MAC Copper Simplifies its Debt Structure with Lower Interest Rate and Improved Liquidity

MAC Copper Limited ARBN 671 963 198 (NYSE: MTAL; ASX:MAC)

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250311692367/en/

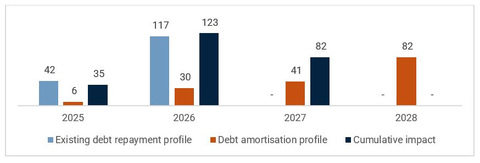

Debt Maturity Profile (US$M) (Graphic: Business Wire)

MAC Copper Limited (“MAC” or the “Company”) is pleased to announce that it has successfully amended its debt and further simplified its balance sheet through the early repayment of the Sprott mezzanine facility.

Overview of the Debt Facilities

- Old MAC facilities comprised of a US$159 million term loan facility, an undrawn US$25 million revolving credit facility, a US$145 million mezzanine facility1 and a A$45 million environmental bond (“Old Facilities”).

- New MAC facilities comprise of a US$159 million term loan facility, an upsized US$125 million revolving credit facility extended to 14 March 2028 and a A$45 million environmental bond now provided by three Australian Banks (“New Facilities”).

Key Highlights

- Simplification of MAC’s balance sheet through the early repayment of the Sprott mezzanine facility.

- A syndicate of six banks (including three Australian banks for the first time) providing the New Facilities.

- New Facilities have a longer dated maturity of 14 March 2028, including repayment holiday until 30 September 2025.

- Updated repayment profile under the New Facilities reduces MAC’s principal repayments by ~US$123 million over the next 21 months until December 2026.

- Revolving credit facility upsized by US$100 million to US$125 million, providing additional liquidity.

- New Facilities reduce MAC’s average weighted cost of debt by ~30%2 to approximately 6.85%.

- Interest cash savings of approximately US$14 million per annum under the New Facilities3.

- Reduction in environmental bond costs of ~93% with the introduction of Australian banks in the syndicate.

- Contingent copper payments to Glencore will not be payable before June 2026 (even if triggered)4.

As outlined in previous announcements, MAC will utilise the proceeds from it’s A$150 million (~US$103 million) equity raising in October 2024 to repay the Sprott mezzanine facility.

Following repayment of the Old Facilities, MAC will have pro-forma cash and cash equivalents of ~US$50 million (~A$80 million) and liquidity of ~US$109 million5 (~A$172 million)6.

Management Comment

MAC CFO, Morné Engelbrecht commented

“We are delighted with the continued support from our existing banking group but also very pleased to welcome three new Australian banks to the syndicate. We thank them for their support. The refinancing of the senior debt and the early repayment of the mezzanine facility supports MAC’s continued efforts to simplify and optimize its balance sheet, while ensuring a robust financial position to fund our promising growth projects. It also aligns our debt structure to our long-life, high-quality CSA Copper Mine.”

Early Repayment of Mezzanine Debt Facility

In accordance with previously disclosed amendments to the mezzanine debt facility with Sprott,1 MAC exercised its right to repay the facility in full by paying a total of US$160.1 million to Sprott, which includes interest from 1 January to 16 June 2025.

This announcement is authorised for release by the CEO.

About MAC Copper Limited

MAC Copper Limited (NYSE: MTAL; ASX:MAC) is a company focused on operating and acquiring metals and mining businesses in high quality, stable jurisdictions that are critical in the electrification and decarbonization of the global economy.

Forward Looking Statements

This release has been prepared by MAC Copper Limited (“Company” or “MAC”) and includes “forward-looking statements.” The forward-looking information is based on the Company’s expectations, estimates, projections, and opinions of management made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management of the Company believes to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove to be incorrect. Assumptions have been made by the Company regarding, among other things: the price of copper, continuing commercial production at the CSA Copper Mine without any major disruption, the receipt of required governmental approvals, the accuracy of capital and operating cost estimates, the ability of the Company to operate in a safe, efficient and effective manner and the ability of the Company to obtain financing as and when required and on reasonable terms. Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used by the Company. Although management believes that the assumptions made by the Company and the expectations represented by such information are reasonable, there can be no assurance that the forward-looking information will prove to be accurate.

MAC’s actual results may differ from expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions (or the negative versions of such words or expressions) are intended to identify such forward- looking statements. These forward-looking statements include, without limitation, MAC’s expectations with respect to future performance of the CSA Copper Mine. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from those discussed in the forward-looking statements. Most of these factors are outside MAC’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: the supply and demand for copper; the future price of copper; the timing and amount of estimated future production, costs of production, capital expenditures and requirements for additional capital; cash flow provided by operating activities; unanticipated reclamation expenses; claims and limitations on insurance coverage; the uncertainty in Mineral Resource estimates; the uncertainty in geological, metallurgical and geotechnical studies and opinions; infrastructure risks;; and other risks and uncertainties indicated from time to time in MAC’s other filings with the SEC and the ASX. MAC cautions that the foregoing list of factors is not exclusive. MAC cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. MAC does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based.

More information on potential factors that could affect MAC’s or CSA Copper Mine’s financial results is included from time to time in MAC’s public reports filed with the SEC and the ASX. If any of these risks materialize or MAC’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that MAC does not presently know, or that MAC currently believes are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect MAC’s expectations, plans or forecasts of future events and views as of the date of this communication. MAC anticipates that subsequent events and developments will cause its assessments to change. However, while MAC may elect to update these forward-looking statements at some point in the future, MAC specifically disclaims any obligation to do so, except as required by law. These forward-looking statements should not be relied upon as representing MAC’s assessment as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements.

_________________________

1 Refer to MAC’s ASX announcement titled ‘MAC Copper Limited and Sprott Amend Loan Agreement to Permit Early Repayment’ dated 17 December 2024 for further details.

2 Comparing the current weighted average interest cost of ~9.72% to an all-in interest rate of ~6.85%. The new interest rate is linked to SOFR and a leverage margin grid.

3 Full year of interest savings based on current interest rate differential.

4 The full form documentation continues to recognise that the contingents are not payable before 16 June 2026, other than from free cash flow and after satisfaction of all operating costs and debt servicing.

5 Includes cash of ~US$50 million plus undrawn Revolving Credit Facility of US$59 million

6 Converted into US$ based on an A$:US$ exchange rate of 0.6307, representing the closing exchange rate on 10 March 2025

View source version on businesswire.com: https://www.businesswire.com/news/home/20250311692367/en/

Contacts

Mick McMullen

Chief Executive Officer & Director

MAC Copper Limited

investors@metalsacqcorp.com

Morné Engelbrecht

Chief Financial Officer

MAC Copper Limited

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.