Bridgewater Associates Is Giving Up on Lyft Stock. Should You?

Lyft (LYFT) makes a reappearance as hedge fund Bridgewater Associates fully unwound its shares in Q3 2025 by completely disposing of its 2.48 million shares it previously owned. The sharp cut of 100% comes as Lyft's revival narrative reaches new heights with records in profitability, ridership volumes, and success in autonomous mobility solutions. The shares have just touched $19 following intense volatility last week.

The overall mobility and sharing economy landscape has transformed over the last twelve months due to increased demand, optimizations in labor market dynamics, and swift adoption of autonomous technologies infused with AI. Lyft has been pursuing its strategies related to efficiency, automation, and premium rides aggressively; however, other players in consumer tech and transport have shown mixed performance. In this environment, Lyft posted its highest free cash flow and accelerating growth in active riders in their last earnings cycle.

About Lyft Stock

Lyft, headquartered in San Francisco, is one of the biggest ride-sharing platforms in North America and is accompanied by other related offerings like ride sharing, premium ride services like chauffeur rides, and autonomous vehicles. The firm is part of the consumer mobility services and transport technology space and had seen its market cap recover in 2025.

In the past 52 weeks, shares of Lyft have ranged from $9.66 to $25.54. While there has been some volatility in these past weeks, it has shown strong year-over-year (YoY) performance. Of late, it had weakened to closer to $19-$20, below what the S&P 500 Index ($SPX) had performed. However, it had shown greater resiliency in recent weeks due to increased demand and ongoing discipline shown by the firm.

In terms of valuation ratios, Lyft trades at 1.36 times its price/sales ratio, 47.96 times its forward earnings ratio, and 75.59 times its cash flow ratio. Although these ratios look rich relative to traditional transport companies and even other consumer internet startups, they actually represent what it costs to build and sustain a profitable business. The shares do not pay any dividend; hence, all bets rest on either growth or execution.

Lyft Posts Earnings Surprise

Lyft’s Q3 2025 results strengthened its hold on the idea of it slowly regaining traction in its recovery plan. The company reported revenue of 11% YoY to a new high of $1.7 billion and gross bookings of 16% to $4.8 billion, which were both new highs. The firm also registered its best profitability results yet, reporting $46.1 million in net income compared to a loss from last year and $138.9 million in adjusted EBITDA, increasing 29% from Q3 2024.

The tone of management’s announcement was quite optimistic. The firm reported its tenth consecutive quarter of double-digit ride growth, which touched 248.8 million rides and 28.7 million active riders. The firm broke $1 billion in trailing twelve months of free cash flow.

For Q4, Lyft forecasts ride volumes to improve in the mid- to high teens from last year, gross bookings of $5.01-$5.13 billion, and adjusted EBITDA of $135-$155 million. The firm mentioned several catalysts for this perspective, which include the acquisition of a luxury fleet service (TBR Global), a new partnership with Waymo in Nashville, and an upcoming consumer-owned autonomous vehicle service powered by Nvidia (NVDA) and its Tensor cores.

The date of its next earnings announcement hasn't been confirmed; therefore, it's advised to keep a watchful eye on the earnings calendar.

What Do Analysts Expect for LYFT Stock?

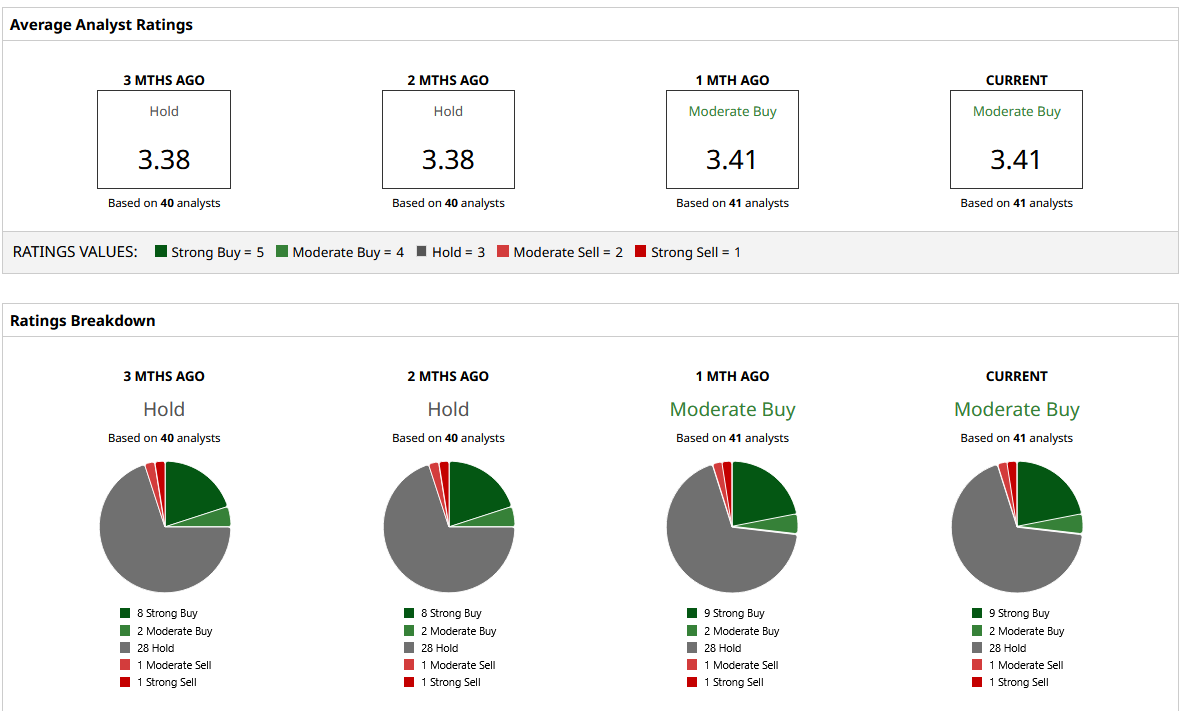

The Wall Street community's opinion about LYFT shares is cautiously optimistic, with a “Moderate Buy” rating and a target price range of $10 to $32; this shows wide variability seen in shares of such companies, which fall in the middle of such high-profile turnaround situations.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- I Paid for Michael Burry’s New $400 Substack So You Don’t Have To

- Bridgewater Associates Is Giving Up on Lyft Stock. Should You?

- Warren Buffett Warns Not to Listen to Investing Gurus, ‘The Only Value of Stock Forecasters Is to Make Fortune Tellers Look Good’

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.