All News about Senior Loan Invesco ETF

Via Talk Markets

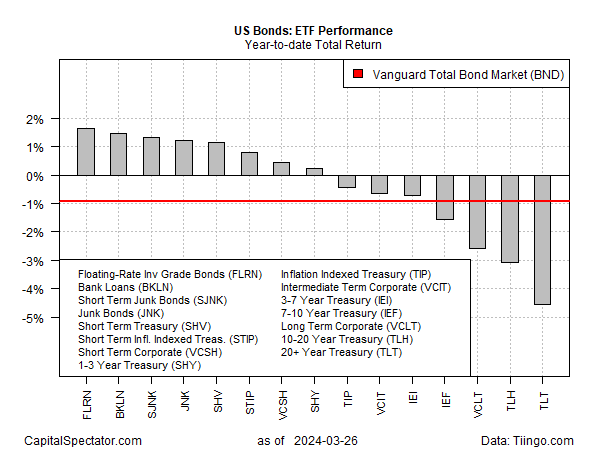

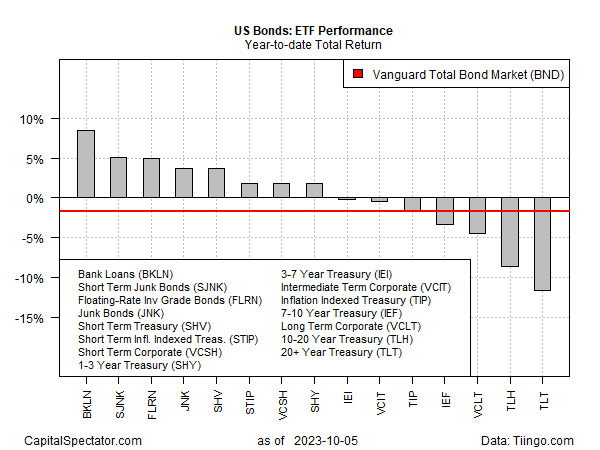

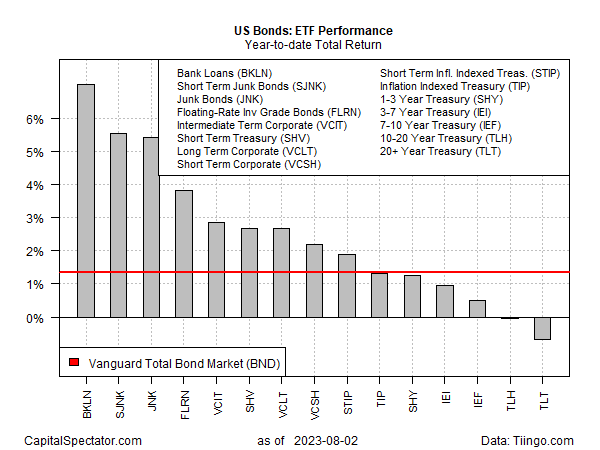

Bank Loans And Junk Bonds Are Having A Good Year

September 21, 2023

Via Talk Markets

An Introduction To Senior Loan ETFs

September 16, 2023

Via Talk Markets

Topics

Bonds

Exposures

Debt Markets

U.S. Weekly FundFlows Insight Report: Investors Pile Into Treasury, Flexible, And High-Yield Funds And ETFs

December 12, 2021

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.