Small Business Banking Customer Satisfaction Surges as Digital and In-Person Support Channels Improve, J.D. Power Finds

Capital One Ranks Highest in Small Business Banking Satisfaction

Small business owners are more optimistic about the future than they were a year ago, with slightly more than half (54%) saying their business is financially healthy, but inflation is still having a negative effect. According to the J.D. Power 2023 U.S. Small Business Banking Satisfaction Study,SM released today, banks are doing a better job of helping small businesses navigate this complicated set of market conditions with improved digital tools and more supportive telephone service and small business relationship managers.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231026540191/en/

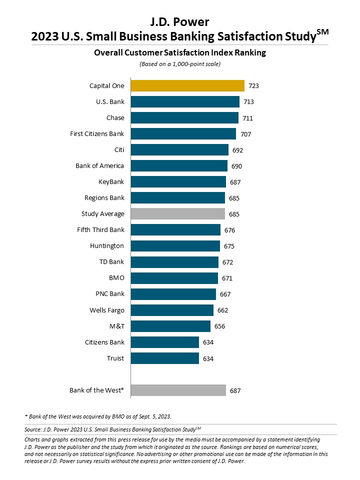

J.D. Power 2023 U.S. Small Business Banking Satisfaction Study (Graphic: Business Wire)

“Small business owners say that banks have reduced friction in digital and telephone banking services, while improving the courtesy and knowledge of branch staff and relationship managers,” said Paul McAdam, senior director of banking and payments intelligence at J.D. Power. “These improvements are paying off in the form of increased utilization of bank advice and significantly higher overall satisfaction and advocacy scores among small business customers. Banks can continue this positive momentum by blending digital services and human support with generative AI-driven technologies to improve personalization and customer engagement.”

Following are some key findings of the 2023 study:

- Live phone and digital support channels drive satisfaction: Overall satisfaction with live phone-based support increases this year as small businesses find it easier to get the help they want on the phone. Satisfaction with digital channels, including website and mobile, increases for speed; visual appeal; ease of navigation; clarity of information provided; and the range of services available.

- Relationship managers influence banking experience: Another big factor influencing small business banking customer satisfaction is the role of the relationship manager. Overall satisfaction with small business relationship managers has increased this year due to improved responsiveness; more frequent communication; and a growing perception that relationship managers are partners who help the company grow.

- Advice plays critical role in navigating uncertain economic environment: More businesses than ever are receptive to receiving financial advice from their bank. Currently, 57% of small business customers are receiving such advice. Three pragmatic forms of advice sought by small businesses include advice on how to avoid fees; spending and savings guidance; and guidance to help the business improve its credit score/creditworthiness.

- Sole proprietors present engagement challenge for banks: Sole proprietors is the only category not to improve in customer satisfaction in this year’s study. Satisfaction is lower among this segment of small business owners for problem resolution and owners in this segment are also less likely to use bank-provided spending and savings guidance and digital services such as spending analysis, budget tools and cash flow projections.

Study Ranking

Capital One ranks highest nationally in small business banking customer satisfaction with a score of 723. U.S. Bank (713) ranks second and Chase (711) ranks third.

The 2023 U.S. Small Business Banking Satisfaction Study measures satisfaction across seven factors (in order of importance): level of trust; people; allowing me to bank how and when I want; account offerings; helping me save time or money; digital channels; and resolving problems or complaints. The study includes responses from 7,104 owners of—or financial decision-makers at—small businesses that use business banking services. The study was fielded from May through August 2023.

For more information about the U.S. Small Business Banking Satisfaction Study, visit https://www.jdpower.com/resource/us-small-business-banking-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2023146.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20231026540191/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.