Is Adobe Stock Underperforming the Dow?

With a market cap of $133.8 billion, Adobe Inc. (ADBE) is one of the world’s largest software companies. The company operates through three core segments: Digital Media; Digital Experience; and Publishing and Advertising, delivering solutions that empower individuals and enterprises to create, manage, and optimize digital content.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and Adobe fits this criterion perfectly. Its flagship offerings, including Creative Cloud and Document Cloud, drive the majority of revenue through subscription and licensing models, serving a wide range of creative professionals, businesses, and consumers worldwide.

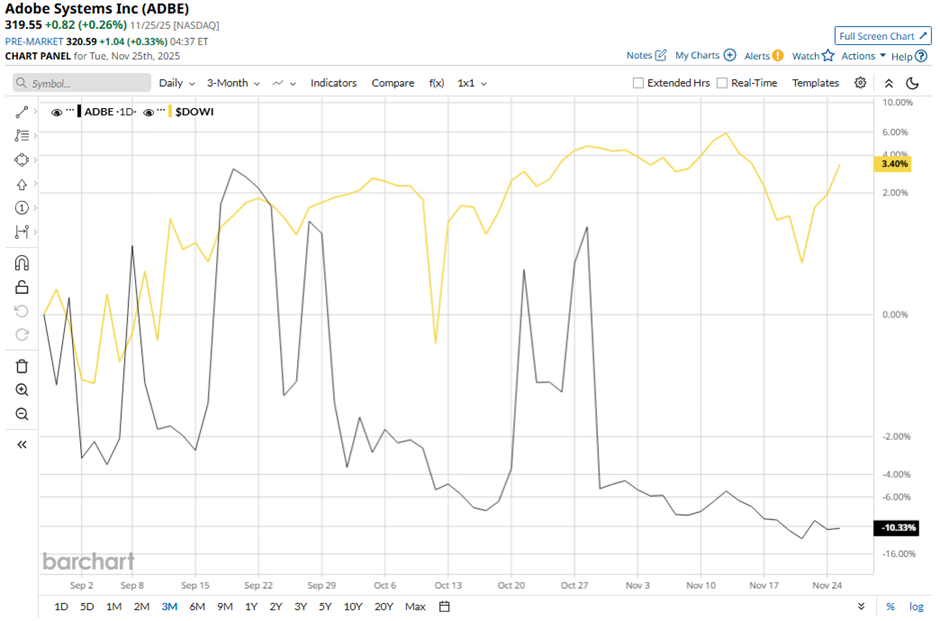

Despite this, shares of the San Jose, California-based company have declined 42.7% from its 52-week high of $557.90. ADBE stock has decreased over 12% over the past three months, lagging behind the broader Dow Jones Industrials Average's ($DOWI) over 4% rise over the same time frame.

In the longer term, Adobe stock is down 28.1% on a YTD basis, underperforming DOWI’s 10.7% gain. Moreover, shares of the software maker have dropped 38.4% over the past 52 weeks, compared to DOWI’s 5.3%return over the same time frame.

The stock has been trading below its 50-day and 200-day moving averages since early December last year.

Adobe reported better-than-expected Q3 2025 adjusted EPS of $5.31 and revenue of $5.99 billion Sept. 11. The company raised its fiscal 2025 revenue forecast to $23.65 billion - $23.70 billion and boosted its adjusted EPS outlook to $20.80 - $20.85. However, the stock fell marginally the next day.

In comparison, ADBE stock has shown a more pronounced decline than its rival Automatic Data Processing, Inc. (ADP). ADP stock has dipped 15.9% over the past 52 weeks and 12.4% on a YTD basis.

Despite the stock’s weak performance, analysts remain moderately optimistic on Adobe. The stock has a consensus rating of “Moderate Buy” from 36 analysts in coverage, and the mean price target of $465.72 is a premium of 45.7% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Tesla Is Looking for ‘Exceptional Ability’ in AI Chips. Does That Make TSLA Stock a Buy Here?

- Bridgewater Associates Is Betting Big on Robinhood Stock. Should You?

- If You Are Bullish on Agentic AI and Nvidia, Buy This 1 Stock

- NVDA Broken Wing Butterfly Trade Targets A Profit Zone Between 165 and 175

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.