QuantumScape (QS) sells solid-state batteries, mainly for electric vehicles (EVs). QS stock has been struggling to make headway in the past few years, up until June of this year, as the company started to make a turnaround.

QuantumScape announced breakthroughs and new partnerships. In the past six months, QS stock has been up 304%, and the second half of this year is turning out to be one of the best on record for the battery maker.

Last week, QuantumScape announced that it began shipping B1 samples of its QSE-5 cell and has separators that were produced using its Cobra process. This process makes it more efficient for high-volume commercial manufacturing aimed at electric vehicles and other applications.

The B1 cells are integrated into QuantumScape's first vehicle demonstration program with the Volkswagen Group's Ducati V21L electric motorcycle.

Earlier, Volkswagen (VWAGY) committed an investment of nearly $300 million to QuantumScape.

QuantumScape Can Serve More Than Just EVs

QuantumScape has been making more breakthroughs recently, but the reaction from the stock market says there's more going on than what may catch the eye.

For instance, the company's Strategic Blueprint says they want to "dramatically improve the performance of everything that uses a battery... including consumer electronics, stationary storage and emerging applications such as data centers, robotics, drones and aviation"

Their new platform lets customers build cells of different shapes and sizes to fit both robots and cars, so the market seems to expect a pivot beyond EVs. The EV market remains relatively depressed, with companies scaling back their electric vehicle plans since 2023. As interest rate cuts take place, this can lead to the pendulum swinging back, but that remains speculative for now.

Where QuantumScape Could Be in the Future

The biggest pitfall for this company would be slowing momentum. Management must translate the record upward movement of the stock price to genuine wins that will reflect well in future financial statements.

QuantumScape extended the balance sheet runway by 12 months last week, "through the end of the decade," and also reported $12.8 million in customer billings. That long cash runway gets rid of the unease investors have when investing in startups like QuantumScape, and it also makes it more likely the company will be able to fund better products that can capture market share. Cash plus marketable securities were at over $1 billion in Q3 2025.

Regardless, the market looks at more than just cash when valuing QuantumScape. Earnings and revenue are crucial, and QuantumScape must scale them both before cash starts to run out.

EPS is deeply negative today and is expected to remain that way for the foreseeable future.

Similarly, revenue will likely be negligible through next year, and any estimate beyond that is speculation.

Should You Buy QS Stock Now?

QuantumScape does bring a lot of promise to the table, but I would buy a less richly priced startup instead. Some of the most optimistic estimates five years out put sales at ~$10 billion. It's very unlikely that QuantumScape will be able to eke out profits by then, but even a 10% net margin means you're paying over 9 times 2030 earnings.

In all likelihood, revenue can end up being much lower. Plus, solid-state batteries are very capital-intensive and need much more scaling for double-digit margins.

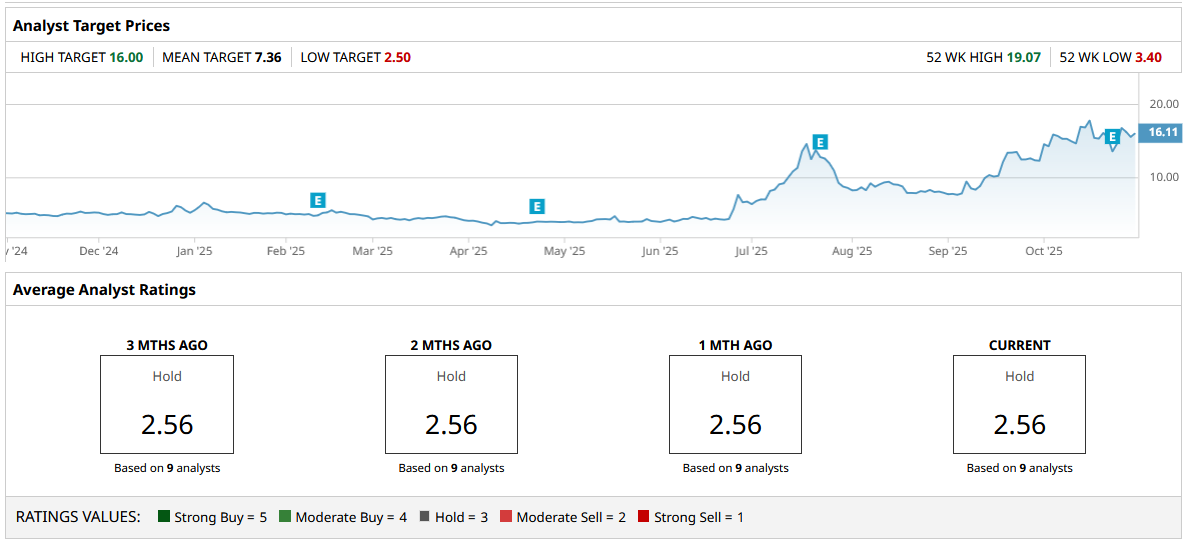

Analyst estimates for QS stock top out at $16, with the mean target at $7.36. The stock currently trades just a few cents over that high target.

I'd hold off on buying for now.

On the date of publication, Omor Ibne Ehsan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart