Roper Technologies Stock: Analyst Estimates & Ratings

Roper Technologies, Inc. (ROP) is a diversified technology company that designs and develops vertical software and technology-enabled products for a variety of defensible niche markets, including application and network software as well as specialized technology products and solutions. The firm operates through multiple segments serving customers across industries such as healthcare, education, insurance, and industrial markets. Roper is headquartered in Sarasota, Florida, and has a market cap of $34.6 billion.

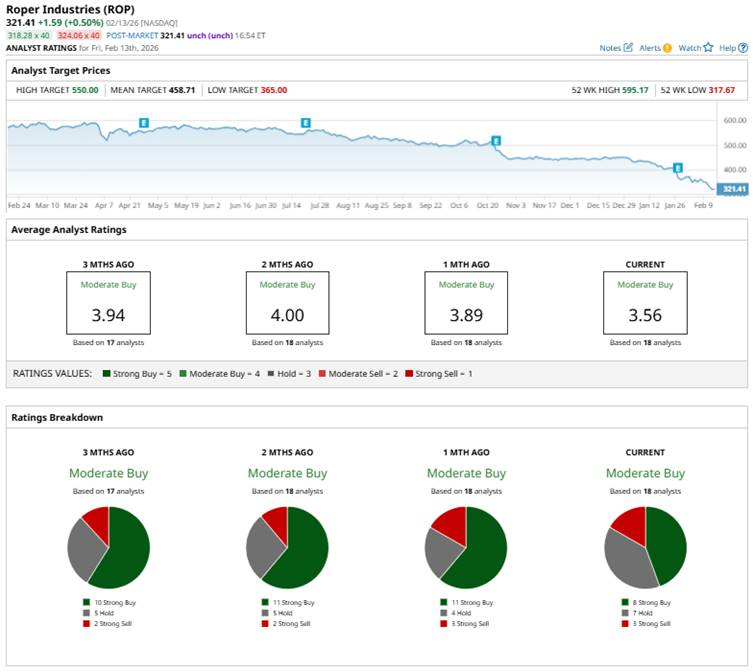

Over the past 52 weeks, shares of Roper Technologies have fallen 44%, underperforming the S&P 500 Index ($SPX), which climbed 11.8% during the same period. Year-to-date (YTD), the stock has continued to lag the broader market, posting a decline of 27.8% compared to the S&P 500’s marginal slump.

Within the broader sector, ROP has also trailed the State Street Technology Select Sector SPDR ETF (XLK), which has risen 16.7% over the past year and declined 3.1% on a YTD basis.

Roper’s stock has been declining primarily because recent earnings and outlook disappointed investors. In Q4 2025, Roper Technologies delivered top-line growth but mixed bottom-line results. Revenue rose about 10% year-over-year to roughly $2.1 billion. However, net earnings declined 7% YOY to $428 million, while adjusted earnings per share increased 8% to $5.21, topping expectations.

For the fiscal year 2026, ending in December 2026, analysts forecast an 4.3% YOY growth in EPS to $20.86. Moreover, the company has a strong track record of consistently outperforming analyst EPS estimates over the trailing four quarters.

Among 18 analysts covering ROP, the consensus rating stands at “Moderate Buy,” comprising eight “Strong Buy” ratings, seven “Hold” recommendations, and three “Strong Sells.”

This configuration is less bullish than one month ago, when there were 11 “Strong Buy” ratings.

Last month, Goldman Sachs lowered its price target on Roper Industries to $440 from $477 but maintained a “Buy” rating, following Roper’s fourth-quarter 2025 earnings report.

The mean price target of $458.71 represents a 42.7% premium to ROP’s current price levels. Meanwhile, the Street-high target of $550 suggests a potential upside of 71.1%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- How To Play These 2 Historically High-Yield Sector ETFs Amid Rally

- Amazon Put Options at Lower Strike Prices Have High Yields

- Calm Waters for Alphabet (GOOG, GOOGL) Stock Present a Tempting Options Trade

- 1 Ultimate Picks-and-Shovels AI Stock That Has a Billionaire Investor Loading Up

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.