Since October 2020, the S&P 500 has delivered a total return of 108%. But one standout stock has more than doubled the market - over the past five years, Academy Sports has surged 242% to $50.14 per share. Its momentum hasn’t stopped as it’s also gained 31.9% in the last six months, beating the S&P by 8%.

Is now the time to buy Academy Sports, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Is Academy Sports Not Exciting?

Despite the momentum, we don't have much confidence in Academy Sports. Here are three reasons we avoid ASO and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

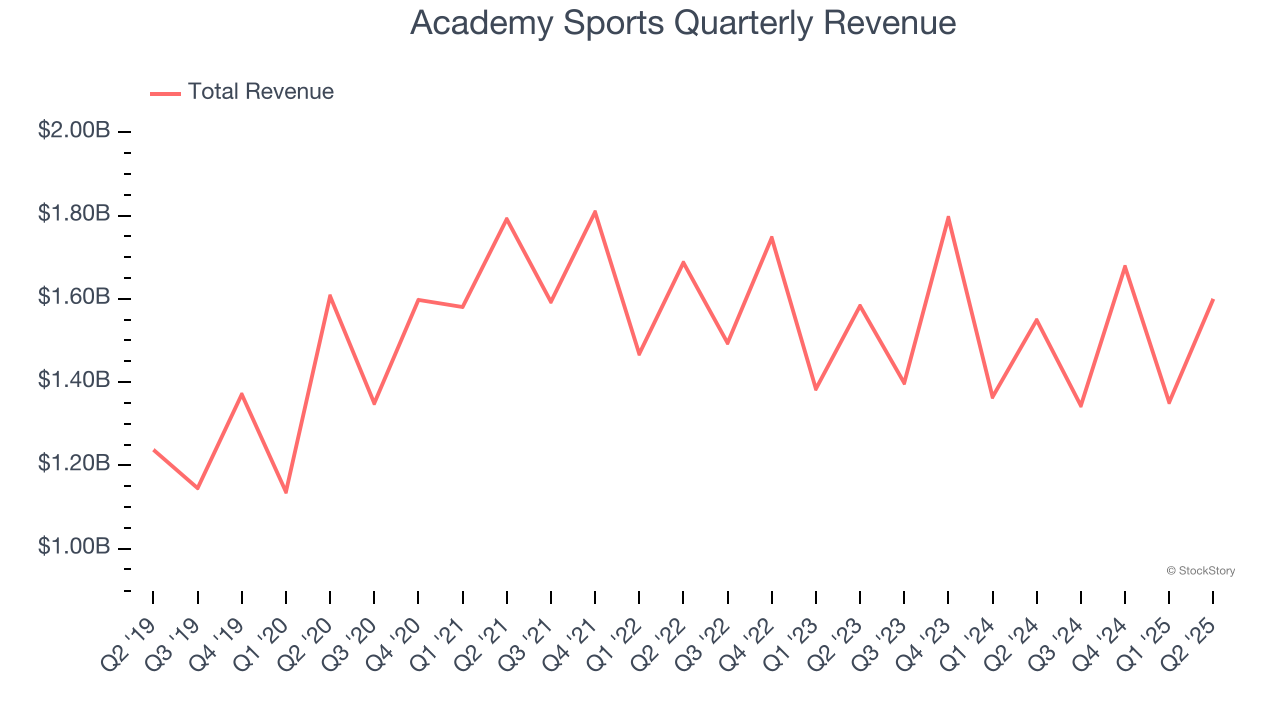

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last six years, Academy Sports grew its sales at a sluggish 4% compounded annual growth rate. This was below our standard for the consumer retail sector.

2. Shrinking Same-Store Sales Indicate Waning Demand

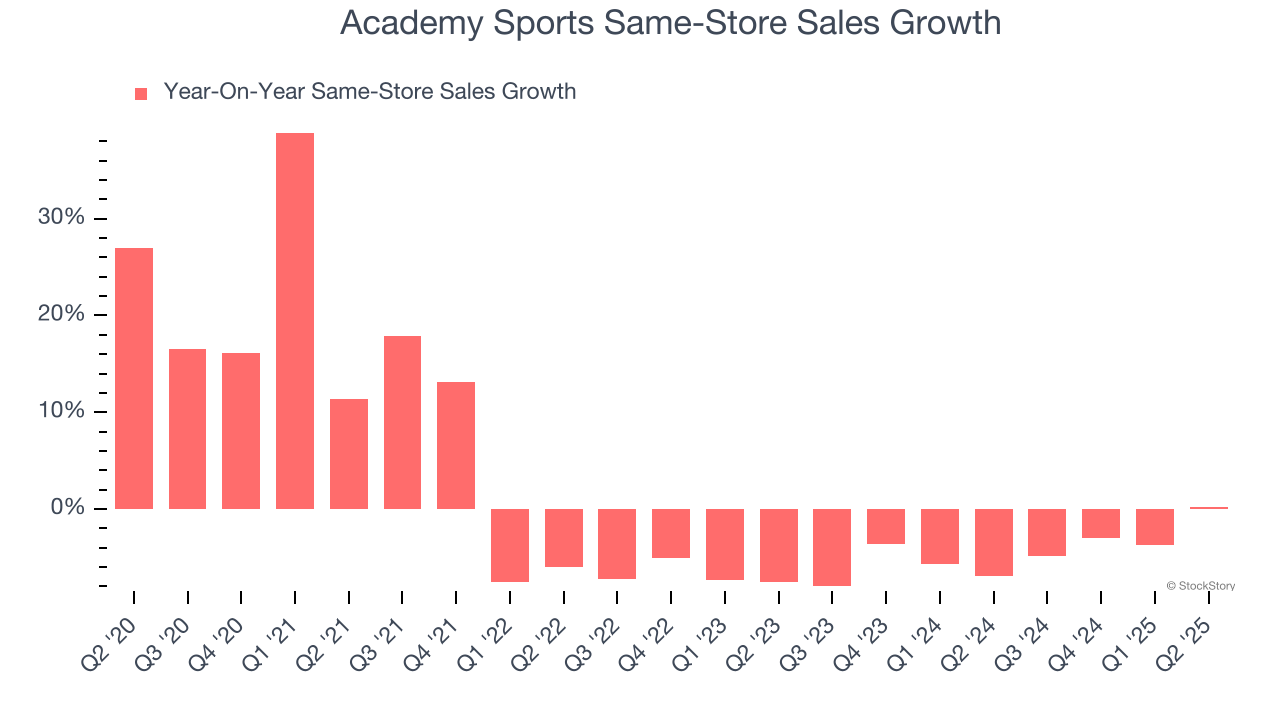

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

Academy Sports’s demand has been shrinking over the last two years as its same-store sales have averaged 4.5% annual declines.

3. EPS Trending Down

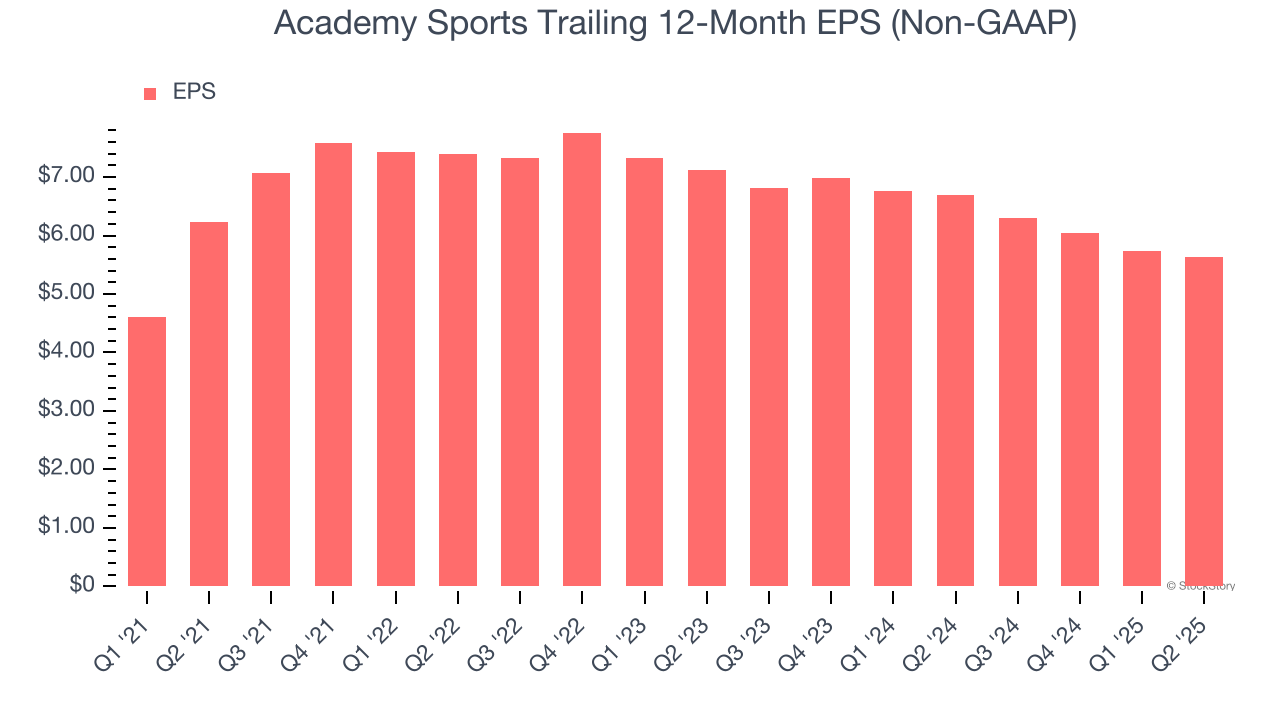

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Academy Sports’s full-year EPS dropped 10.2%, or 2.5% annually, over the last four years. In a mature sector such as consumer retail, we tend to steer our readers away from companies with falling EPS because it could imply changing secular trends and preferences. If the tide turns unexpectedly, Academy Sports’s low margin of safety could leave its stock price susceptible to large downswings.

Final Judgment

Academy Sports isn’t a terrible business, but it doesn’t pass our quality test. With its shares topping the market in recent months, the stock trades at 8.1× forward P/E (or $50.14 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at our favorite semiconductor picks and shovels play.

Stocks We Would Buy Instead of Academy Sports

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.