Although Glacier Bancorp (currently trading at $43.59 per share) has gained 6.6% over the last six months, it has trailed the S&P 500’s 24.4% return during that period. This might have investors contemplating their next move.

Is now the time to buy Glacier Bancorp, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Is Glacier Bancorp Not Exciting?

We're cautious about Glacier Bancorp. Here are three reasons why GBCI doesn't excite us and a stock we'd rather own.

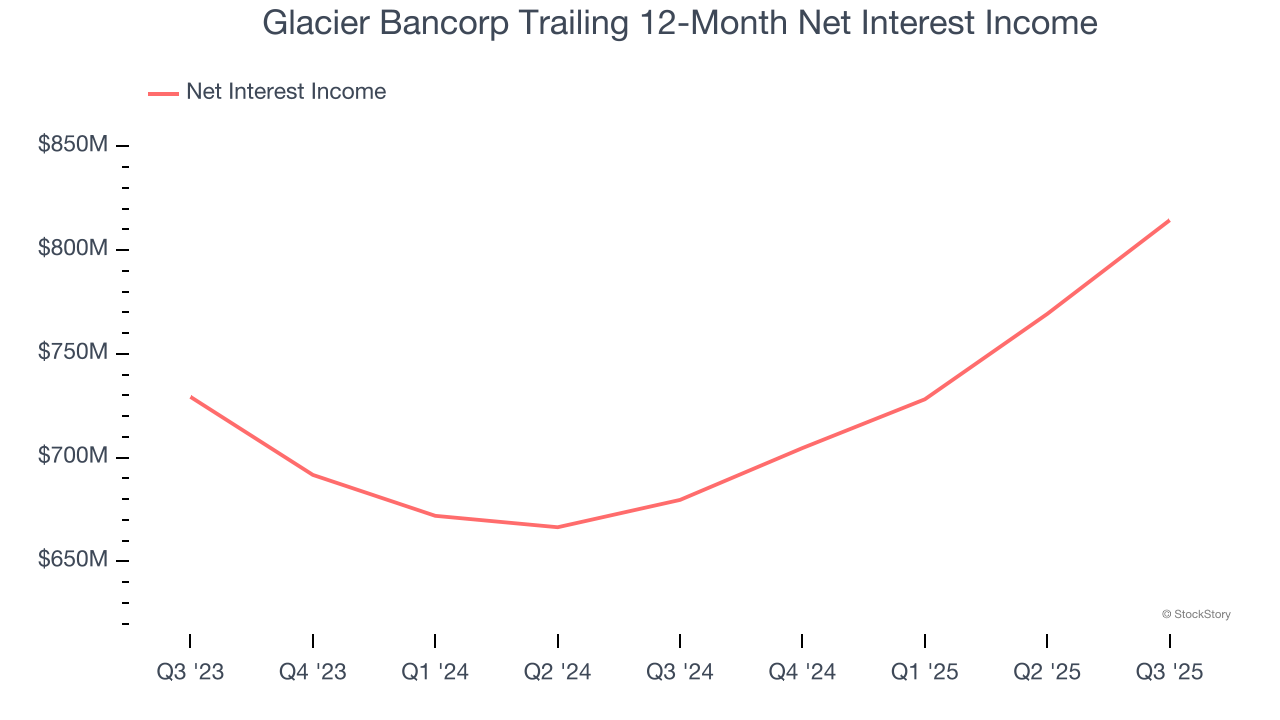

1. Net Interest Income Points to Soft Demand

While bank generate revenue from multiple sources, investors view net interest income as a cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of one-time fees.

Glacier Bancorp’s net interest income has grown at a 7.5% annualized rate over the last five years, slightly worse than the broader banking industry.

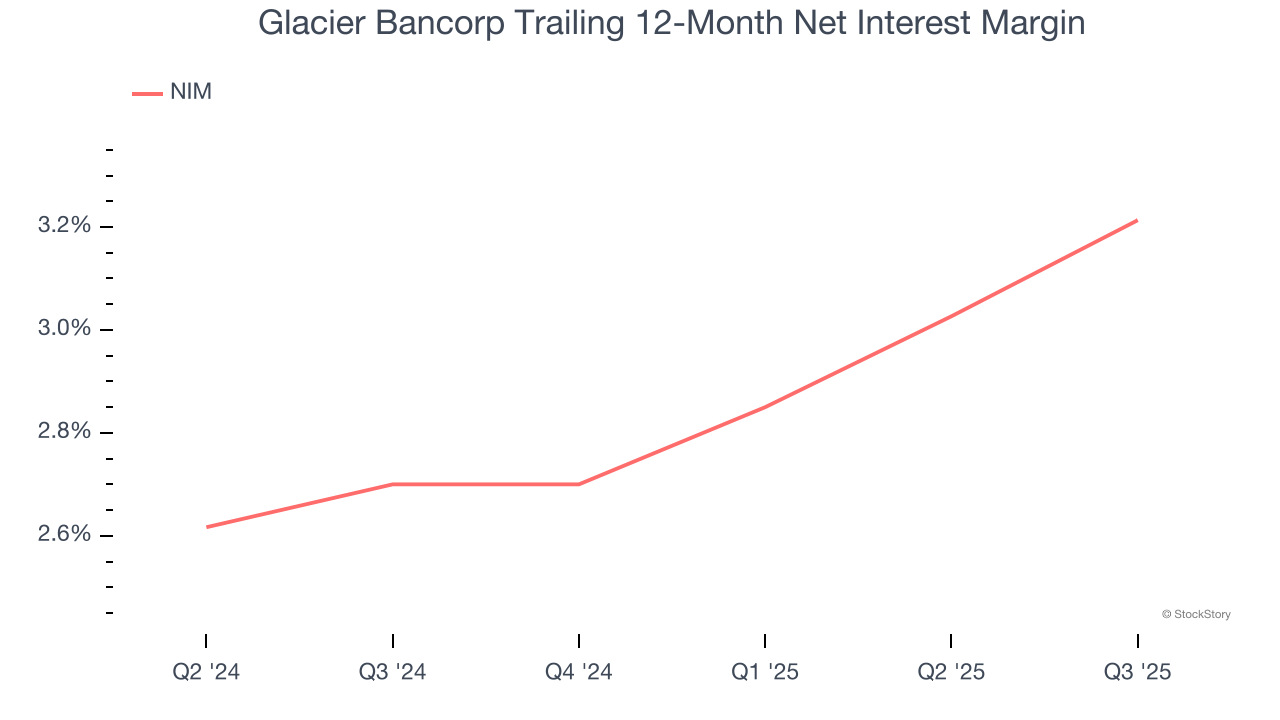

2. Low Net Interest Margin Reveals Weak Loan Book Profitability

Net interest margin (NIM) represents the unit economics of a bank by measuring the profitability of its interest-bearing assets relative to its interest-bearing liabilities. It's a fundamental metric that investors use to assess lending premiums and returns.

Over the past two years, we can see that Glacier Bancorp’s net interest margin averaged a weak 3%, reflecting its high servicing and capital costs.

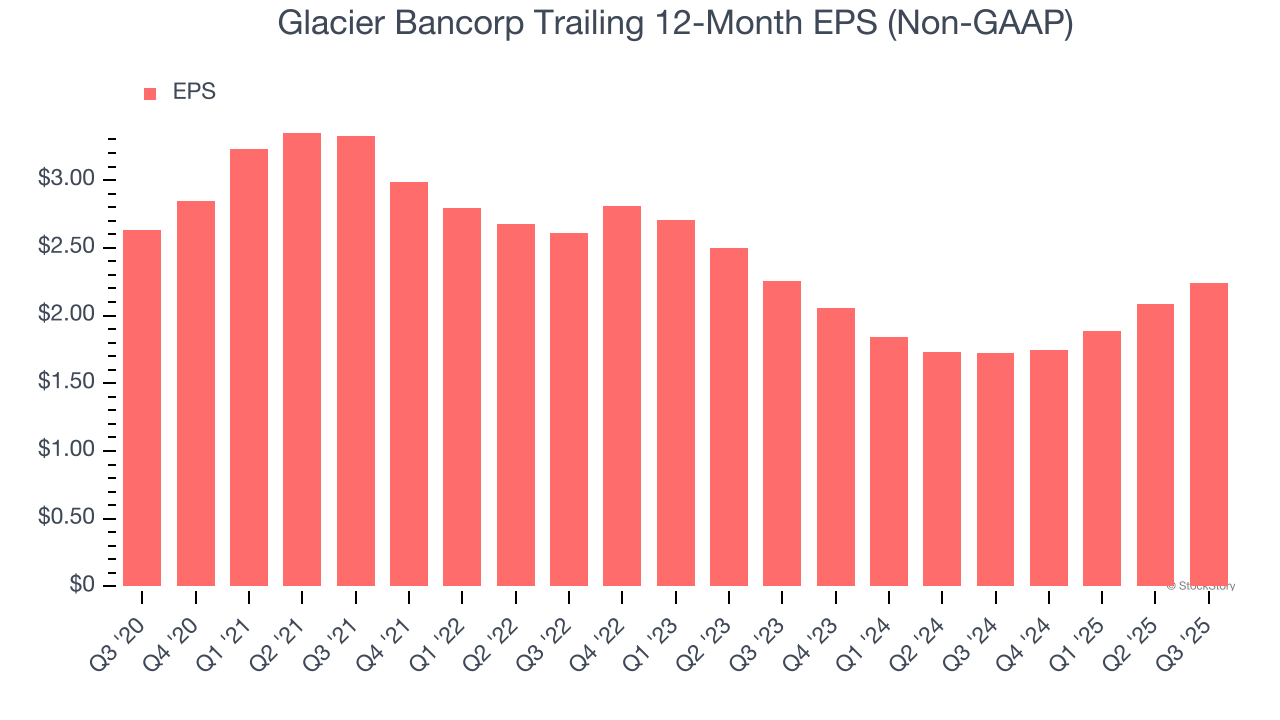

3. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Glacier Bancorp, its EPS declined by 3.2% annually over the last five years while its revenue grew by 5.2%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Glacier Bancorp isn’t a terrible business, but it isn’t one of our picks. With its shares lagging the market recently, the stock trades at 1.4× forward P/B (or $43.59 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. Let us point you toward a top digital advertising platform riding the creator economy.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.