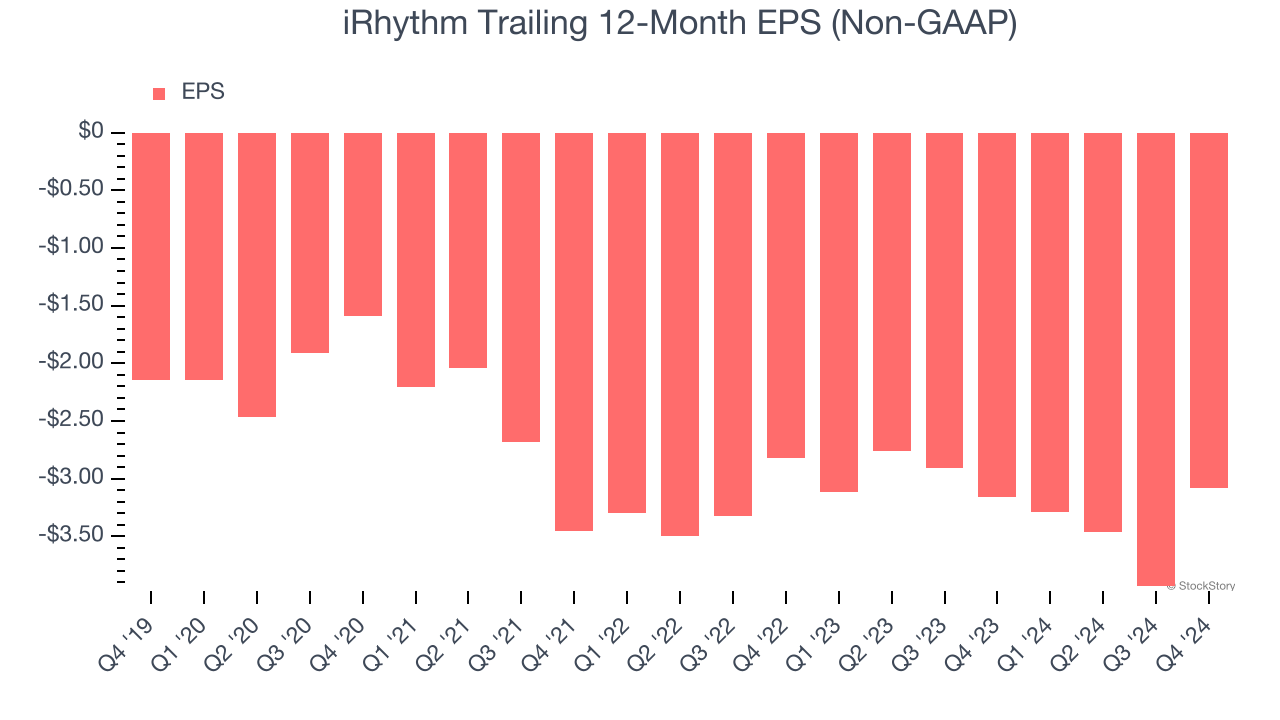

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

iRhythm’s earnings losses deepened over the last five years as its EPS dropped 7.5% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, iRhythm’s low margin of safety could leave its stock price susceptible to large downswings.

In Q4, iRhythm reported EPS at $0.01, up from negative $0.84 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects iRhythm to improve its earnings losses. Analysts forecast its full-year EPS of negative $3.08 will advance to negative $1.60.

Key Takeaways from iRhythm’s Q4 Results

We were impressed by how significantly iRhythm blew past analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a solid quarter. The stock traded up 5.2% to $118.30 immediately after reporting.

iRhythm put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.