Corporación América Airports S.A. Reports February 2025 Passenger Traffic

Total passenger traffic up 6.0% YoY, or up 8.2% YoY ex-Natal

International passenger traffic up 11.2% YoY; up 19.1% YoY in Argentina

Corporación América Airports S.A. (NYSE: CAAP), (“CAAP” or the “Company”), one of the leading private airport operators in the world, reported today a 6.0% year-on-year (YoY) increase in passenger traffic in February 2025. Excluding Natal for comparison purposes, total traffic in February increased by 8.2% YoY.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250318243846/en/

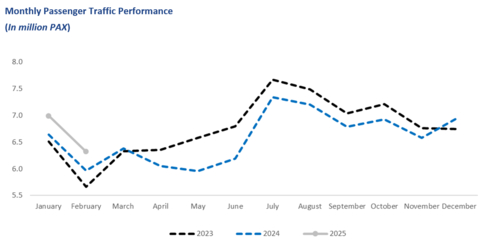

Monthly Passenger Traffic Performance (In million PAX)

Passenger Traffic, Cargo Volume and Aircraft Movements Highlights (2025 vs. 2024) |

||||||||

Statistics |

Feb'25 |

Feb'24 |

% Var. |

|

YTD’25 |

YTD'24 |

% Var. |

|

Domestic Passengers (thousands) |

3,292 |

3,219 |

2.2% |

|

6,864 |

6,829 |

0.5% |

|

International Passengers (thousands) |

2,442 |

2,197 |

11.2% |

|

5,160 |

4,583 |

12.6% |

|

Transit Passengers (thousands) |

588 |

546 |

7.6% |

|

1,292 |

1,189 |

8.7% |

|

Total Passengers (thousands)1 |

6,322 |

5,962 |

6.0% |

|

13,316 |

12,602 |

5.7% |

|

Cargo Volume (thousand tons) |

29.6 |

28.1 |

5.3% |

|

61.6 |

56.6 |

8.8% |

|

Total Aircraft Movements (thousands) |

64.2 |

62.9 |

2.0% |

|

134.8 |

132.7 |

1.6% |

|

1 Excluding Natal for comparison purposes, total passenger traffic was up 8.2% in February. |

Passenger Traffic Overview

Total passenger traffic increased by 6.0% in February compared to the same month in 2024, or by 8.2% when adjusted for the discontinuation of operations at Natal Airport. Domestic passenger traffic increased by 2.2% year-over-year or by 5.9% when excluding Natal. This growth was primarily driven by a recovery in domestic traffic in Argentina, along with strong performances in Italy and Brazil (excluding Natal). Meanwhile, international traffic grew by 11.2%, with all operating countries contributing positively year-over-year, except Armenia and Ecuador. Notably, Argentina accounted for 87% of the total international traffic growth.

In Argentina, total passenger traffic increased by 9.7% YoY after two consecutive months of record-high traffic figures. This growth was primarily driven by the ongoing recovery in domestic traffic, which rose by 5.7% YoY, marking three consecutive months of positive YoY growth. Notably, domestic traffic YoY comparisons are no longer affected by the ‘Previaje’ incentive program, which was suspended in December 2023 following the swearing-in of the new government. JetSMART, which recently added three Airbus A321neo aircraft, has continued to gain market share, serving 65% more passengers than in February 2024. Also in February, Flybondi inaugurated the Buenos Aires–Río Gallegos route, operating six weekly flights. International passenger traffic remained strong, increasing by a solid 19.1% YoY. The routes with the highest occupancy levels included Rio de Janeiro, São Paulo, Florianopolis, Madrid, Miami, and Panama.

In Italy, passenger traffic grew by 14.1% compared to the same month in 2024. International passenger traffic, which accounted for over 75% of the total traffic, increased by 11.8% YoY, driven by an 18.1% increase at Pisa airport and a 5.0% increase at Florence airport. Domestic passenger traffic increased by a robust 21.9% YoY, with strong performances at both Pisa and Florence airports.

In Brazil, total passenger traffic decreased by 1.7% YoY, or increased by 9.2% YoY when adjusting for the discontinuation of Natal Airport. These results reflect an improvement in traffic trends despite the still challenging aviation context and aircraft constraints in the country. Domestic traffic, which accounted for over 55% of the total traffic, was down 9.7% YoY, or up 6.9% when excluding Natal, while transit passengers were up 9.9% YoY. As a reminder, following the friendly termination process concluded in February 2024, CAAP no longer operates Natal Airport, effective February 19, 2024. Therefore, statistics for Natal are available up to February 18, 2024.

In Uruguay, total passenger traffic, predominantly international, continued its recovery, rising by 1.6% YoY, driven by new routes launched for the summer season. In December, SKY Airline introduced a new route connecting Montevideo with Rio de Janeiro, while Azul Linhas Aéreas began operating flights to Florianópolis. At Punta del Este Airport, the company kicked off the summer season with the first direct flight from Santiago de Chile to Punta del Este, operated by LATAM, with three weekly flights from November to March.

In Ecuador, where security concerns persist, passenger traffic declined by 2.3% YoY. International passenger traffic decreased by 2.5% YoY, while domestic traffic fell by 2.8% YoY, impacted by high airfare prices that have reduced travel demand.

In Armenia, passenger traffic decreased by 4.5% YoY, following a strong recovery post-Covid. Despite YoY traffic decline in February, travel in Armenia has been benefiting from the introduction of new airlines and routes, along with an increase in flight frequencies.

Cargo Volume and Aircraft Movements

Cargo volume increased by 5.3% compared to the same month in 2024, with positive YoY contributions from all countries of operation, except Ecuador: Argentina (+4.6%), Uruguay (+19.3%), Armenia (+2.9%), Italy (+0.6%), Brazil (+6.3%), and Ecuador (-0.2%). Argentina, Brazil, and Armenia accounted for almost 80% of the total cargo volume in February.

Aircraft movements increased by 2.0% YoY, mainly driven by Italy and Argentina with YoY increases of 13.2% and 2.1%, respectively. Argentina, Brazil, and Ecuador accounted for more 85% of total aircraft movements in February.

Summary Passenger Traffic, Cargo Volume and Aircraft Movements (2025 vs. 2024)

|

Feb'25 |

Feb'24 |

% Var. |

|

YTD'25 |

YTD'24 |

% Var. |

Passenger Traffic (thousands) |

|

|

|

|

|

|

|

Argentina |

3,798 |

3,461 |

9.7% |

|

8,016 |

7,200 |

11.3% |

Italy |

505 |

442 |

14.1% |

|

990 |

902 |

9.8% |

Brazil (1) |

1,172 |

1,192 |

-1.7% |

|

2,455 |

2,690 |

-8.7% |

Uruguay |

209 |

206 |

1.6% |

|

452 |

437 |

3.3% |

Ecuador |

344 |

352 |

-2.3% |

|

717 |

697 |

2.8% |

Armenia |

294 |

308 |

-4.5% |

|

687 |

676 |

1.6% |

TOTAL |

6,322 |

5,962 |

6.0% |

|

13,316 |

12,602 |

5.7% |

(1) |

Following the friendly termination process concluded in February 2024, CAAP no longer operates Natal airport. Statistics for Natal are available up to February 18, 2024. |

|

|

|

|

|

|

|

|

Cargo Volume (tons) |

|

|

|

|

|

|

|

Argentina |

14,831 |

14,173 |

4.6% |

|

32,489 |

29,643 |

9.6% |

Italy |

1,014 |

1,009 |

0.6% |

|

2,087 |

2,037 |

2.5% |

Brazil |

5,313 |

4,999 |

6.3% |

|

9,747 |

9,652 |

1.0% |

Uruguay |

2,713 |

2,275 |

19.3% |

|

5,663 |

4,297 |

31.8% |

Ecuador |

2,707 |

2,712 |

-0.2% |

|

5,518 |

5,665 |

-2.6% |

Armenia |

3,001 |

2,916 |

2.9% |

|

6,129 |

5,345 |

14.7% |

TOTAL |

29,580 |

28,083 |

5.3% |

|

61,633 |

56,640 |

8.8% |

Aircraft Movements |

|

|

|

|

|

|

|

Argentina |

36,941 |

36,174 |

2.1% |

|

78,057 |

75,526 |

3.4% |

Italy |

4,581 |

4,046 |

13.2% |

|

9,105 |

8,405 |

8.3% |

Brazil |

11,394 |

11,394 |

0.0% |

|

22,466 |

24,059 |

-6.6% |

Uruguay |

2,952 |

2,978 |

-0.9% |

|

6,851 |

6,813 |

0.6% |

Ecuador |

5,956 |

5,986 |

-0.5% |

|

12,809 |

12,580 |

1.8% |

Armenia |

2,361 |

2,365 |

-0.2% |

|

5,509 |

5,326 |

3.4% |

TOTAL |

64,185 |

62,943 |

2.0% |

|

134,797 |

132,709 |

1.6% |

About Corporación América Airports

Corporación América Airports acquires, develops and operates airport concessions. Currently, the Company operates 52 airports in 6 countries across Latin America and Europe (Argentina, Brazil, Uruguay, Ecuador, Armenia and Italy). In 2024, Corporación América Airports served 79.0 million passengers, 2.7% (or 0.4% excluding Natal) below the 81.1 million passengers served in 2023, and 6.2% below the 84.2 million served in 2019. The Company is listed on the New York Stock Exchange where it trades under the ticker “CAAP”. For more information, visit http://investors.corporacionamericaairports.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250318243846/en/

Contacts

Investor Relations Contact

Patricio Iñaki Esnaola

Email: patricio.esnaola@caairports.com

Phone: +5411 4899-6716

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.