Retail Banks Miss the Mark on Financial Advice as Customer Expectations Grow, J.D. Power Finds

Capital One Ranks Highest in Customer Satisfaction with Retail Banking Advice

Facing a toxic combination of rising household costs, a looming recession and record levels of debt, fully 59% of retail bank customers say they expect their financial institutions to help them improve their financial health. The problem is, according to the J.D. Power 2022 U.S. Retail Banking Advice Satisfaction Study,SM released today, very few banks are delivering on that expectation. In fact, overall customer satisfaction with the advice and guidance provided by national and regional banks is notably 30 points lower (on a 1,000-point scale) than a year ago.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220623005329/en/

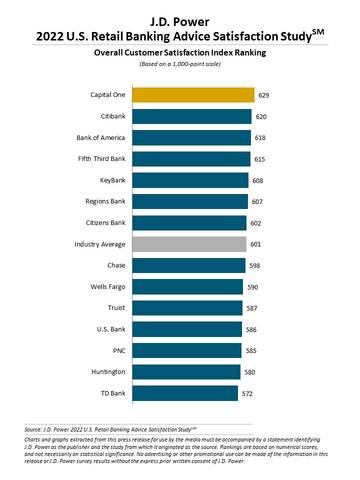

J.D. Power 2022 U.S. Retail Banking Advice Satisfaction Study (Graphic: Business Wire)

"The past few years have been tough on consumers in general, and many of the financial pressures they face may not subside all that quickly," said Jennifer White, senior director for banking and payments intelligence at J.D. Power. “The data make it crystal clear: retail bank customers want guidance, but many aren't receiving it. The tools banks have at their disposal aren't always being used or, when they are, they are not used effectively. Neither banks nor their customers benefit from this dynamic. If banks don't begin to make more progress in making advice content resonate, they could be facing significant attrition risk."

Following are key findings of the 2022 study:

- Less frequent, lower quality guidance contributes to seismic drop: Overall satisfaction with the advice and guidance provided by retail banks has fallen to 601, down a significant 30 points from 2021. The downward movement can be seen across all attributes of satisfaction, but the largest declines are in customer perceptions of the frequency of advice/guidance about financial products and/or financial needs and quality of advice/guidance. All of this occurs despite the view from retail bank customers that financial firms should be helping them improve their financial situation, evident across different age groups and personal financial health categories.

- Less advice recalled: Many banks may be trying to meet their customers’ advice needs yet recall of specific advice content is down. Nearly two-thirds (63%) of customers this year say they received advice two or more times in categories including financial planning; investment and retirement; savings, tips and information; or banking services. This is down from 70% a year ago. Advice related to saving and tips and information declines the most compared with 2021. The only category of advice not to see a decline is borrowing and housing.

- Bank customers feeling financially vulnerable: Using respondent-cited data on spending/savings ratio, credit worthiness and safety-net items such as insurance coverage, J.D. Power creates a measure of customer financial health, placing customers on a continuum from healthy to vulnerable. Just 47% of bank consumers who have received advice fall into the financially healthy category. The remaining 53% are categorized as either vulnerable (28%), overextended (16%) or stressed (9%).

- Moving forward: Retail bank customers want advice and guidance. When two or more instances of advice are recalled by customers, overall satisfaction increases 52 points. But a cookie-cutter approach will not suffice. Advice and guidance must be personalized to the specific customer, delivered to the right person at the right time. When advice is tailored to meet customers’ specific needs, satisfaction is even higher. Customers who receive advice just once that is personalized have higher satisfaction (697) than those who receive advice on five or more topics that is not personalized (583).

Study Ranking

Capital One ranks highest in customer satisfaction with retail banking advice with a score of 629. Citibank (620) ranks second and Bank of America (618) ranks third.

The 2022 U.S. Retail Banking Advice Satisfaction Study includes responses of 5,177 retail bank customers in the United States who received any advice/guidance from their primary bank regarding relevant products and services or other financial needs in the past 12 months. The study was fielded in January-February 2022. In addition to bank financial advice ratings, the study also provides financial health support index benchmarking data evaluating banks’ and credit card issuers’ proficiency in delivering financial support to customers.

Top-performing banks in the banking financial health support index are (in alphabetical order): Bank of America, Capital One, Chase, Huntington and U.S. Bank. Top-performing credit card providers in the credit card financial support index are (in alphabetical order): American Express, Bank of America, Discover, Fifth Third Bank, PNC and U.S. Bank.

For more information about the U.S. Retail Banking Advice Satisfaction Study, visit https://www.jdpower.com/business/financial-services/us-retail-banking-advice-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2022069.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20220623005329/en/

Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.