Electrovaya Reports Q1 FY2022 Results

Company reiterates revenue guidance for Fiscal 2022 of approximately $27 million

TORONTO, ON / ACCESSWIRE / February 14, 2022 / Electrovaya Inc. ("Electrovaya" or the "Company") (TSX:EFL)(OTCQB:EFLVF), a lithium-ion battery manufacturer with differentiated intellectual property that allows heightened safety and improved longevity enabling industry-leading performance, today reported its financial results for the fiscal first quarter ended December 31, 2021 ("Q1 FY2022"). All dollar amounts are in U.S. dollars unless otherwise noted.

Financial Highlights:

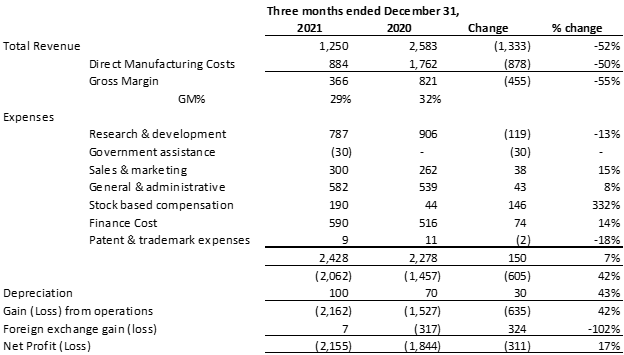

- Revenue for Q1 FY2022 was $1.3 million (C$1.5 million), compared to $2.6 million (C$3.3 million) in the fiscal first quarter ended December 31, 2020 ("Q1 FY2021"). Electrovaya has not historically experienced seasonality in its business. In recent periods, however, revenue has been relatively low in the fiscal first quarter, reflecting the preference of certain customers to defer product delivery past the holiday season in order to minimize disruptions at high-volume distribution centers during peak periods.

- Gross margin for Q1 FY2022 was 29%, compared to 32% for Q1 FY 2021. The decrease is due to a number of factors including changes in the product mix, material cost inflation, increased shipping and logistics costs, and foreign exchange movements.

- On December 7, 2021, the Company filed a final base shelf prospectus with the securities regulatory authorities in each of the provinces of Canada. The base shelf prospectus is valid for a 25-month period, during which time the Company may offer and issue, from time to time, common shares, warrants, units, subscription receipts, debt securities, or any combination thereof, having an aggregate offering price of up to $100 million.

- On December 17, 2021, the promissory note which was due to mature on December 31, 2021 was amended to extend the maturity to July 1, 2022. On the same day, the Company amended its C$7 million working capital facility to extend the maturity from December 31, 2021 to December 31, 2022.

Business Highlights:

- In January 2022, the Company announced approximately $6 million of orders through its OEM sales channel for a single end user, which is a Fortune 100 company. The end user will deploy the batteries in Materials Handling Electric Vehicles in two new distribution centres in the United States.

- On February 7, 2022, the Company announced the appointment of Kartick Kumar to its Board of Directors, effective immediately. Mr. Kumar brings extensive expertise on decarbonization and energy transition issues. Over his career, he has led investments and mobilized more than $2.5 billion of capital for growth-oriented companies active in wind, solar, hydropower and other renewable energies.

Positive Financial Outlook

The Company maintains its revenue guidance of approximately $27 million for the fiscal year ending September 30, 2022 ("FY 2022") and expects to be adjusted EBITDA1 positive for the year, barring any unforeseen circumstances. This is more than double the revenue total of $11.6 million in the 2021 fiscal year.

1 Non-IFRS Measure: Adjusted EBITDA is defined as loss from operations, plus finance costs, stock-based compensation costs and depreciation. Adjusted EBITDA does not have a standardized meaning under IFRS. We believe that certain investors and analysts use Adjusted EBITDA to measure the performance of the business and is an accepted measure of financial performance in our industry. It is not a measure of financial performance under IFRS, and may not be defined and calculated in the same manner by other companies and should not be considered in isolation or as an alternative to Income (loss) from operations.

Impact of COVID-19 Pandemic and Global Supply Chain Challenges:

Electrovaya is an essential business and has operated without major interruption during the COVID-19 pandemic to date. The Company's customers include large global firms in industries such as e-commerce, grocery, and logistics that are continuing to provide critical services during this difficult period. The crisis has highlighted Electrovaya's important role in helping its customers execute mission-critical applications under highly challenging conditions.

Global supply chain challenges continue to impact the Company's supply chain from many of its vendors. This is straining the Company's ability to meet delivery targets and resulting in associated cost increases. Steps have been taken to mitigate supply chain interruptions, such as holding additional safety stocks, qualifying multiple vendors, and increased emphasis on onshore supply. Management is monitoring the situation closely and taking corrective action to minimize disruptions as much as possible.

Selected Financial Information for the Quarters ended December 31, 2021 and 2020

Quarterly Results of Operations

(Expressed in thousands of U.S. dollars)

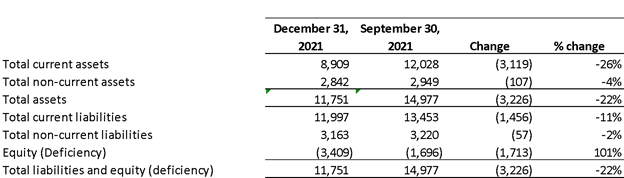

Summary Financial Position

(Expressed in thousands of U.S. dollars)

The Company's complete Financial Statements and Management Discussion and Analysis for the fiscal first quarter ended December 31, 2021 are available at www.sedar.com or on the Company's website at www.electrovaya.com.

Conference Call Details:

The Company will hold a conference call on Tuesday, February 15, 2022 at 8:00 a.m. Eastern Time (ET) to discuss the December 31, 2021 quarter end financial results and to provide a business update.

US and Canada toll free: (877) 407-8291

International: + 1(201) 689-8345

To help ensure that the conference begins in a timely manner, please dial in 10 minutes prior to

the start of the call.

For those unable to participate in the conference call, a replay will be available for two weeks

beginning on February 15, 2022 through March 1, 2022. To access the replay, the U.S. dial-in number is (877) 660-6853 and the non-U.S. dial-in number is +1 (201) 612-7415. The replay conference ID is 13727091.

For more information, please contact:

Investor Contact:

Jason Roy

Electrovaya Inc.

Telephone: 905-855-4618

Email: jroy@electrovaya.com

About Electrovaya Inc.

Electrovaya Inc. (TSX:EFL)(OTCQB:EFLVF) designs, develops and manufactures proprietary Lithium Ion batteries, battery systems, and battery-related products for energy storage, clean electric transportation and other specialized applications. Electrovaya is a technology focused company with extensive IP. Headquartered in Ontario, Canada, Electrovaya has production facilities in Canada with customers around the globe.

To learn more about how Electrovaya is powering mobility and energy storage, please explore www.electrovaya.com.

Forward-Looking Statements

This press release contains forward-looking statements, including statements that relate to, among other things, revenue and adjusted EBITDA forecasts and in particular the revenue and adjusted EBITDA forecasts for the fiscal year ending September 30, 2022, expected improvements in sales, revenues and adjusted EBITDA in fiscal year 2022, the Company's ability to satisfy its ongoing debt obligations, the ability to draw under the Company's shelf prospectus, anticipated increased collaboration with OEMs and OEM channels constituting a source of sales growth for the Company, in particular, the Company's OEM partner making purchases under the OEM Strategic Supply Agreement in the minimum amount necessary to maintain exclusivity, anticipated continued increases in sales momentum in fiscal 2022 in the Company's direct sales channel, the future direction of the Company's business and products, the effect of the ongoing global COVID-19 public health emergency on the Company's operations, employees and other stakeholders, including on customer demand, supply chain, and delivery schedule, the Company's ability to source supply to satisfy demand for its products and satisfy current order volume, technology development progress, plans for product development, and the Company's markets, objectives, goals, strategies, intentions, beliefs, expectations and estimates generally, and can generally be identified by the use of words such as "may", "will", "could", "should", "would", "likely", "possible", "expect", "intend", "estimate", "anticipate", "believe", "plan", "objective" and "continue" (or the negative thereof) and words and expressions of similar import. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, such statements involve risks and uncertainties, and undue reliance should not be placed on such statements. Certain material factors or assumptions are applied in making forward-looking statements, and actual results may differ materially from those expressed or implied in such statements. Important factors that could cause actual results to differ materially from expectations include but are not limited to: that current customers will continue to make and increase orders for the Company's products, and in accordance with communicated intentions and expectations, that the Company's alternate supply chain will be adequate to replace material supply and manufacturing, that the Company's settlement of the Litarion insolvency proceedings will proceed as outlined in the settlement agreement and without a significant negative effect on the Company or its assets, general business and economic conditions (including but not limited to currency rates and creditworthiness of customers), Company liquidity and capital resources, including the availability of additional capital resources to fund its activities, competition in the battery production and energy storage industry, changes in laws and regulations, legal and regulatory proceedings, the ability to adapt products and services to the changing market, the ability to attract and retain key executives, and the ability to execute strategic plans. Additional information about material factors that could cause actual results to differ materially from expectations and about material factors or assumptions applied in making forward-looking statements may be found in the Company's Annual Information Form for the year ended September 30, 2021 under "Risk Factors", and in the Company's most recent annual Management's Discussion and Analysis under "Qualitative And Quantitative Disclosures about Risk and Uncertainties" as well as in other public disclosure documents filed with Canadian securities regulatory authorities. The Company does not undertake any obligation to update publicly or to revise any of the forward-looking statements contained in this document, whether as a result of new information, future events or otherwise, except as required by law.

Revenue forecasts herein constitute future‐oriented financial information and financial outlooks (collectively, "FOFI"), and generally, are, without limitation, based on the assumptions and subject to the risks set out above under "Forward‐Looking Statements". Although management believes such assumption to be reasonable, a number of such assumptions are beyond the Company's control and there can be no assurance that the assumptions made in preparing the FOFI will prove accurate. FOFI is provided for the purpose of providing information about management's current expectations and plans relating to the Company's future performance, and may not be appropriate for other purposes.

The FOFI does not purport to present the Company's financial condition in accordance with IFRS, and it is expected that there may be differences between actual and forecasted results, and the differences may be material. The inclusion of the FOFI in this news release disclosure should not be regarded as an indication that the Company considers the FOFI to be a reliable prediction of future events, and the FOFI should not be relied upon as such.

SOURCE: Electrovaya Inc.

View source version on accesswire.com:

https://www.accesswire.com/688712/Electrovaya-Reports-Q1-FY2022-Results

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.