U.S. Insurance Industry Shows Signs of Resilience Despite Continued Headwinds in 2024

JERSEY CITY, N.J., March 20, 2025 (GLOBE NEWSWIRE) -- Verisk (Nasdaq: VRSK), a leading global data analytics and technology provider, and The American Property Casualty Insurance Association (APCIA), the primary national trade association for home, auto and business insurers, today reported full-year 2024 net income for the insurance industry, which is estimated to be $170 billion. Adjusting for over $70 billion in capital gains realized by one insurer, full-year 2024 net income is estimated to be $100 billion.

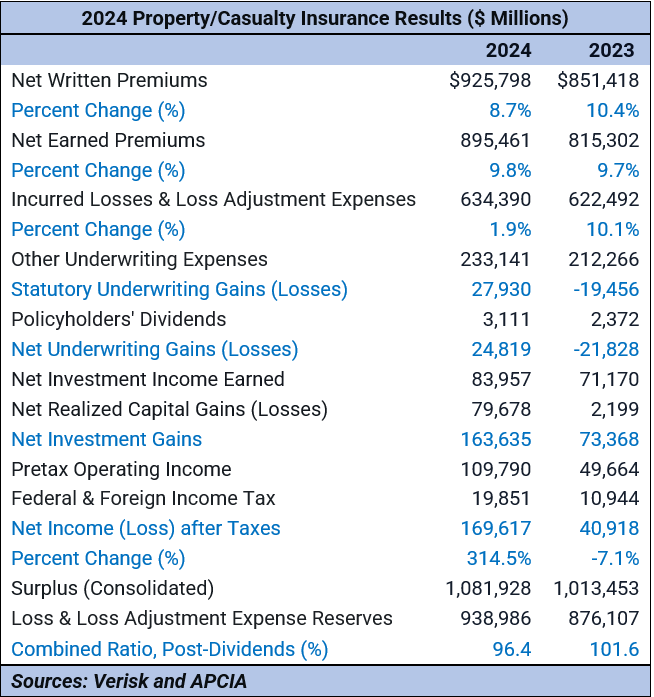

According to key financial indicators for private U.S. property/casualty insurers, an underwriting gain of $24.8 billion in 2024 showed significant improvement compared to the underwriting loss of $21.8 billion recorded in 2023. This is the first full-year underwriting gain reported in four years. These improvements can be attributed to premium increases to better match levels of risk.

"While many of the loss drivers of 2023 persisted into 2024, the industry's ability to bring premiums closer to the requisite levels has led to an underwriting gain for the first time since 2020," said Saurabh Khemka, co-president of Underwriting Solutions at Verisk. "However, the broader market continues to face challenges, particularly in property coverages, where the impact of natural catastrophes remains a defining issue. The increasing frequency and severity of these events reflect shifting weather patterns and evolving risk landscapes, underscoring the growing complexity of underwriting in the property/casualty space. Last year marked the second worst year for catastrophic losses since 1950, with the vast majority of damages stemming from hurricane and convective storm activity. Most notably, Hurricane Milton, along with a series of late-season storms, drove fourth-quarter catastrophe claims to surge 113 percent higher than the same period in 2023, highlighting both the volatility and financial strain insurers face.”

Khemka added: “On a positive note, personal auto demonstrated improvements, primarily due to necessary premium adjustments within personal lines. While commercial auto premiums followed a similar trend, its growth rate did not match the levels seen in 2023. These shifts signal a market recalibrating in response to prolonged underwriting losses, but with ongoing uncertainty, carriers will need to balance pricing, risk selection and claims management strategies to sustain profitability. Looking ahead, insurers will continue to rely on technology that enhances data-driven decision making and underwriting accuracy.”

- Premiums written: Insurers wrote $926 billion in premiums during 2024, compared to $851 billion in 2023. Similarly, earned premiums grew 9.8 percent to $895 billion in 2024, compared to a 9.7 percent jump in 2023.

- Underwriting gain: The estimated U.S. insurance industry net underwriting gain of $24.8 billion is a significant improvement over the $21.8 billion in net underwriting losses reported in 2023.

- Incurred losses and loss adjustment expenses increased by 1.9 percent, compared to the 10.1 percent increase reported in 2023. The combined ratio, a crucial measure of profitability for insurers, improved to 96.4 percent in 2024 versus 101.6 percent in 2023.

- Surplus: The policyholders’ surplus increased from $1,013 billion at the end of 2023 to $1,082 billion at the end of 2024.

“The property casualty insurance industry continued to stabilize in 2024, with a swing from close to a $22 billion net underwriting loss to a nearly $25 billion net underwriting gain. Net income for the year improved significantly as well, although roughly 40 percent resulted from the capital gains of unusual stock sales by a multinational conglomerate that owns several insurers,” said Robert Gordon, senior vice president, policy, research and international at APCIA. “By this time next year, homeowners insurers will have likely reported seven consecutive years of net underwriting losses, including record insured losses caused by the California wildfires this January. Personal auto insurance loss ratios improved in 2024 but continue to be impacted by rising inflation and legal system abuse, and proposed tariffs could result in an estimated additional $7-24 billion in annual auto insurance claims costs.”

Gordon continued: "Insurers significantly increased loss and loss adjustment reserves at the end of 2024 to reflect escalating adverse development resulting from worsening legal system abuse and social inflation. Insurers are also deeply concerned about the market impact of pressures in California to retroactively change claims settlement standards for contents and expand coverage standards for wildfire smoke in an already extremely distressed homeowners insurance market."

2H2024 Showed Improvements, Despite Cat Impacts

In the second half of 2024, the industry’s net underwriting gain increased to $21.0 billion, up from $3.8 billion in first half of the year and $1.7 billion in the same period of 2023.

- The second half of 2024 was heavily impacted by Hurricanes Helene at the end of the third quarter and Milton at the beginning of the fourth quarter, while the second half of 2023 experienced below-average catastrophe activity.

- Net written premiums increased by $29.8 billion in the second half of 2024, representing a growth of 6.9 percent compared to the previous year.

- The combined ratio improved from 99.1 percent in the second half of 2023 to 95.3 in the same period this year.

The preliminary 2024 property/casualty insurance industry results, as shown in the table below, represent consolidated estimates derived from annual statements submitted by insurers to insurance regulators. These results are based on approximately 97 percent of all business underwritten by private U.S. property/casualty insurers.

Note: The results above are based on annual statements filed with insurance regulators by private property/casualty insurers domiciled in the United States, including reinsurers, excess and surplus insurers, and domestic insurers owned by foreign parents, and excluding state funds for workers' compensation and other residual market insurers, the National Flood Insurance Program, and foreign insurers. The figures are consolidated estimates based on reports accounting for about 97 percent of all business written by U.S. property/casualty insurers. All figures are net of reinsurance unless otherwise noted and occasionally may not balance due to rounding.

###

About Verisk

Verisk (Nasdaq: VRSK) is a leading strategic data analytics and technology partner to the global insurance industry. It empowers clients to strengthen operating efficiency, improve underwriting and claims outcomes, combat fraud and make informed decisions about global risks, including climate change, extreme events, sustainability and political issues. Through advanced data analytics, software, scientific research and deep industry knowledge, Verisk helps build global resilience for individuals, communities, and businesses. With teams across more than 20 countries, Verisk consistently earns certification by Great Place to Work and fosters an inclusive culture where all team members feel they belong. For more, visit Verisk.com and the Verisk Newsroom.

About APCIA

The American Property Casualty Insurance Association (APCIA) is the primary national trade association for home, auto, and business insurers. APCIA promotes and protects the viability of private competition for the benefit of consumers and insurers, with a legacy dating back 150 years. APCIA members represent all sizes, structures, and regions-protecting families, communities, and businesses in the U.S. and across the globe.

Morgan Hurley Verisk 551-655-7858 morgan.hurley@verisk.com

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.