Uranium Markets Surge as Spot Price Rise (STUD, CCJ, UEC, URNM, SRUUF)

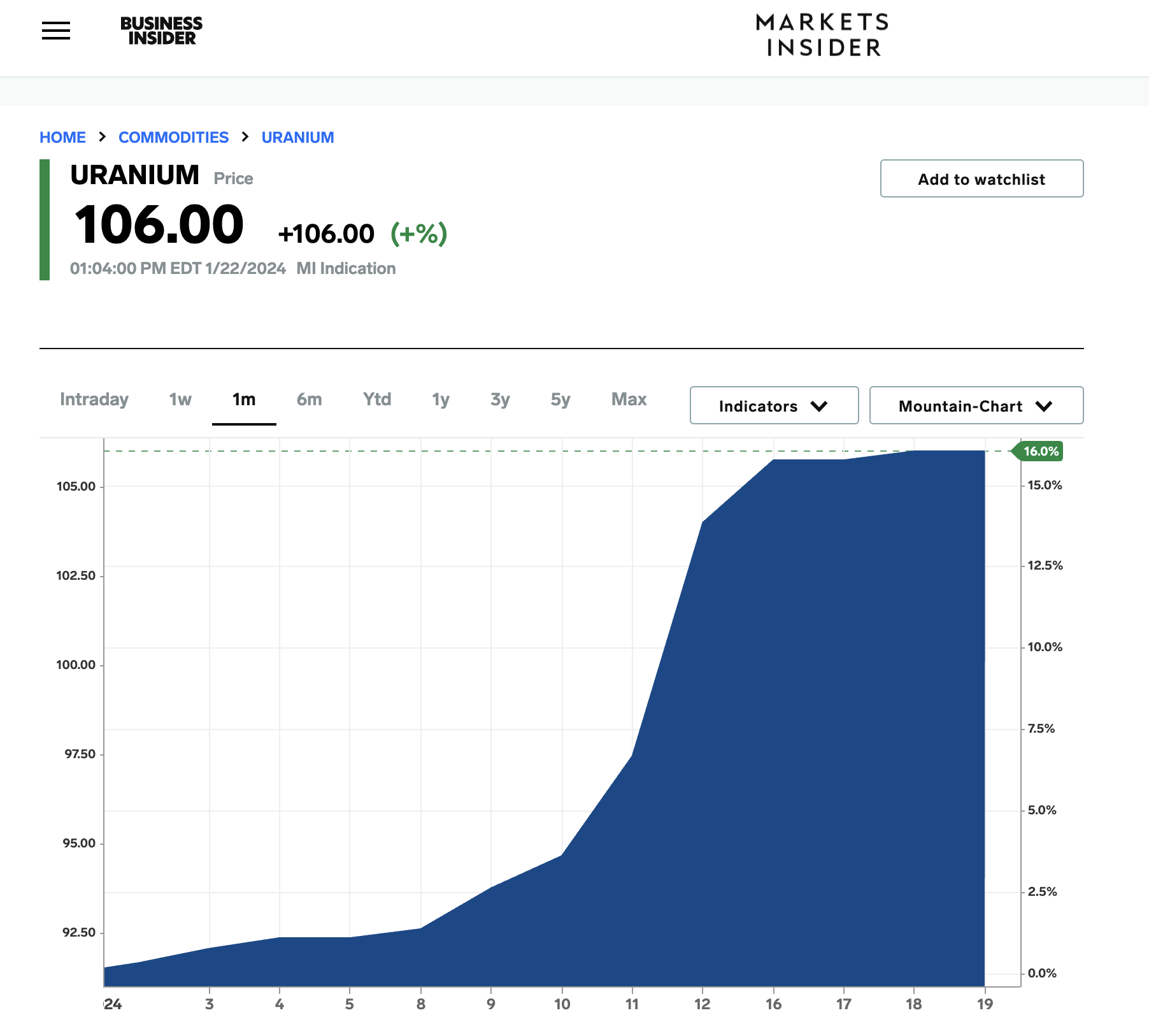

A dramatic rally has been underway in the uranium market, a sector that industry watchers expect to continue its upward trajectory. The spot price for uranium, vital for fueling nuclear reactors, has climbed to just over $106 per pound as of Tuesday. This surge represents a significant increase, with the metal experiencing a roughly 90% price gain in 2023 in a market struggling to meet rising demand.

The global uranium markets are experiencing a remarkable resurgence, drawing the attention of investors, energy analysts, and governments worldwide. Uranium's role in nuclear energy production - a reliable and relatively clean power source - is pivotal. Nuclear reactors utilize enriched uranium to generate electricity, a process considered crucial in the global energy mix for its efficiency and reduced greenhouse gas emissions, making it a key contributor in the fight against climate change.

Investors looking to capitalize on the surging uranium market should consider ETFs and small-cap trades poised to outperform. Notably, ETFs like Sprott Uranium Miners (URNM), which includes significant uranium miners like Cameco (CCJ), and the Sprott Physical Uranium Trust (SRUUF), are prime candidates. These ETFs consist of uranium miners operating both domestically and internationally, offering a diversified investment approach.

A company of particular interest is Stallion Uranium (TSX-V: STUD) (OTCQB: STLNF), which has made significant strides in acquiring mineral-rich land. Stallion Uranium boasts a substantial 692,647-acre project adjacent to key players like Cameco Corporation (CCJ), Orano Canada Inc, NexGen Energy (NYSE: NXE), and F3 Uranium Corp. (FUU.V), potentially positioning it as a notable contender in the industry.

Recently, Stallion Uranium Corp. (TSX-V: STUD; OTCQB: STLNF; FSE: HM40) announced that it has acquired by staking three new prospective uranium exploration dispositions in northern Saskatchewan, increasing Stallion’s total land package to 313,381 hectares (774,381 acres). The three dispositions add an additional 13,175 hectares to Stallion’s 100% owned holdings in the Athabasca Basin.

“In the Athabasca Basin, home to the highest-grade uranium deposits in the world, landholdings have become an increasingly competitive environment. With this staking we have added over 32,000 highly prospective acres to what was already the largest exploration project in the prolific southwestern Athabasca Basin,” stated Drew Zimmerman, CEO. “This addition builds on Stallion’s strategy to secure large, high potential land packages and work to advance the most compelling target areas towards drill testing, giving the company the highest probability of discovering the next significant uranium deposit.”

Several factors are driving the surge in uranium prices. These include supply constraints due to challenges in mining and production, growing global energy demands as the world transitions to cleaner energy sources, government support for nuclear infrastructure, and geopolitical tensions adding market uncertainty.

This surge in uranium prices is significantly impacting the energy sector. We are witnessing a potential nuclear renaissance, with higher uranium prices encouraging new investments in nuclear power plants and the revitalization of existing ones. This resurgence is in line with the global push for cleaner energy sources, as nuclear power can complement renewable energy by providing stable baseload power. Consequently, uranium and related investments, such as STLNF, are drawing increased interest from investors.

The resurgence of uranium markets, underscored by rising spot prices, represents a transformative development in the global energy landscape. As nations seek cleaner and more reliable energy sources, nuclear power, backed by a robust uranium market, is poised for a significant comeback. However, this resurgence brings challenges and considerations that need addressing for sustainable and responsible utilization. The future of uranium markets and nuclear energy is a development worth monitoring closely, especially for investors and traders looking towards a more sustainable energy future. As always, conduct your own due diligence.

Sources: https://ca.finance.yahoo.com/news/stallion-uranium-announces-expansion-largest-110000474.html

https://markets.businessinsider.com/commodities/uranium-price

https://stud.report/

Disclaimer: This blog post is for informational purposes only and is not intended as investment advice. Investors are advised to conduct their own research and consult with financial professionals before making any investment decisions. Please conduct your own research or consult a financial advisor before making any investment decisions. FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Please ensure to fully read and comprehend our disclaimer found at https://Stud.Report/disclaimer/. Starting on December 1, 2023, STUD.report has been compensated $25,000 per month for coverage of STUD by Volans Capital Corp. Stud.Report is neither an investment advisor nor a registered broker. No current owner, employee, or independent contractor of Stud.Report is registered as a securities broker-dealer, broker, investment advisor, or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. This article may contain forward-looking statements as defined under Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. These statements, often incorporating terms like "believes," "anticipates," "estimates," "expects," "projects," "intends," or similar expressions about future performance or conduct, are based on present expectations, estimates, and projections, and are not historical facts. They carry various risks and uncertainties that may result in significant deviation from the anticipated results or events. Past performance does not guarantee future results.Stud.Report does not commit to updating forward-looking statements based on new information or future events. Readers are encouraged to review all public SEC filings made by the profiled companies at https://www.sec.gov/edgar/searchedgar/companysearch. It is always important to conduct thorough due diligence and exercise caution in trading.Stud.Report is not managed by a licensed broker, a dealer, or a registered investment adviser. The content here is purely informational and should not be taken as investment advice. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor regarding forward-looking statements. Any statement that projects, foresees, expects, anticipates, estimates, believes, or understands certain actions to possibly occur are not historical facts and may be forward-looking statements. These statements are based on expectations, estimates, and projections that could cause actual results to differ greatly from those anticipated. Investing in micro-cap and growth securities is speculative and entails a high degree of risk, potentially leading to a total or substantial loss of investment. Please note that no content published here constitutes a recommendation to buy or sell a security. It is solely informational, and you should not construe it as legal, tax, investment, financial, or other advice. No content in this article constitutes an offer or solicitation by Stud.Report or any third-party service provider to buy or sell securities or other financial instruments. The content in this article does not address the circumstances of any specific individual or entity and does not constitute professional and/or financial advice. Stud.Report is not a fiduciary by virtue of any person's use of or access to this content.

Media Contact

Company Name: Stud.Report

Contact Person: Jason Roy

Email: info@stud.report

Country: United States

Website: https://stud.report/

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.