IonQ (IONQ), once hailed as a frontrunner in quantum computing and a darling among high-growth tech stocks, has hit a rough patch. Despite pioneering advancements in trapped-ion quantum technology, shares have plunged 42% over the past two months from their October peak near $85, reflecting broader market skepticism toward speculative tech names. Today, the stock is trading around $48, marking a continued losing streak after dropping 5% in the past week amid insider sales and market unease.

Quantum computing stocks were all the rage earlier this year, fueled by breakthroughs and hype around potential disruption in AI, cryptography, and drug discovery. But sentiment has abruptly cooled, with peers like Rigetti Computing (RGTI), D-Wave Quantum (QBTS), and Quantum Computing (QUBT) also experiencing sharp declines as the market shifted to a risk-off stance.

About IonQ Stock

IonQ is a College Park, Maryland, pure-play quantum computing company specializing in trapped-ion quantum computers and networks. It provides access to its systems via cloud platforms like AWS, Azure, and Google Cloud, targeting complex problems in research and industry. Operating in the emerging quantum computing industry, it has a market capitalization of $16 billion.

Shares reached an all-time high of $84.64 in October before correcting sharply, closing the period down significantly from that peak but still up substantially year-to-date from earlier lows. Still, it’s a far cry from the 1,100% gains of 2024, though recent declines have erased much of the momentum, underperforming broader indices in the fourth quarter amid tech sector rotation.

IonQ trades at an forward price-sales ratio of over 100 times its 2025 revenue guidance of $106 million to $110 million, far exceeding industry averages for hardware and emerging tech peers. This premium reflects high expectations for explosive revenue scaling, but signals overvaluation compared to historical norms for pre-profit companies, where such multiples often precede corrections in speculative sectors.

Given ongoing losses and no expectations of becoming profitable soon, IonQ stock appears overvalued, though backers argue it’s fairly priced for its disruptive potential.

IonQ Beats on Q3 Earnings

IonQ reported third-quarter results on Nov. 5, handily beating Wall Street estimates with record revenue of $39.9 million – up 222% year-over-year – versus expectations of $27 million. Adjusted losses of $0.17 also topped forecasts of a $0.44 loss. Absolute losses, however, remain substantial amid heavy investments.

Management raised full-year 2025 revenue guidance to $106 million to $110 million and expressed confidence in continued momentum into upcoming quarters, though no specific quarterly EPS or revenue forecasts were provided beyond the annual outlook. Wall Street has not provided forecasts for revenue or earnings.

Key highlights included achieving a world-record 99.99% two-qubit gate fidelity, completing acquisitions of Oxford Ionics and Vector Atomic to bolster its full-stack platform, and hitting the 2025 technical milestone of #AQ 64 on Tempo ahead of schedule. These advancements underscore IonQ’s leadership in scalable quantum systems, with new contracts and partnerships driving bookings growth.

What Do Analysts Expect for IonQ Stock?

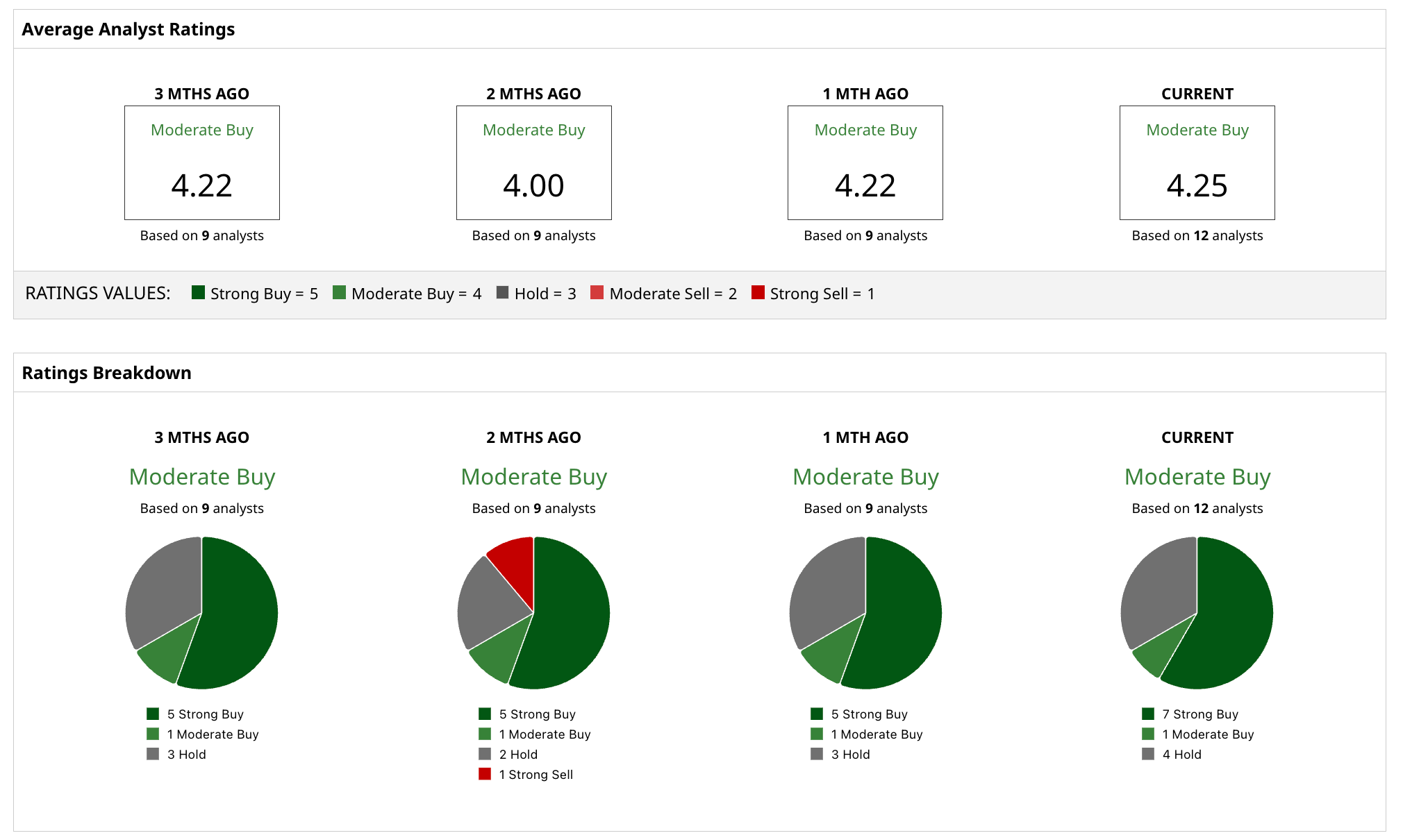

Analysts maintain a generally positive outlook on IonQ, with a consensus leaning toward a “Moderate Buy” based on coverage from around 12 firms, including recent initiations from Jefferies (“Buy,” $100 target) and Mizuho (“Outperform,” $90 target). Overall, seven analysts rate it a “Strong Buy,” one analyst rates it a “Buy,” and four have a “Hold” rating. No one says to “sell,” reflecting optimism on technical progress despite near-term volatility. Moreover, the consensus has strengthened in recent months with multiple upgrades and high targets.

Analysts have a mean price target of $75.50, which represents potential upside of over 50% from current levels around $48. The industry high target of $100 assigned by Rosenblatt Securities last month implies IonQ could more than double from here. Risk-tolerant investors might want to take a speculative dip into the stock for the potential upside quantum computing promises.

On the date of publication, Rich Duprey did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Intuit Jumps Into Stablecoin Business, Should You Buy, Sell, or Hold INTU Stock?

- ConocoPhillips Stock Still Looks 18% Undervalued - How to Play COP Stock?

- Nike, Tilray, and Palantir: Their Unusually Active Put Options Will Boost Your Wallet After Christmas

- Micron Says ‘We Are More Than Sold Out.’ Should You Buy MU Stock After Earnings?