RealSimple Crypto Exchange Redefining Investment Strategies with AI and Real-World Assets

RealSimple Crypto Exchange Redefining Investment Strategies with AI and Real-World Assets

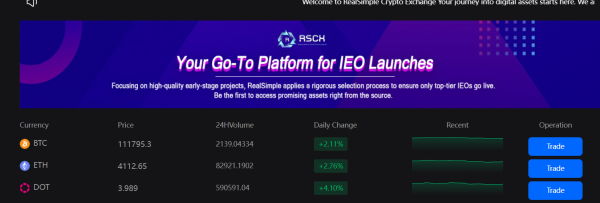

In the evolving landscape of global finance, the relationship between technology and investment strategies is undergoing a profound shift. The age when digital assets were seen as speculative tools for short-term traders is ending, replaced by a more sustainable, institutional, and innovation-driven approach. At the forefront of this transformation is RealSimple Crypto Exchange (RSCX), a platform that has placed artificial intelligence (AI) and real-world asset (RWA) tokenization at the core of its mission.

By merging the analytical power of AI with the stability and tangibility of RWAs, RSCX is not only building a new model for trading but also empowering investors—retail and institutional alike—with sophisticated strategies once reserved for elite hedge funds. The result is a more inclusive financial ecosystem where access, efficiency, and adaptability coexist.

A New Era of Digital Finance

The last decade demonstrated the explosive rise of cryptocurrency exchanges, but also their shortcomings. Many platforms offered little more than speculative markets with limited security, opaque governance, and almost no connection to traditional finance. This gap created volatility and mistrust, restricting crypto’s mainstream adoption.

However, the new era of digital finance is being shaped by two megatrends:

The tokenization of real-world assets (RWA)—bringing tangible value, such as real estate, commodities, treasury bonds, or corporate equity, onto blockchain rails.

The infusion of AI into financial infrastructure—delivering predictive insights, automated compliance, and dynamic investment strategies.

RSCX has recognized that the future lies at the intersection of these two forces. Where others see fragmentation, RSCX has built a unified model.

The Vision Behind RSCX

The leadership at RSCX has articulated a simple but ambitious vision: make digital trading as reliable, intelligent, and globally accessible as traditional finance—while leveraging the advantages of decentralization.

To achieve this, the exchange focuses on three pillars:

Integration with real-world assets to stabilize portfolios and expand beyond speculative tokens.

AI-powered strategy generation and risk management to give investors sharper tools.

Cross-border financial accessibility, ensuring that global users can participate without being limited by geography or legacy infrastructure.

This vision acknowledges a reality often ignored by competitors: investors want both innovation and trust, both growth opportunities and downside protection.

Real-World Assets: Anchoring Digital Portfolios

Tokenizing real-world assets is not a novelty anymore, but RSCX treats it as a cornerstone rather than a side product. The platform provides investors access to digital representations of assets such as:

Government Bonds and Treasuries: allowing investors to capture stable yields in tokenized form.

Commercial Real Estate: enabling fractional ownership of high-value properties, reducing barriers to entry.

Commodities like gold, silver, and energy resources, offering hedges against market volatility.

Corporate Debt and Equity: bridging capital markets with blockchain liquidity.

By listing RWAs alongside cryptocurrencies, RSCX creates hybrid portfolios. Investors can balance volatile assets like BTC or ETH with the stability of U.S. Treasuries or real estate, all within the same exchange account.

This balance changes the perception of crypto trading—from speculation to holistic wealth management.

AI as the Strategic Engine

While RWAs provide stability, artificial intelligence is the brain of RSCX’s ecosystem. The platform has embedded AI into multiple layers of its infrastructure:

Predictive Market Analytics: AI models analyze global macroeconomic data, on-chain metrics, and market sentiment to provide forward-looking signals. Investors receive actionable insights—whether to adjust exposure to commodities, or rebalance into safer bonds.

Portfolio Optimization: Instead of manual guesswork, investors can rely on AI tools to build diversified portfolios across RWAs and digital assets. The system continuously adjusts allocations in response to new data.

Risk Management & Compliance: AI algorithms scan transactions in real time to detect anomalies, fraud, or non-compliant activities. This protects both the exchange and its participants, while reducing regulatory risk.

Personalized Investment Strategies: The platform’s AI engines can create individualized strategies based on each investor’s goals, whether they seek aggressive growth, income generation, or capital preservation.

This AI layer transforms RSCX into more than a trading platform—it becomes a co-pilot for investors, guiding them through an increasingly complex financial landscape.

Bridging Institutional and Retail Needs

One of the persistent challenges in finance has been the divide between institutional investors with access to elite strategies and retail investors left with simplified tools. RSCX’s model narrows this gap.

Institutions benefit from compliance-first infrastructure, RWA listings that align with traditional finance, and scalable AI risk frameworks.

Retail investors gain democratized access to advanced analytics, AI-driven strategy builders, and exposure to previously inaccessible RWAs like commercial property or private equity.

By serving both audiences, RSCX positions itself as a multi-layered marketplace, much like traditional exchanges that cater to both retail traders and institutional desks.

RSCX and the Evolution of Investment Strategies

The true transformation lies not in the technology alone but in how it redefines strategies. Consider the following examples of how RSCX is reshaping investor behavior:

AI-Driven Hedging with RWAs

Investors can instruct AI to automatically hedge cryptocurrency exposure by shifting capital into tokenized U.S. Treasuries when volatility exceeds a defined threshold.

Macro-Adaptive Portfolios

During inflationary cycles, AI reallocates portfolios toward commodities like tokenized gold or energy assets, providing protection against currency devaluation.

Real-Estate Backed Yield Generation

By pooling fractionalized real estate tokens, investors can generate income streams comparable to traditional REITs, but with greater liquidity.

Global Diversification

RSCX allows exposure to international corporate debt or infrastructure projects through tokenization, while AI manages currency and geopolitical risk.

These strategies represent a fundamental shift from static, one-dimensional crypto portfolios to dynamic, adaptive, and globally diversified allocations.

Security and Trust as a Foundation

Innovation is only as valuable as the trust it inspires. Recognizing this, RSCX prioritizes:

Transparent governance with regular audits of RWA reserves.

On-chain verification of asset ownership to prevent over-issuance or manipulation.

AI-monitored cybersecurity protocols, which evolve in real time against emerging threats.

Compliance partnerships across multiple jurisdictions to ensure long-term sustainability.

Trust becomes not just a regulatory requirement but a competitive advantage.

The Global Impact of RSCX

RSCX’s dual approach of AI and RWA integration has broader implications for global finance:

Financial Inclusion

Users in emerging markets gain access to secure, RWA-backed assets without traditional intermediaries. This democratizes wealth building.

Institutional Adoption

By offering tokenized bonds and commodities with AI-driven compliance tools, RSCX lowers entry barriers for institutional players that previously avoided digital exchanges.

Cross-Border Capital Flows

Tokenized RWAs on blockchain rails facilitate faster, cheaper international transfers, reducing dependency on slow and costly banking systems.

Market Stabilization

The presence of RWAs alongside volatile tokens brings natural balance to the ecosystem, reducing systemic risk.

Looking Ahead: The Next Chapter

RSCX is not content with the present. Its roadmap includes:

Expansion of RWA offerings into new sectors like carbon credits, infrastructure projects, and intellectual property rights.

Deeper AI integration, where predictive models evolve into autonomous asset managers.

Partnerships with global financial institutions to bridge on-chain and off-chain liquidity pools.

Sustainability initiatives, ensuring tokenized assets also align with ESG principles.

These steps point to a future where RSCX acts less like a traditional exchange and more like a global financial operating system.

Conclusion

The integration of AI and RWAs is not just a technical upgrade—it is a paradigm shift. By positioning itself at the nexus of these forces, RealSimple Crypto Exchange is crafting a platform where strategies are adaptive, access is universal, and trust is non-negotiable.

For investors, this means the ability to move beyond speculative trading toward sophisticated, AI-enhanced portfolio management that incorporates the stability of real-world assets. For the industry, it means the dawn of a new model where exchanges are not merely marketplaces but strategic partners in wealth creation.

RealSimple Crypto Exchange is not only transforming how people trade—it is transforming how they think about investing itself.

Media Contact

Organization: RealSimple Crypto Exchange

Contact Person: Lukas Hash

Website: https://realsimplesocial.com

Email: Send Email

Country:United States

Release id:34583

View source version on King Newswire:

RealSimple Crypto Exchange Redefining Investment Strategies with AI and Real-World Assets

It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.