Plano, Texas-based Tyler Technologies, Inc. (TYL) provides integrated software services that empower government entities to operate efficiently and transparently. It connects data and processes across disparate systems, which transform how clients gain actionable insights into opportunities and solutions for their communities. With a market cap of $20.3 billion, Tyler has more than 40,000 successful installations across nearly 13,000 locations, with clients spread across the U.S. and internationally.

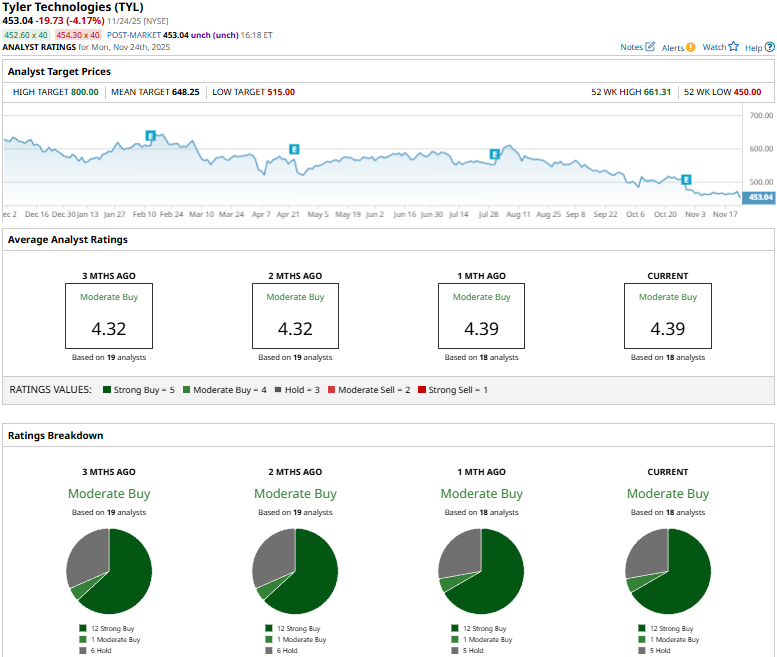

The tech major has notably underperformed the broader market over the past year. Tyler’s stock prices have plummeted 25.6% over the past 52 weeks and dropped 21.4% on a YTD basis, compared to the S&P 500 Index’s ($SPX) 12% returns over the past year and 14% surge in 2025.

Narrowing the focus, Tyler Technologies has also underperformed the Technology Select Sector SPDR Fund’s (XLK) 19.7% surge over the past 52 weeks and 20.3% returns on a YTD basis.

Tyler Technologies’ stock prices observed a modest 2 bps uptick in the trading session following the release of its Q3 results on Oct. 29. Driven by growth in its subscription, professional services, and hardware revenues, the company’s overall topline for the quarter grew 9.7% year-over-year to $595.9 million, exceeding the Street’s expectations by 19 bps. Meanwhile, its adjusted EPS soared 17.9% year-over-year to $2.97, beating the consensus estimates by a notable margin.

For the full fiscal 2025, ending in December, analysts expect TYL to deliver an adjusted EPS of $8.76, up 15.6% year-over-year. Further, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

Among the 18 analysts covering the TYL stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buys,” one “Moderate Buy,” and five “Holds.”

This configuration has remained mostly stable in recent months.

On Oct. 31, Evercore ISI analyst Kirk Materne reiterated an “In-Line” rating on TYL, but lowered the price target from $595 to $575.

As of writing, TYL’s mean price target of $648.25 represents a 43.1% premium to current price levels. Meanwhile, the street-high target of $800 suggests a massive 76.7% upside potential.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart