Visa’s Unusual Options Activity on Thursday Signals 3 Smart Profit Moves You Can Make Now

Another workweek is almost in the books. The holidays are near. On Sunday evening, Hanukkah begins and runs until Dec. 22. Shortly after, Christmas is on tap; New Year’s is a week later, and 2026 is upon us. What the year ahead brings is anyone’s guess.

According to Binance, the average analyst estimate for the S&P 500's 2026 year-end closing value is 7,315, 6% higher than yesterday’s close. While that’s not double digits, it would be the fourth consecutive year of gains for the index. Let’s not get greedy.

If you read Howard Marks’ latest memo from Dec. 9, you’re likely moving to cash or other defensive positions. He’s not very optimistic about what lies ahead for the U.S. economy. I guess we’ll see soon enough.

Visa (V) jumped out at me as I pondered what to write in today’s commentary.

Not only did it have a share volume of 12.95 million, nearly double its 30-day average of 6.27 million, but its options volume was 66,369, nearly triple its 30-day average of 23,452, the highest volume since Oct. 29. Visa stock was up 6.1% yesterday, a 200% return on its 2025 share-price performance.

While I don’t follow Visa or Mastercard (MA) closely, the action caught my attention.

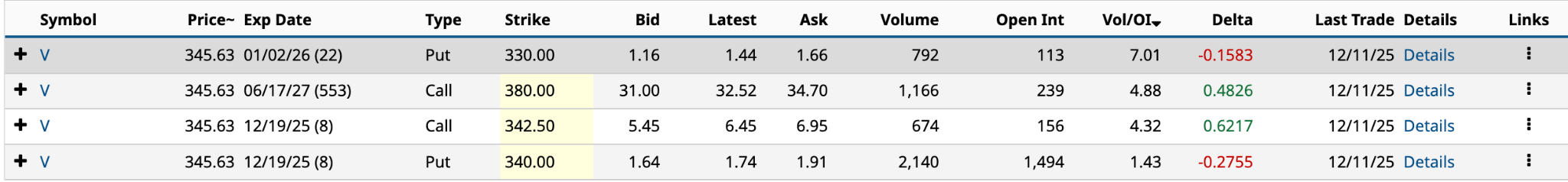

As it relates to unusual options activity, Visa had four yesterday (two calls and two puts), with Vol/OI (volume-to-open-interest) ratios above 1.24. They provide investors with three possible options strategies to profit from Visa stock’s newfound strength.

Have an excellent weekend.

The Options in Question

As I said in the introduction, Visa had four unusually active options yesterday: two calls and two puts.

None of the four would be considered massive volumes, but they do fit the description of unusually active options. More importantly, given the surge in share and option volume, Visa warrants attention.

None of the four would be considered massive volumes, but they do fit the description of unusually active options. More importantly, given the surge in share and option volume, Visa warrants attention.

While you could buy long calls or puts, or sell short calls or puts, and call it a day, I’m looking to consider more exotic possibilities to profit from Visa stock. Here are my three ideas.

The Visa Collar

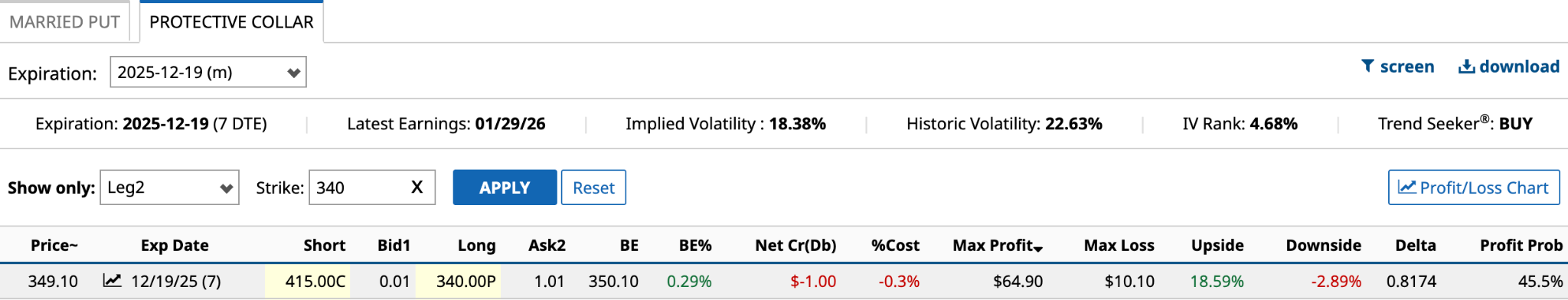

The collar is the most straightforward strategy. It involves selling an ITM (in-the-money) call for premium income and buying an OTM put (out-of-the-money) put for downside protection on a stock you already own, in this case, Visa.

The protective collar works with the call and put expiring next Friday, Dec. 19. This strategy combines a Covered Call with a Long Put.

The covered call would generate premium income of $545 ($5.45 bid price). The 100 shares would cost $34,563 ($345.63 per share).

The long put would cost $191 ($1.91 ask price) for a net credit of $354 on the two options. That’s good. It lowers the cost of the downside protection on Visa stock.

The maximum profit on this collar would be $41.00 [$342.50 call strike price - $345.63 share price + $3.54 net credit]. The maximum loss would be $209 [$340.00 put strike price - $345.63 share price + $3.54 net credit].

As you can see, the profit potential of this trade is next to nothing, with a maximum loss five times the maximum profit. It’s a non-starter.

However, if you stayed with the $340 put strike long and sold the $415 call instead, your upside relative to downside gets much better.

Could the Synthetic Long Stock Strategy Be the Trick for Visa?

Let’s assume that we’re bullish about Visa. I don’t think there’s any question that it’s an excellent stock to own for the long term.

Using a synthetic long stock strategy, you would buy a long call and sell a short put with the same strike price and expiration date. The strategy creates a risk-reward profile similar to actually owning the stock, but with a much lower capital outlay. Notably, this strategy would forgo dividends and other rights attached to actual ownership.

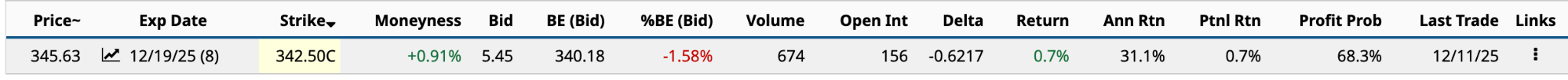

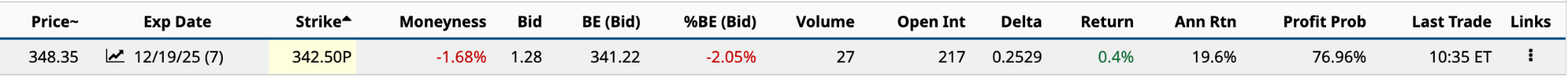

Ideally, the strike price is ATM (at the money). That best describes the Dec. 19 $342.5o call we discussed in the previous section. So, you would buy one $342.50 call and sell one $342.50 put. Both are expiring in a week today.

Using current prices as I write this late on Friday morning, here’s how the call and put look.

The $342.50 strike price is less ideal today than it was at yesterday’s close. Visa’s share price is up a few dollars, so the call is further ITM, while the put is further OTM.

Regardless, the net debit on the trade based on the above would be $682 [$8.10 ask price on call - $1.28 bid price on put]. That’s just 1.95% of the share price. Let’s assume that Visa’s momentum over the past week continues and the share price gains another 5% to $365.77.

That would produce a gain of $1,741.75 on the call [$365.77 share price - $348.35 call strike], the put would expire worthless, and you would pocket $1,059.75 [$1,741.75 gain - $682 net debit].

If the share price dropped 5% instead, based on the above, the call would expire worthless, and you would have to buy 100 Visa shares at $342.50, a $11.57 a share higher than the $330.93 share price at expiration. In addition, you’d incur a net debit of $682, for a total loss of $1,839.

Importantly, the loss on the put is unrealized until you sell the shares. If you’re bullish, you’ll wait for the shares to recover. The current analyst target price is $401.93, 15% above the current share price.

You’ve got to make lemonade out of lemons.

Can the Long Iron Butterfly Take Flight for Visa Stock?

This one is not for the faint of heart. It involves four options (two puts and two calls) at three strike prices, all with the same expiration date.

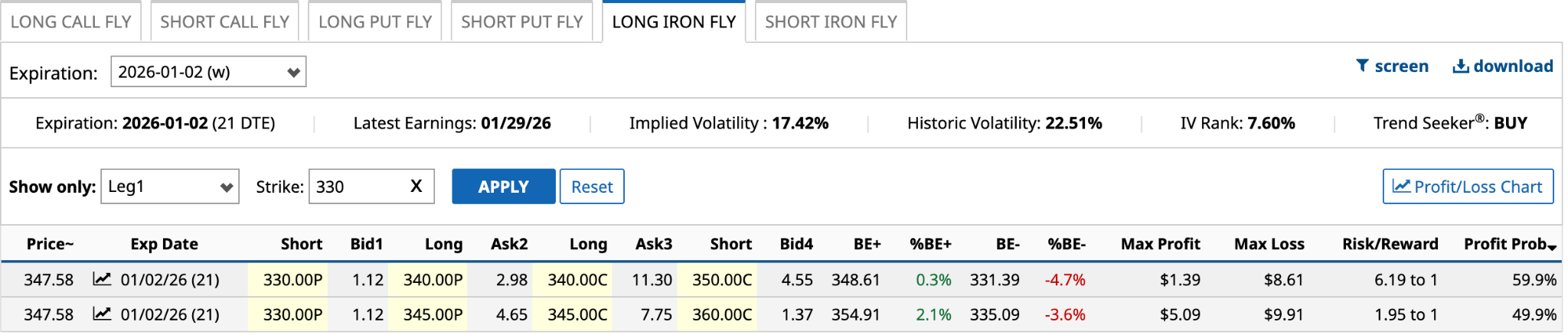

The Jan. 2/2026 $330 put from yesterday’s unusual options activity is the example I’ll use for the Long Iron Butterfly. Investors use the strategy when seeking a significant move in either direction by expiration. In this case, Jan. 2.

You sell the $330 put, buy the $340 or $345 put, buy the $340 or $345 call, and sell the $350 or $360 call.

Admittedly, I don’t use Iron Butterfly or Iron Condor options strategies, but many successful options traders do. They are better equipped to conduct a deep dive into the subject.

The strategy came to mind because of the call and put expiring next Friday. Because I’ve already used them, I thought I’d go with the $330 put expiring a week later.

I’m always thinking about balancing the cash outlay with the risk/reward. If the reward is high enough, investors shouldn’t necessarily pass on the bet because it’s more costly. Of course, everyone is different.

But based on the two examples above, if I’m generally bullish on Visa, the second, with the higher $345 long call, appears to be the better bet. The maximum loss is slightly higher, but the risk/reward and profit potential are much greater: a maximum profit of $5.09, and a risk/reward of 1.95 to 1.

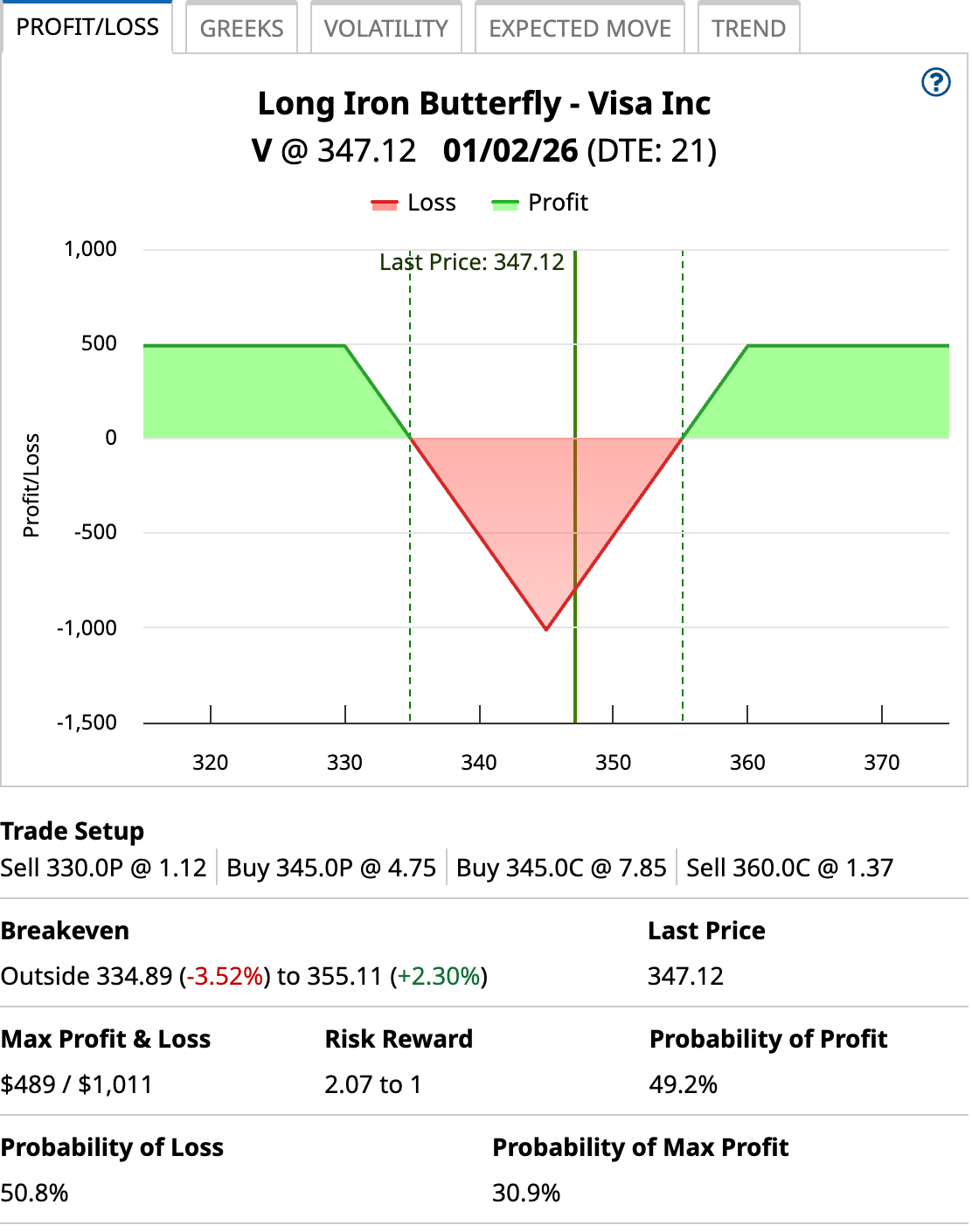

The iron butterfly strategy gets its name from the profit/loss chart it makes. It looks like a butterfly.

As shown above, due to price changes, the risk/reward has increased slightly to 2.07 to 1, but it is still much lower than the $340 call. Your net debit or maximum loss is $1,011, while your maximum profit is $489. You have nearly a 50/50 chance that the share price at expiration in three weeks will be above $355.11 or below $334.89.

You generate the maximum profit if the share price is at or above $360 or at or below $330 at expiration--right on the butterfly’s wings.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Visa’s Unusual Options Activity on Thursday Signals 3 Smart Profit Moves You Can Make Now

- Adobe Impresses the Market With Strong Free Cash Flow - Is ADBE Stock Worth Buying?

- This 1 Unusually Active IWM Put Option Screams Covered Strangle

- 2 Defined-Risk Options Strategies to Trade Quarterly Earnings Without Gambling

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.