Apple Inc. (AAPL) is a leading multinational technology company headquartered in Cupertino, California. Apple designs, manufactures, and markets a broad range of consumer electronics, including the iPhone, Mac, iPad, and Apple Watch, as well as software, services, and digital content. Apple’s market cap stands at around $4.1 trillion, making it one of the most valuable companies in the world.

Companies valued at over $200 billion are typically classified as “mega-cap stocks,” a category Apple easily falls into with its market cap well beyond that level, underscoring its massive scale, industry influence, and leadership in consumer electronics. The company has reshaped personal technology through innovations like the iPhone, iPad, and Apple Watch, consistently delivering seamless user experiences and pioneering new services that define modern tech.

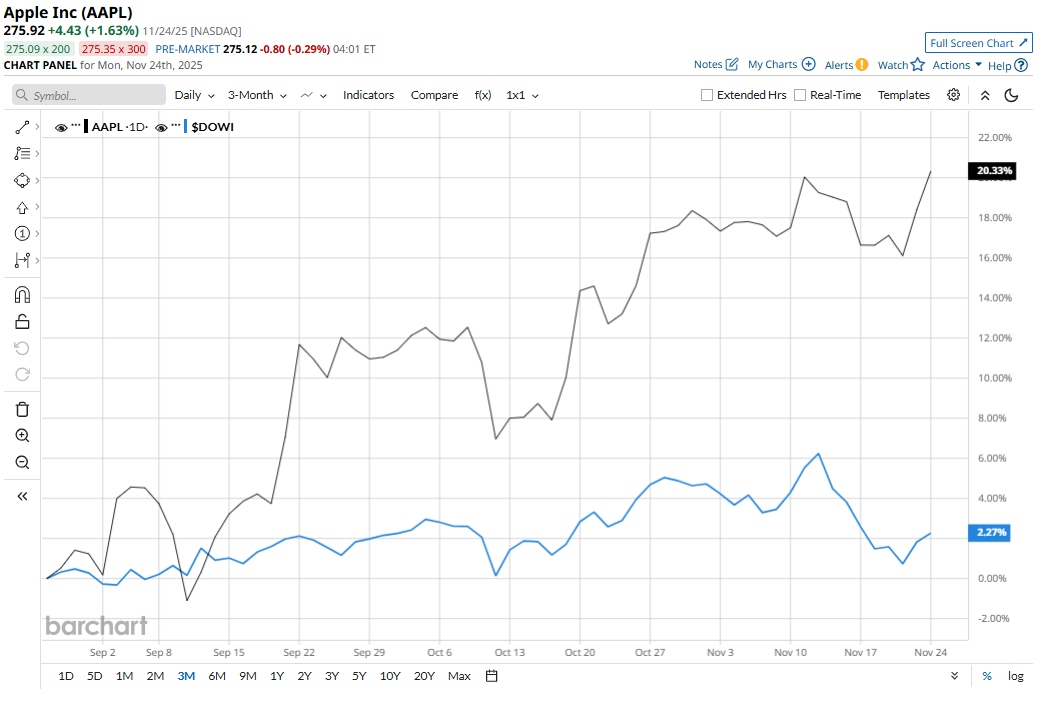

Apple is down marginally from its 52-week high of $277.32, achieved on Oct. 31. Over the past three months, AAPL stock gained 21.2%, outperforming the Dow Jones Industrials Average’s ($DOWI) 2.3% gains during the same time frame.

In the longer term, shares of Apple rose 10.2% on a year-to-date (YTD) basis and climbed 20% over the past 52 weeks, outperforming the Dow Jones Industrials Average’s YTD gains of 9.2% and 3.4% returns over the past year.

To confirm the bullish trend, Apple has traded above its 50-day and 200-day moving averages since early August.

AAPL stock's rally is being driven by renewed optimism around its iPhone business, particularly strong demand for the iPhone 17 line, which has sparked hopes of a robust upgrade cycle. At the same time, its services segment continues to grow strongly, offering high-margin, recurring revenue.

In the consumer electronics domain, Dell Technologies Inc. (DELL) has taken a slight lead over Apple on a YTD basis with a 10.4% return, but has underperformed over the past year with a decline of 11.8%.

Wall Street analysts are moderately bullish on Apple’s prospects. The stock has a consensus “Moderate Buy” rating from the 40 analysts covering it, and the mean price target of $285.29 suggests a potential upside of 3.4% from current price levels.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart