JetBlue Airways Missed Estimates, Is It a Buying Opportunity?

The major airline carriers have finally gotten back into the black as the NYSE: LUV">profits roll in for Delta Air Lines (NYSE: DAL), United Airlines (NYSE: UAL), and American Airlines (NYSE: AA). All the majors reported profits that exceeded analyst expectations indicating that the pandemic is in the rearview mirror. Even NYSE: LUV">regional airlines like Southwest Airlines (NYSE: LUV) have returned to profitability, but not all of them are NYSE: LUV">blowing out analyst estimates. JetBlue (NYSE: JBLU) surprised investors with its first profitable quarter since the pandemic but still missed analyst estimates. The stock was recovering off its 52-week lows heading into earnings, fell on earnings, and quickly rebounded back to retest the $7.60 resistance level. This could mark the capitulation for JBLU stock as the volume has been steadily rising higher for the past three weeks. Strong demand spurred by leisure travel and visiting friends and relatives (VFR) led the Company into the black. They expect this backdrop to remain into the year-end holiday peak season as the airline expects capacity to rise 1% to 4% over year three and unit revenue to increase 15% to 19% year over three. How a recession would affect these expectations is frankly still a wildcard for airline investors.

The major airline carriers have finally gotten back into the black as the NYSE: LUV">profits roll in for Delta Air Lines (NYSE: DAL), United Airlines (NYSE: UAL), and American Airlines (NYSE: AA). All the majors reported profits that exceeded analyst expectations indicating that the pandemic is in the rearview mirror. Even NYSE: LUV">regional airlines like Southwest Airlines (NYSE: LUV) have returned to profitability, but not all of them are NYSE: LUV">blowing out analyst estimates. JetBlue (NYSE: JBLU) surprised investors with its first profitable quarter since the pandemic but still missed analyst estimates. The stock was recovering off its 52-week lows heading into earnings, fell on earnings, and quickly rebounded back to retest the $7.60 resistance level. This could mark the capitulation for JBLU stock as the volume has been steadily rising higher for the past three weeks. Strong demand spurred by leisure travel and visiting friends and relatives (VFR) led the Company into the black. They expect this backdrop to remain into the year-end holiday peak season as the airline expects capacity to rise 1% to 4% over year three and unit revenue to increase 15% to 19% year over three. How a recession would affect these expectations is frankly still a wildcard for airline investors.

Here’s What the Charts Say

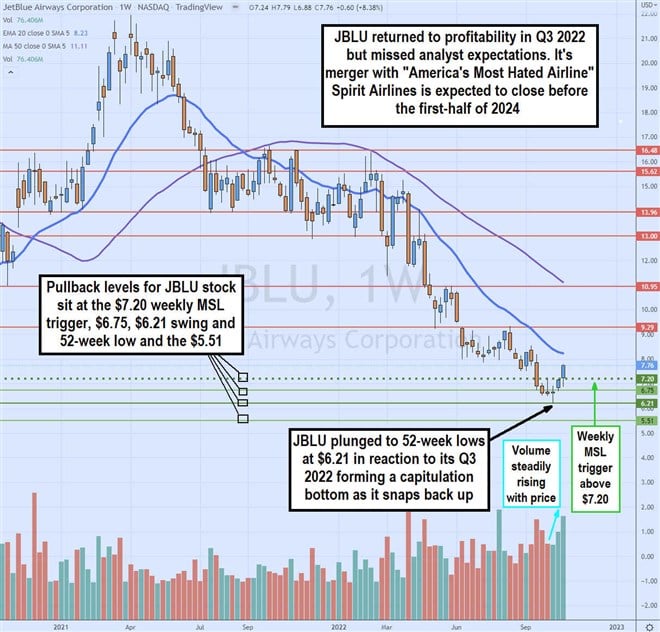

JBLU stock initially collapsed to a new 52-week low at $6.21 heading into its Q3 2022 earnings report. It managed to slingshot back up on the weekly MSL trigger breakout through $7.20. It’s making another attempt to break through the very tough $7.60 resistance area. The rising volume on the bounce off the 52-week lows indicates that buyers are patiently and steadily bidding up shares slowly after a sharp capitulation bottom. The weekly 20-period exponential moving average (MA) resistance sits at $8.23 followed by the weekly 50-period MA at $11.11. The $9.29 remains a solid resistance level followed by the $10.95 level. Investors watching for JBLU pullback should monitor the $7.20 weekly MSL trigger, $6.75 support, $6.21 swing low, and $5.51 sticky 5’s price levels.

Back in the Black

On October 25, 2022, JetBlue released its fiscal third-quarter 2022 results for September 2022. The Company reported an earnings-per-share (EPS) profit of $0.21 excluding non-recurring items versus consensus analyst estimates for a profit of $0.24, a (-$0.03) beat. Revenues grew 29.9% year-over-year (YoY) to $2.56 billion beating analyst estimates for $2.55 billion. Revenue per available seat mile rose 23.4% year over three. Strong leisure and VFR trends drove the quarter. Hurricane Fiona and Ian had net neutral impacts to unit revenues in the quarter, but negatively affected CASH ex-fuel by one point to CASM-ex in the quarter and had no impact in the fourth quarter. The Company paid down $66 million of debt, funded $260 million in capex, and spent $25 million in Spirit Airline acquisition-related fees. Jet Blue ended the quarter with $2.3 billion in cash and investments. The realized fuel price was $3.84 per gallon compared to $2.06 in Q3 2019, up 86%. Jet Blue entered into a forward fuel derivatives contract to hedge 27% of its fuel consumption for the fourth quarter with an average all-in price of $3.65 per gallon in the fourth quarter.

Merging with the "Most Hated Airline" in the U.S.

JetBlue’s merger with arguably the country’s “most hated airline” Spirit Airlines (NYSE: SAVE) is expected to close before the first half of 2024. JetBlue beat out Frontier Airlines (NASDAQ: ULCC), to the relief of Frontier’s shareholders, in its bid to acquire Spirit for $33.50 per share in cash or $3.8 billion. The October 19th shareholder approval to acquire Spirit Airlines triggered the agreed-upon $272 million prepayment or $2.50 per share cash payment to Spirit shareholders. Incidentally, Spirit Airlines also reported a surprise profit in its most recent earnings. The combination of the two airlines will create the fifth largest airline in the U.S. Jet Blue expects to cover a larger demographic with its combination but faces integration challenges. They expect to fly under one banner by the first-half of 2025, but full integration may take up to five years afterward.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.