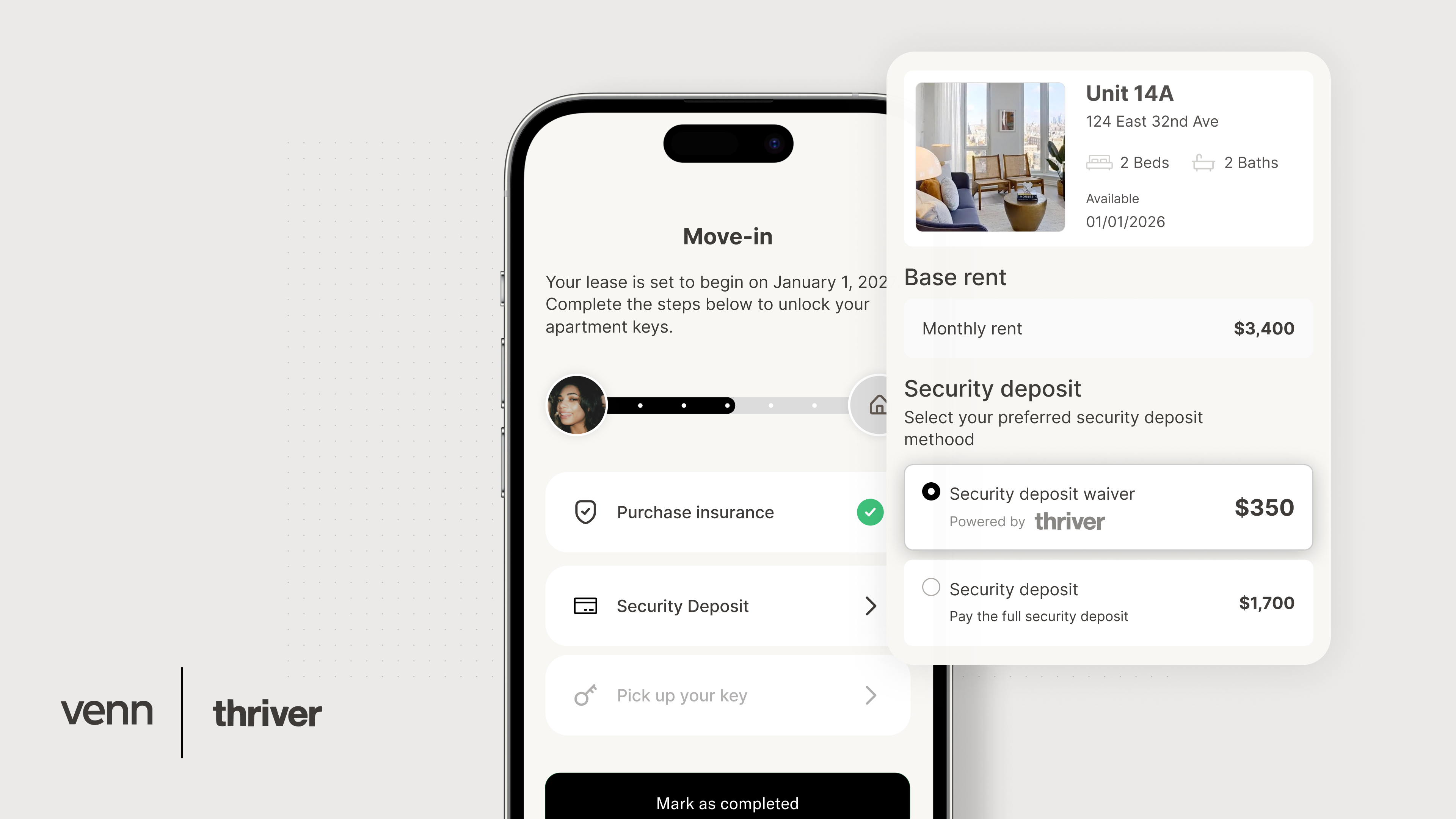

NEW YORK, Dec. 17, 2025 (GLOBE NEWSWIRE) -- For decades, security deposits have been a stubborn obstacle in what should be a seamless digital leasing experience. They are expensive, manual, and out of sync with the way renters operate. Now, Venn and Thriver are introducing a Klarna-inspired, “keep your cash now” deposit experience, bringing the same clarity, simplicity, and consumer-friendly choice directly into the Venn platform. Instead of paying a large upfront deposit, residents can select Thriver’s low-cost waiver instantly, right inside the move-in flow.

“Deposits shouldn’t be the moment where excitement turns into anxiety,” said Chen Avni, Co-Founder & CPO at Venn. “By embedding a modern, Klarna-style choice that lets residents hold onto more cash on day one, we’re finally giving renters an experience that matches the rest of their digital lives.”

A Deposit Experience That Finally Feels Modern

Historically, renters have been forced to navigate a disjointed deposit process: follow a link, create a new login, wait for approval, re-enter personal information, and hope the pricing is transparent. With Venn and Thriver, that entire process collapses into one simple decision at the exact moment it’s needed.

Inside Venn’s Move-In Checklist, residents see their traditional deposit amount alongside Thriver’s low-cost waiver. They select their option in seconds. There are no delays, no portals, and no uncertainty. Because the checklist already guides residents through a dynamic, revenue-driving onboarding flow, this choice appears exactly where it creates the most clarity and the most conversion. It means residents keep their cash upfront, operators get stronger protection, and the moment that used to feel expensive suddenly becomes effortless.

The technology disappears. The experience improves. And the move-in moment becomes something renters can actually look forward to.

Stronger Protection, Lower Barriers, Better Outcomes

What makes this leap forward possible is Thriver’s financial foundation. Backed by a major national insurance partner, the waiver offers deeper, more reliable coverage to operators while opening the door for more residents to qualify through the lowest credit thresholds in the industry.

“This partnership with Venn is a big step toward the version of leasing we’ve always believed should exist,” said Matt Mayberry, CEO of Thriver. “When deposit decisions live natively in a trusted platform, operators gain cleaner workflows and residents get immediate access to something that used to feel expensive, confusing, or out of reach. It’s a rare shift that benefits both sides of the lease equally.”

One Click Activation for Operators and Zero Added Work

A key strength of the Venn–Thriver integration is how little operators need to do. There is no training for site teams, no new tools and no new workflows.

Operators simply request activation, and the deposit experience appears instantly inside the existing Venn platform. All setup, communication, and promotion happen automatically.

“We designed this so operators feel the upside without feeling the lift,” added Barak Turns, VP of Strategy at Venn. “It’s effortless to turn on but meaningful in its impact. More applications converting, fewer bottlenecks, and a leasing journey that just feels cleaner.”

Venn and Thriver are bringing the simplicity of modern checkout to multifamily, transforming deposits from a financial barrier into a cash-preserving, fluid, digital decision that moves everyone forward.

About Venn

Venn powers the resident journey and onsite operations from application through renewal. By unifying data across every touchpoint, Venn is the only platform that enables operators to build a true consumer lifestyle brand, delivering personalized experiences that drive loyalty, unlock new revenue, and help teams run leaner and more efficiently. Venn has invested $70M in product infrastructure, led by investors including Group 11 and noa, and is trusted by top operators such as Bozzuto, CIM, and Veris Residential. For more information, visit venn.city.

About Thriver

Thriver is owned by United Risk and Applied Underwriters, a multibillion-dollar insurance group and one of the largest MGA platforms in the world. Thriver replaces traditional and legacy deposit alternatives with a fully embedded, instantly approved deposit waiver built for modern leasing and claims workflows. For operators, Thriver transforms deposits into a lever for conversion, efficiency, and protected NOI. For residents, it offers a transparent, digital-first option they can complete in seconds, making communities feel more modern, more affordable, and easier to move into. For more information, visit getthriver.com.

For Media inquiries contact:

Sydney Webber

VP, Marketing at Venn

sydney@venn.city

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/c00e33d5-e2f4-433a-93a5-202e006318d6