Newtown, Pennsylvania-based EPAM Systems, Inc. (EPAM) is a global digital engineering and IT consulting company that helps enterprises design, build, and modernize complex software and digital platforms. Valued at a market cap of $11.6 billion, the company specializes in software development, cloud transformation, data and analytics, AI-driven solutions, and product engineering, serving clients across industries such as financial services, healthcare, consumer goods, and technology.

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and EPAM fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the information technology services industry. Known for its strong engineering talent base and delivery excellence, EPAM partners with large global enterprises to drive digital transformation and innovation at scale.

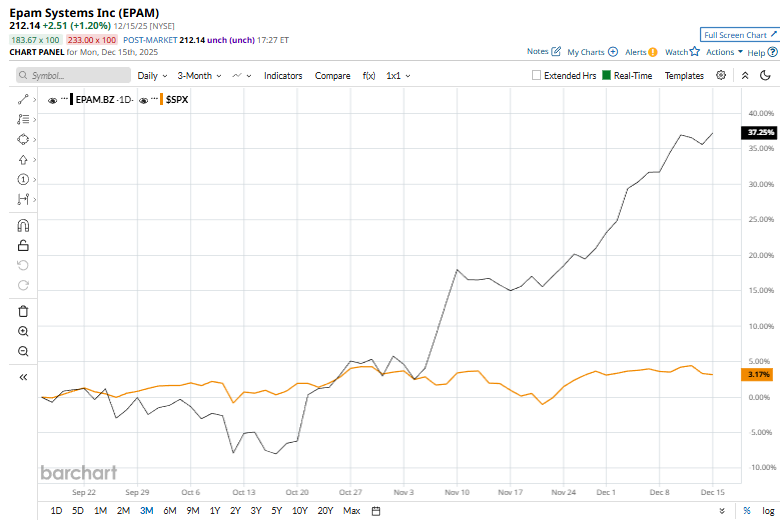

However, this tech company has slipped 21.1% from its 52-week high of $269, reached on Feb. 18. Shares of EPAM have increased 37.3% over the past three months, considerably underperforming the S&P 500 Index ($SPX) 3% surge over the same time frame.

In the longer term, EPAM has fallen 13.3% over the past 52 weeks, significantly lagging behind SPX’s 12.7% uptick over the same time period. Moreover, on a YTD basis, shares of EPAM are down 9.3%, compared to SPX’s 15.9% rise.

Despite that, EPAM has been trading above its 50-day and 200-day moving averages since late October and early November, reinforcing an uptrend.

On Dec. 9, shares of EPAM Systems rose about 3% in the afternoon session after the company announced the launch of seven new AI agents on the Google Cloud Marketplace, designed to tackle complex use cases across finance, healthcare, and retail. The ready-to-deploy solutions, covering areas such as KYC automation, drug discovery acceleration, and clinical trial documentation, boosted investor confidence by highlighting EPAM’s expanding AI capabilities and strategic collaboration with Google Cloud.

EPAM has outpaced its rival, Accenture plc’s (ACN) 23.4% drop over the past 52 weeks and 21.9% loss on a YTD basis.

Despite EPAM’s underperformance compared to the broader market over the past year, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 17 analysts covering it, and the stock currently trades above its mean price target of $211.73.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart