CORRECTING and REPLACING GRAPHIC Adobe Digital Price Index: Online Inflation Slows in June to 0.3%

- Online prices in June 2022 up 0.3% on annual basis, dropping 1% month-over-month

- $74.1 billion was spent online in June; over $451.7 billion spent online year to date, growing 7.5% year-over-year

- Grocery prices continue to surge, hitting another record high at 12.44%

Please replace the first graphic with the accompanying corrected graphic.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220712005535/en/

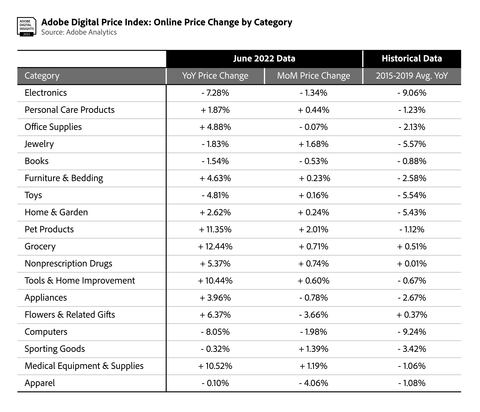

Price Table Year over Year (Graphic: Business Wire)

The release reads:

ADOBE DIGITAL PRICE INDEX: ONLINE INFLATION SLOWS IN JUNE TO 0.3%

- Online prices in June 2022 up 0.3% on annual basis, dropping 1% month-over-month

- $74.1 billion was spent online in June; over $451.7 billion spent online year to date, growing 7.5% year-over-year

- Grocery prices continue to surge, hitting another record high at 12.44%

Adobe (Nasdaq:ADBE) today announced the latest online inflation data from the Adobe Digital Price Index (DPI), powered by Adobe Analytics. In June 2022, online prices increased 0.3% year-over-year (YoY) while decreasing 1% month-over-month (MoM). While this marks the 25th month of inflation online YoY, June is the third month where online price increases have slowed.

Key categories including online electronics and apparel saw price decreases, driving down online retail inflation overall. Electronics experienced price decreases at 7.28% YoY (down 1.34% MoM). Prices for apparel decreased 0.10% YoY (down 4.06% MoM), significantly down compared to the 9.03% YoY increase in May. Grocery, tools and home improvement, and pet products were categories where prices continued to tick up. Grocery prices hit record highs, increasing 12.44% YoY (up 0.71% MoM). Tools and home improvement increased 10.44% YoY (0.60% MoM). Pet products increased 11.3% YoY (increasing 2% MoM).

In 2022 so far, consumers have spent a total of $451.7 billion online, growing 7.5% YoY. In June, consumers spent $74.1 billion online which represents approximately 1% YoY growth. Online spending decreased in June compared to April ($77.8 billion) and May ($78.8 billion). The Prime Day event – which historically drives higher levels of overall online spending within June will be occurring in July this year.

The DPI provides the most comprehensive view into how much consumers pay for goods online, as e-commerce expands to new categories and as brands focus on making the digital economy personal. Powered by Adobe Analytics, it analyzes one trillion visits to retail sites and over 100 million SKUs across 18 product categories: electronics, apparel, appliances, books, toys, computers, groceries, furniture/bedding, tools/home improvement, home/garden, pet products, jewelry, medical equipment/supplies, sporting goods, personal care products, flowers/related gifts, non-prescription drug and office supplies.

In June, 11 of the 18 categories tracked by the DPI saw YoY price increases, with groceries rising the most. Price drops were observed in seven categories: electronics, jewelry, books, toys, computers, sporting goods and apparel.

Eleven of the 18 categories in the DPI saw price increases MoM. Price drops were observed across seven categories including electronics, office supplies, books, appliances, flowers and related gifts, computers and apparel.

Notable categories in the Adobe Digital Price Index for June:

- Apparel: Prices were down 0.10% YoY (down 4.06% MoM) – standing out as the category with most notable change in June. This is the largest YoY drop for the category since March 2021, when prices were down 3.4% YoY. Price decreases in this category are helping drive down online retail inflation overall.

- Electronics: Prices continued to decrease 7.28% YoY (down 1.34% MoM). This is the largest YoY decrease for the category since May 2020, when prices were down 6.8% YoY. As the biggest category in e-commerce by share of spend, price movements have an outsized impact on overall inflation online.

- Groceries: Prices continued to surge and rose 12.44% YoY (up 0.7% MoM), setting a new record on an annual basis. This follows a series of record highs: 11.7% YoY increase in May, 10.3% YoY increase in April, 9% YoY increase in March and a 7.6% YoY increase in February. Groceries remains one of the main categories to move in lockstep with the CPI on a long-term basis, with online prices rising now for 29 consecutive months.

- Pet Products: Prices were up 11.35% YoY (up 2.01% MoM), continuing to set record YoY highs for the category. Online inflation for pet products has now been observed for 26 consecutive months as consumers continue to bring pets home, boosting demand.

- Tools and Home Improvement: Prices were up 10.44% YoY (0.60% MoM), the highest increase for the category on an annual basis. June also marks the 19th consecutive month of YoY inflation for the category.

Methodology

The DPI is modeled after the Consumer Price Index (CPI), published by the U.S. Bureau of Labor Statistics and uses the Fisher Price Index to track online prices. The Fisher Price Index uses quantities of matched products purchased in the current period (month) and a previous period (previous month) to calculate the price changes by category. Adobe’s analysis is weighted by the real quantities of the products purchased in the two adjacent months.

Powered by Adobe Analytics, Adobe uses a combination of Adobe Sensei, Adobe’s AI and machine learning framework, and manual effort to segment the products into the categories defined by the CPI manual. The methodology was first developed alongside renowned economists Austan Goolsbee and Pete Klenow.

About Adobe

Adobe is changing the world through digital experiences. For more information, visit www.adobe.com.

© 2022 Adobe. All rights reserved. Adobe and the Adobe logo are either registered trademarks or trademarks of Adobe in the United States and/or other countries. All other trademarks are the property of their respective owners.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220712005535/en/

Contacts

Public relations contacts

Erin Di Leva

Adobe

edileva@adobe.com

Bassil Elkadi

Adobe

belkadi@adobe.com

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.