ALT 5 – DIGITAL ASSETS MORNING CALL

By:

EIN Presswire

April 26, 2022 at 09:19 AM EDT

Bitcoin is coming to retirement plans; bitcoin-Nasdaq correlation strengthens

NEW YORK, US, April 26, 2022 /EINPresswire.com/ -- ALT 5 Sigma Inc. a global fintech that provides next generation blockchain powered technologies for tokenization, trading, clearing, settlement, payment, and insured custodianship of digital instruments releases its digital assets morning call.• Fidelity’s plan to include bitcoin in 401K plan offerings broadens access to crypto markets

• The correlation between bitcoin and the Nasdaq Composite has risen markedly this year

• The shift highlights the continuing impact of the Fed pivot on risk assets

Fidelity plans to allow bitcoin investments in the 401K plans it administers, according to a report in the Wall Street Journal. Individual employers who use Fidelity to administer their 401K plans will still have to decide whether include crypto in the investment offerings to their employees, and bitcoin will be the only crypto investment initially offered on the Fidelity 401K platform.

Retirement plan inclusion will broaden investor access to crypto assets

Fidelity is among the country’s largest 401K administrators and, according to the article, manages retirement plans for some 20 million individuals. That’s a significant, potential source of new money entering the crypto space and the move further widens the potential adoption of crypto assets, a bullish development for crypto prices, other things being equal. It also helps to address increased interest from individual investors to include crypto in their retirement plans. And if the Fidelity move proves popular with investors, it’s reasonable to expect other 401K plan administrators to include crypto in their investment offerings as well.

Equity and crypto assets rebound

As close followers of crypto markets have observed, major crypto assets have been trading more in line with risk assets in recent months. That is evident again this week, as the stabilization in US equities on Monday (using the Nasdaq Composite as an example) from their considerable declines the previous week concurred with a similar recovery in bitcoin, ethereum and solana with those coins now back above key psychological thresholds of $40,000, $3,000 and $100 respectively.

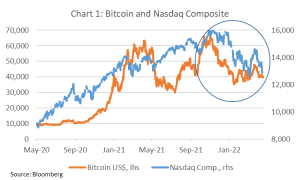

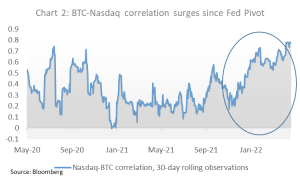

The correlation between bitcoin and the Nasdaq Composite has surged

It’s not just in recent days or weeks that the relationship has been evident. As Chart 1 shows, the movements in bitcoin and the Nasdaq have been mirroring each other more closely since late last year. And as shown in Chart 2, the correlation between bitcoin and the Nasdaq has surged since November and has recently topped 0.70 (based on 30-day rolling observations).

The obvious catalyst for this has been the “Fed pivot” in November, when the central bank began to tell markets that the period of easy monetary policy would be coming to an end. That signaled an end to the open-ended liquidity injections into the economy and financial system that had supported risk assets, including crypto prices, since the early days of the covid pandemic.

It’s important to note that the correlation has and will continue to change over time. As the charts show, the correlation was not always strong during the pandemic, demonstrating that there are other factors that can impact crypto prices beyond changes in monetary and fiscal liquidity injections. For example, crypto mining costs, regulations and institutional adoption are just some of the factors that have previously and will in the future have an outsized impact on prices.

But from our perspective, the change by central banks and governments to reverse course and withdraw liquidity—and the macro dynamics driving that change—continues to be the dominant force driving the prices of major crypto assets at present.

Correlations will eventually shift but macro factors look to remain key for now

Admittedly, this story has now been evident for roughly half a year and is much better reflected in current crypto prices. But with the actual path of Fed policy rates, the impact of upcoming Fed balance sheet reduction, and the economy’s reaction to these anticipated developments still not clear, it is likely that macro factors will continue to exert significant influence on crypto prices—and risk assets generally—for the foreseeable future.

Robert Lynch

Head of Research and Strategy

ALT 5 Sigma Inc.

bob@alt5sigma.com

ABOUT ALT 5 Sigma

ALT 5 Sigma is a global fintech that provides next generation blockchain powered technologies for the trading, clearing, settlement, payment, and insured custodianship of digital instruments. ALT 5 was founded by financial industry specialists out of the necessity to provide the digital asset economy with security, accessibility, transparency, and compliance. ALT 5 provides its clients the ability to buy, sell and hold digital assets in a safe and secure environment deployed with the best practices of the financial industry. ALT 5 Sigma's products and services are available to Banks, Broker Dealers, Funds, Family Offices, Professional Traders, Retail Traders, Digital Asset Exchanges, Digital Asset Brokers, Blockchain Developers, and Financial Information Providers. ALT 5's digital asset custodian services are secured by Fireblocks.

DISCLAIMER:

Digital Asset Morning Call is for informational purposes only and does not constitute, either explicitly or implicitly, any provision of services or products by ALT 5 Sigma ("ALT 5"). Investors should determine for themselves whether a particular service or product is suitable for their investment needs or should seek such professional advice for their particular situation. ALT 5 Sigma. makes no representation or warranty to any investor regarding the legality of any investment, the income or tax consequences, or the suitability of an investment for such investor. ALT 5 Sigma does not solicit or provide any financial advice. This is at the sole discretion of the individual.

ALT 5 Sigma Inc.

ALT 5

+1 888-778-7091

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

More News

View More

3 ETFs Combining Market-Beating Performance and ESG Goals ↗

Today 8:24 EST

Via MarketBeat

Tickers

DKNG

The One Metric Bulls Watch in Palantir Before Earnings ↗

January 21, 2026

Via MarketBeat

Small Cap Spike: Semi Stock AEHR Up +40% in 2026 Post-Earnings ↗

January 21, 2026

Via MarketBeat

Tickers

AEHR

Tupperware Lives On: Why Betterware Is Up 8% on the News ↗

January 21, 2026

Via MarketBeat

Tickers

BWMX

Recent Quotes

View More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

>