Ternium Announces Third Quarter and First Nine Months of 2023 Results

LUXEMBOURG / ACCESSWIRE / October 31, 2023 / Ternium S.A. (NYSE: TX) today announced its results for the third quarter and first nine months ended September 30, 2023.

The financial and operational information contained in this press release is based on Ternium S.A.'s operational data and consolidated condensed interim financial statements prepared in accordance with IAS 34 "Interim financial reporting" (IFRS) and presented in US dollars ($) and metric tons. Interim financial figures are unaudited. This press release includes certain non-IFRS alternative performance measures such as Adjusted Net Result, Adjusted Equity Holders' Net Result, Adjusted Earnings per ADS, Adjusted EBITDA, Net Cash and Free Cash Flow. The reconciliation of these figures to the most directly comparable IFRS measures is included in Exhibit I.

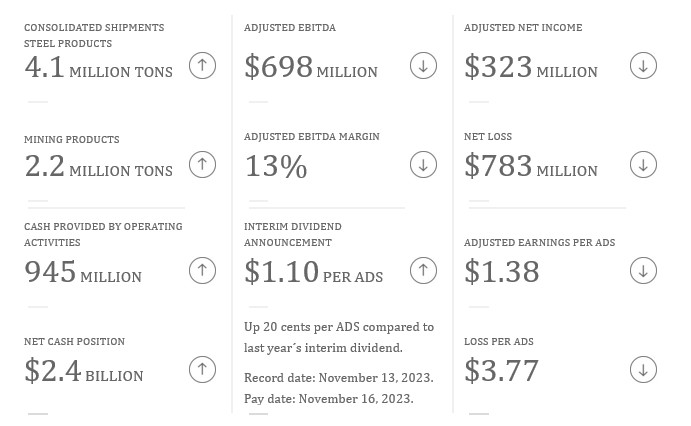

Third Quarter of 2023 Highlights

Summary of Third Quarter of 2023 Results

CONSOLIDATED |

3Q23 | 2Q23 | DIF | 3Q22 | DIF | 9M23 | 9M22 | DIF | ||||||||||||||||

Steel Shipments (thousand tons) |

4,131 | 2,982 | 39 | % | 2,967 | 39 | % | 10,179 | 8,876 | 15 | % | |||||||||||||

Mining Shipments (thousand tons) |

2,176 | - | - | 2,176 | - | |||||||||||||||||||

Net Sales ($ million) |

5,185 | 3,871 | 34 | % | 4,125 | 26 | % | 12,679 | 12,868 | -1 | % | |||||||||||||

Operating Income ($ million) |

527 | 732 | -28 | % | 526 | 0 | % | 1,616 | 2,656 | -39 | % | |||||||||||||

Adjusted EBITDA ($ million) |

698 | 883 | -22 | % | 679 | 2 | % | 2,089 | 3,112 | -33 | % | |||||||||||||

Adjusted EBITDA Margin (% of net sales) |

13 | % | 23 | % | 16 | % | 16 | % | 24 | % | ||||||||||||||

Net (Loss) Income ($ million) |

(783 | ) | 736 | 220 | 433 | 2,034 | ||||||||||||||||||

Equity Holders' Net (Loss) Income ($ million) |

(739 | ) | 627 | 153 | 262 | 1,728 | ||||||||||||||||||

(Losses) Earnings per ADS1 ($) |

(3.77 | ) | 3.19 | 0.78 | 1.34 | 8.80 | ||||||||||||||||||

Adjusted Net Income ($ million) |

323 | 736 | 220 | 1,539 | 2,034 | |||||||||||||||||||

Adjusted Equity Holders' Net Income ($ million) |

271 | 627 | 153 | 1,272 | 1,728 | |||||||||||||||||||

Adjusted Earnings per ADS1 ($) |

1.38 | 3.19 | 0.78 | 6.48 | 8.80 | |||||||||||||||||||

1 American Depositary Share. Each ADS represents 10 shares of Ternium's common stock. Results are based on a weighted average number of shares of common stock outstanding (net of treasury shares) of 1,963,076,776.

Net sales and shipments

Net sales were $1.3 billion higher sequentially in the third quarter of 2023, mainly as a result of an increase of $1.2 billion from the consolidation of Usiminas' sales.

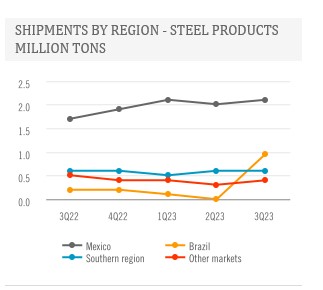

In Mexico, volumes increased sequentially in the third quarter, driven mainly by higher shipments to commercial customers and increased demand from the country's automotive industry. On the other hand, revenue per ton decreased in this region reflecting lower market steel prices, partially offset by higher industrial contract prices.

As a result of the consolidation of Usiminas, steel shipments in Brazil increased 1.0 million tons sequentially in the third quarter. Shipments to industrial customers account for approximately 70% of total steel shipments in the country, with a significant participation of the Brazilian automotive sector.

In the Southern Region, Ternium's shipments increased 7% sequentially in the third quarter of 2023 mainly as a result of the consolidation of Usiminas shipments to this region. Revenue per ton in the period remained relatively unchanged compared to the prior quarter. In Argentina, steel demand from industrial and commercial customers in the third quarter was similar to that in the second quarter.

In Other Markets, the company's shipments increased 26% in the third quarter of 2023 compared with the second quarter, reflecting the consolidation of Usiminas shipments in this region and higher shipments in the US market.

Results and capital allocation

Ternium's adjusted EBITDA decreased 22% sequentially in the third quarter of 2023 mainly due to the negative impact of lower steel prices in the USMCA region and higher cost of purchased slabs, partially offset by higher shipments in Mexico and Other Markets. Adjusted EBITDA margin in the period was affected by these variables, as well as by the consolidation of Usiminas' operating results, which recorded a very low level of profitability in the quarter.

Capital expenditures increased in the third quarter mainly due to the consolidation of Usiminas. The main projects carried out during the period were those for the relining of blast furnace #3 in the Ipatinga facilities and the construction of new downstream facilities in the Pesquería facilities.

During the period, Ternium acquired additional shares of Usiminas and announced an interim dividend payable to the company's shareholders on November 16, 2023.

Effects of the increase in the participation in Usiminas

On July 3, 2023, Ternium acquired an additional stake in Usiminas of 57.7 million ordinary shares, increasing its participation in the Usiminas control group to 51.5% and its economic participation to 23.3%. In addition, the Usiminas shareholders agreement was updated to reflect a new governance structure. Pursuant to the updated agreement, Ternium started to fully consolidate Usiminas balance sheet and results of operations. The increase in the participation in Usiminas resulted in a $1.1 billion non-cash net loss and a net $171 reduction in the value of Ternium's Equity.

Non-cash $935 million loss mainly due to the recycling of Currency Translation Adjustment (CTA) from Other Comprehensive Income to Net Results

As of June 30, 2023, items recognized in Other Comprehensive Income related to Ternium's previous stake in Usiminas amounted to a loss of $935 million. This negative reserve was mainly related to CTA losses due to the impact on Usiminas valuation of the depreciation, over the years, of the Brazilian Real versus the U.S. dollar, as Usiminas uses the Brazilian Real as its functional currency.

As a result of the increase in the participation in Usiminas, items recognized in Other Comprehensive Income related to Ternium's previous stake in Usiminas were recycled to the results of the period. The resulting loss is non-cash, it has no income tax effects and did not change the value of Ternium's equity.

Remeasurement of Ternium's stake in Usiminas

As a result of the purchase price allocation related to the business combination performed in the third quarter of 2023 and the remeasurement of Ternium's previous stake in Usiminas, the company registered a net loss of $171 million.

Recognition of contingencies as part of the business combination

As part of the business combination Ternium recognized Usiminas' contingencies of $656 million related to tax, civil, labor and other issues that were defined as "of no probable occurrence". These contingencies are not recognized in Usiminas' standalone balance sheet.

Interim Dividend Payment

Ternium's board of directors approved the payment of an interim dividend for 2023 of $1.10 per ADS ($0.11 per share), or $216 million in the aggregate. The interim dividend will be paid on November 16, 2023 to shareholders on record as of November 13, 2023. This represents an increase of 20 cents per ADS, or 22%, compared to last year's interim dividend.

Outlook

Ternium expects fourth quarter adjusted EBITDA to decrease compared to the third quarter, with lower adjusted EBITDA margin partially offset by slightly higher steel shipments. The company anticipates a sequential decrease in steel revenue per ton in the fourth quarter, reflecting lower realized prices in Mexico and Brazil.

In Mexico, the company expects apparent steel consumption to remain strong in the fourth quarter. Industrial sectors are showing healthy steel demand. Similarly, the commercial market continues to be very active due to low inventory levels and a recent improvement in steel benchmark prices. However, Ternium anticipates realized prices in Mexico to sequentially decrease in the fourth quarter, due primarily to the delayed impact of quarterly contract prices resetting at lower levels than in the third quarter.

In Brazil, Ternium expects shipments to remain relatively stable in most market sectors. In addition, the company anticipates realized steel prices to decrease in the fourth quarter compared to the third quarter due to a recent decrease in prices of local steel finished products.

In Argentina, the company anticipates a sequential decrease in fourth quarter shipments due to seasonality and government-imposed restrictions on the importation of inputs required for production by the company and its value chain. The steel market also continues to be highly unpredictable, as it is unclear what government measures may be taken to address the country's ongoing macroeconomic challenges when a new administration takes office in December of 2023.

Analysis of Third Quarter of 2023 Results

Consolidated Steel Products Sales

Ternium reports its sales of steel products under the Steel and Usiminas segments. The consolidation of Usiminas resulted in a $1.2 billion sequential increase in net sales to third parties in the third quarter of 2023 (1.0 million tons). The Steel segment net sales remained relatively stable sequentially in the third quarter, as higher shipments of steel products were offset by a lower revenue per ton.

Particularly in Mexico, revenue per ton decreased sequentially in the third quarter reflecting lower market steel prices in the USMCA region, partially offset by higher industrial contract prices.

Ternium's steel shipments in Mexico achieved a new all-time high in the third quarter. Volumes to industrial customers continued growing supported by the company's new state-of-the-art facilities in Pesquería. In addition, shipments to commercial customers improved sequentially in the third quarter.

The consolidation of Usiminas' shipments led to a significant increase in reported steel volumes in Brazil and to a moderate increase in steel volumes in the Southern Region and Other Markets.

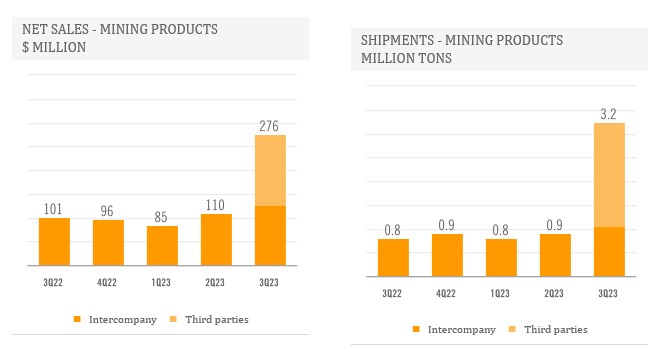

Mining Products Sales

Ternium reports intercompany and third-party sales of mining products under the Mining and Usiminas segments. The consolidation of Usiminas resulted in a $149 million sequential increase in net sales to third parties in the third quarter of 2023 (2.2 million tons).

CONSOLIDATED |

NET SALES ($ MILLION) | SHIPMENTS (THOUSAND TONS) | REVENUE/TON ($/TON) | ||||||||||||||||||||||||

| 3Q23 | 2Q23 | DIF | 3Q23 | 2Q23 | DIF | 3Q23 | 2Q23 | DIF | |||||||||||||||||||

Mexico |

2,383 | 2,457 | -3 | % | 2,135 | 2,031 | 5 | % | 1,116 | 1,209 | -8 | % | |||||||||||||||

Brazil |

1,136 | 38 | 957 | 42 | 1,187 | 906 | |||||||||||||||||||||

Southern Region |

941 | 870 | 8 | % | 603 | 563 | 7 | % | 1,561 | 1,545 | 1 | % | |||||||||||||||

Other Markets |

504 | 442 | 14 | % | 436 | 346 | 26 | % | 1,157 | 1,277 | -9 | % | |||||||||||||||

Total steel products |

4,964 | 3,806 | 30 | % | 4,131 | 2,982 | 39 | % | 1,202 | 1,276 | -6 | % | |||||||||||||||

Mining products |

149 | - | 2,176 | - | 68 | ||||||||||||||||||||||

Other products |

72 | 65 | 11 | % | |||||||||||||||||||||||

Net sales |

5,185 | 3,871 | 34 | % | |||||||||||||||||||||||

CONSOLIDATED |

NET SALES ($ MILLION) | SHIPMENTS (THOUSAND TONS) | REVENUE/TON ($/TON) | ||||||||||||||||||||||||

| 9M23 | 9M22 | DIF | 9M23 | 9M22 | DIF | 9M23 | 9M22 | DIF | |||||||||||||||||||

Mexico |

7,046 | 6,874 | 3 | % | 6,233 | 4,970 | 25 | % | 1,130 | 1,383 | -18 | % | |||||||||||||||

Brazil |

1,216 | 467 | 161 | % | 1,063 | 541 | 96 | % | 1,144 | 862 | 33 | % | |||||||||||||||

Southern Region |

2,664 | 2,883 | -8 | % | 1,709 | 1,773 | -4 | % | 1,559 | 1,626 | -4 | % | |||||||||||||||

Other Markets |

1,398 | 2,386 | -41 | % | 1,174 | 1,592 | -26 | % | 1,191 | 1,499 | -21 | % | |||||||||||||||

Total steel products |

12,324 | 12,610 | -2 | % | 10,179 | 8,876 | 15 | % | 1,211 | 1,421 | -15 | % | |||||||||||||||

Mining products |

149 | - | 2,176 | - | 68 | ||||||||||||||||||||||

Other products |

207 | 258 | -20 | % | |||||||||||||||||||||||

Net sales |

12,679 | 12,868 | -1 | % | |||||||||||||||||||||||

Note: other products include mainly electricity sales in Mexico and Brazil.

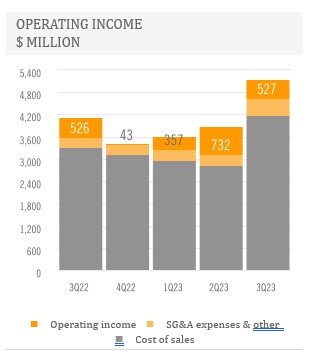

Operating Income

The consolidation of Usiminas' financial statements did not add significant results at the operating income level in the third quarter of 2023.

The sequential decrease in Ternium's operating income in the third quarter was primarily due to lower steel prices in the USMCA region and higher purchased slab costs, partially offset by higher shipments in Mexico and Other Markets.

$ MILLION |

3Q23 | 2Q23 | DIF | 3Q22 | DIF | 9M23 | 9M22 | DIF | ||||||||||||||||

Operating income |

527 | 732 | -28 | % | 526 | 0 | % | 1,616 | 2,656 | -39 | % | |||||||||||||

Net sales |

5,185 | 3,871 | 34 | % | 4,126 | 26 | % | 12,679 | 12,868 | -1 | % | |||||||||||||

Cost of sales |

(4,192 | ) | (2,839 | ) | 48 | % | (3,325 | ) | 26 | % | (10,012 | ) | (9,368 | ) | 7 | % | ||||||||

SG&A expenses |

(443 | ) | (304 | ) | 46 | % | (277 | ) | 60 | % | (1,040 | ) | (869 | ) | 20 | % | ||||||||

Other operating (loss) income |

(22 | ) | 4 | 3 | (11 | ) | 26 | |||||||||||||||||

Net Financial Results

Net foreign exchange results in the third quarter of 2023 were a loss of $33 million, mainly due to the impact of the depreciation of the Brazilian Real against the US dollar on Usiminas' net short foreign currency position. Fair value of Ternium Argentina's financial investments increased during the period. The US dollar value of these investments is based on their Argentine Peso local market price, converted at the ARS/$ official exchange rate.

$ MILLION |

3Q23 | 2Q23 | 3Q22 | 9M23 | 9M22 | ||||||||||

Net interest results |

30 | 25 | (8 | ) | 80 | 18 | |||||||||

Net foreign exchange result |

(33 | ) | (25 | ) | (19 | ) | (73 | ) | (137 | ) | |||||

Change in fair value of financial assets |

36 | (14 | ) | (23 | ) | 26 | 56 | ||||||||

Other financial income (expense), net |

(3 | ) | (4 | ) | (5 | ) | (13 | ) | (16 | ) | |||||

Net financial results |

30 | (18 | ) | (55 | ) | 20 | (79 | ) |

Income Tax Results

Ternium's effective tax rate in the third quarter of 2023 was affected by a $1.1 billion non-cash and non-taxable loss in connection with the increase in the participation in Usiminas. In addition, Ternium's subsidiaries in Mexico and Argentina recorded deferred tax losses as a result of the depreciation of the Mexican Peso and the Argentine Peso against the US dollar (net of the positive impact of inflation).

$ MILLION |

3Q23 | 2Q23 | 3Q22 | 9M23 | 9M22 | ||||||||||

Current income tax expense |

(164 | ) | (148 | ) | (73 | ) | (450 | ) | (577 | ) | |||||

Deferred tax gain (loss) |

(89 | ) | 143 | (89 | ) | 271 | 15 | ||||||||

Income tax (expense) gain |

(253 | ) | (5 | ) | (162 | ) | (179 | ) | (562 | ) | |||||

Result before income tax |

(530 | ) | 741 | 382 | 611 | 2,596 | |||||||||

Effective tax rate |

48 | % | -1 | % | -42 | % | -29 | % | -22 | % |

Net Income

Adjusted net income in the third quarter equals a net loss of $783 million, adjusted to exclude a loss of $1.1 billion in connection with the increase in the participation in Usiminas.

Adjusted equity holders' net income in the period equals an equity holders' net loss of $739 million adjusted to exclude a loss of $1.1 billion in connection with the increase in the participation in Usiminas.

Adjusted earnings per ADS equals adjusted equity holders' net income of $271 million divided by 1,963 million outstanding shares of Ternium's common stock, net of treasury shares, expressed in ADS equivalent (each ADS represents 10 shares).

View source version on accesswire.com:

https://www.accesswire.com/798173/ternium-announces-third-quarter-and-first-nine-months-of-2023-results

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.