Is DocuSign On The Verge Of A Major Reversal?

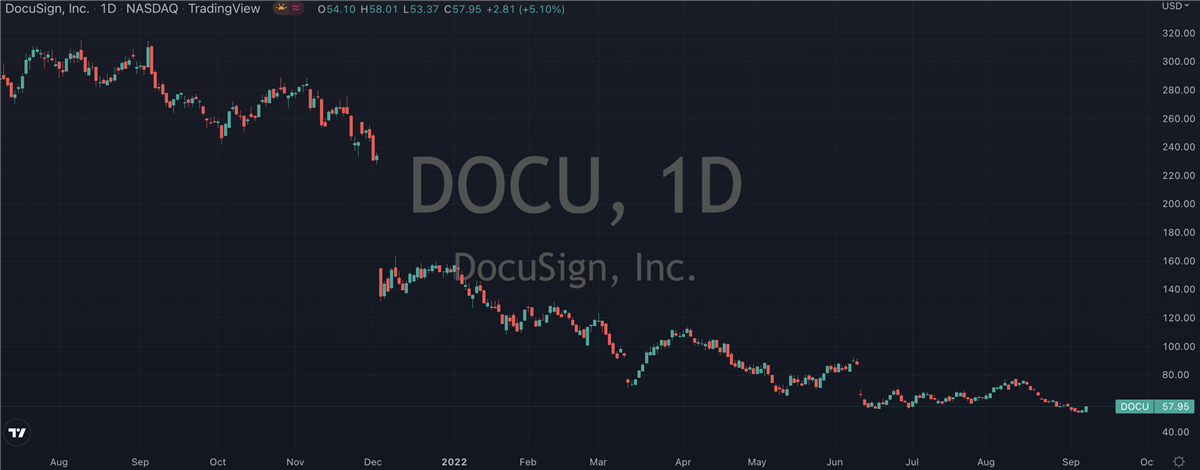

After hitting fresh 52 week lows earlier this week, it’s looking like shares of e-signature company DocuSign (NASDAQ: DOCU) are set to finish out the week with a bang. They’re currently up 17% in Friday’s pre-market session and they’ll be eclipsing a month’s worth of candles if this is where they open. While they’ll have a long way yet to go before we can call this a trend reversal, it’s not a bad start.

After hitting fresh 52 week lows earlier this week, it’s looking like shares of e-signature company DocuSign (NASDAQ: DOCU) are set to finish out the week with a bang. They’re currently up 17% in Friday’s pre-market session and they’ll be eclipsing a month’s worth of candles if this is where they open. While they’ll have a long way yet to go before we can call this a trend reversal, it’s not a bad start.The catalyst for the pop was the company’s Q2 earnings which were released after the bell rang to end Thursday’s session. Both earnings and revenue beat analyst expectations with the latter showing year-on-year growth of 21%. Management’s forward-looking guidance was also at the upper end, if not straight out higher, than the consensus. This can often be one of the strongest ingredients in a rally as the new forecasts force investors to quickly find the new fair value.

The bullish report was reinforced by comments from the company’s interim CEO, Maggie Wilderotter. She told investors that "we delivered solid Q2 results, with a strong finish to the first half of the year. These results reflect the focus and dedication of our team on execution during this transition period, with a stronger foundation in place to deliver in the second half of the year. We enter this next phase with a clear set of vital deliverables for our people initiatives and product roadmap, while driving sustainable and profitable growth at scale. We have a $50 billion market opportunity, an industry leading digital agreement platform, strong market position, and an experienced leadership team. I have total confidence our team will successfully deliver for all stakeholders."

Will this week’s low of around $54 come to be regarded as the bottom of DocuSign’s multi-month selloff? It could well be, if this upward trend continues to gather momentum through the rest of the year. If so, it will be a funny turn of events, given that only a few weeks ago DocuSign was being trimmed by analysts. Towards the end of August, analyst Rishi Jaluria from RBC cut his rating sector perform from outperform and lowered his price target to $65 from $80, noting that while there is a "long path" to a turnaround, the company has a number of issues facing it. He may well be revisiting his old rating next week given these fresh numbers and management’s new outlook. In addition, hedge fund giant Tiger Global Management threw in the towel on its DocuSign position last month as well.

For today at least, DocuSign shares look set to cause these guys some mild embarrassment but that could quickly turn to regret in the coming weeks. August’s high of around $77 is a natural first target for them to aim for, and if they can hold onto Friday’s pre-market gains into the week they stand a good chance of continuing the upward trend next week.

The risk of course is that these results were a flash in the pan, an anomaly in what has otherwise been a sinking trend of poor report after poor report. But you have to be thinking that at some point the worst case scenario is fully baked into the stock price. After losing close to 90% of their value in the past twelve months, there’s a fair argument to be made that we’re at that point now. Yesterday’s report is exactly the kind of upside surprise that bargain hunters look for in beaten down stocks, and while a double digit percentage jump the following day may feel like a lot, it’s often weeks before investors can say they’ve truly missed the boat with reversals like this.

From a technical perspective, the stocks relative strength index is just starting to move up off the 30 mark, suggesting it’s still heavily oversold, while the MACD is on course to have a bullish crossover in the next few days. We also have a surprise momentum swing in the fundamentals, that seems to be coinciding with a broader return to strength across equities in general. This could just be another one of those rare buying opportunities that have been popping up lately.  NASDAQ: DOCU) On The Verge Of A Major Reversal?" width="1200" height="470">

NASDAQ: DOCU) On The Verge Of A Major Reversal?" width="1200" height="470">

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.