2 Auto Dealers Booking Record Profits

The auto industry has been on a tear recently, with auto dealers, in particular, booking record profit margins on new car sales. This results from a supply shortage of new cars, often allowing dealers to sell cars well above their sticker prices. AutoNation (NYSE: AN) and Penske Automotive Group (NYSE: PAG) are two companies leading the charge.

Although automakers have resolved some supply chain issues that contributed to the post-pandemic car shortage, there's still a shortage of new cars. Automakers like General Motors, Stellantis, and Ford have shifted their strategies, producing fewer cars at higher prices rather than relying on high-volume, low-margin sales.

The average new car sold for over $49,388 in January, up 30% from February 2020 prices. And inventories are down across the industry as well. Edmunds forecasts only 14.3 million new vehicle sales for 2023, which are recession-like numbers compared to the average of 17 million between 2013 and 2019.

Despite the low sales volume, dealers have adapted to the new climate. They're stocking fewer cars, selling higher-priced models, and booking record profits.

While Carvana (NYSE: CVNA) steals the spotlight in this sector due to ongoing short squeeze plays, this article will focus on two auto dealers well positioned to benefit from the positive backdrop of significantly higher margins.

AutoNation

AutoNation (NYSE: AN) is a leading auto dealer currently well positioned to benefit from the tight new car market, as new cars account for most of their revenue. The company operates hundreds of dealerships across the sunbelt region of the United States, with Honda and Toyota being their most popular brands.

And AutoNation has the best type of problem. They can’t keep enough product on their shelves to support demand. The company has an average of 19 days of supply in inventory, compared to the traditional auto dealership model of 75-90 days.

And as a result, they’re making record profits on new car sales. In 2022, they made $5,942 in gross profit per new car sold, more than tripling 2019 profit levels of $1,783 per new car. But many analysts

AutoNation has also been buying back shares aggressively over the last two years, almost halving its outstanding shares from 83 million to 48 million. Between significant buyback activity and record profits in multiple segments, AutoNation's EPS has grown from $4.56 in 2019 to $24.57 for 2022.

Source: AutoNation Q4 2022 Earnings Presentation

However, it's clear Wall Street doesn't see 2022 earnings levels as sustainable, as the stock is trading at less than 6x 2022 earnings, even after growing earnings at a 40% CAGR over the last five years. However, the low multiple provides some safety margin for investors, especially because the company continues to buy back shares.

There’s serious momentum in AutoNation stock right now, and the significant decline in US stocks Tuesday just teed up a potential buy point within an uptrend, as AutoNation declined nearly 9%:

Penske Automotive Group

Penske Automotive Group (NYSE: PAG) is a more diversified business, sporting a mix of new and used car dealerships and commercial truck leasing and sales. For this reason, they're less of a "pure play" on the new car trend than AutoNation.

However, Penske's new car dealerships are some of the strongest due to their luxury product mix, with premium brands like BMW, Audi, and Mercedes-Benz accounting for 71% of their sales.

Not only does this product mix contribute to higher profits, earning them $6,700 in gross profit per new car sold, but their more affluent customer base is the least hard-hit by inflation and recessionary pressures, making them less fragile than their peers.

And even given Penske's more diversified set of operations, earnings have similarly exploded to the upside, as in the case of AutoNation. They've grown EPS to $18.55 for 2022, compared with $5.28 for 2019, representing 251% growth in the three years.

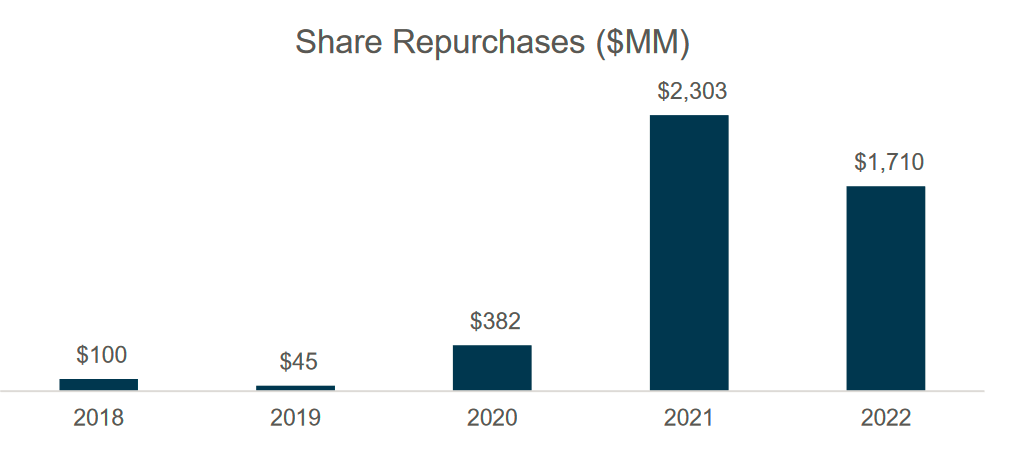

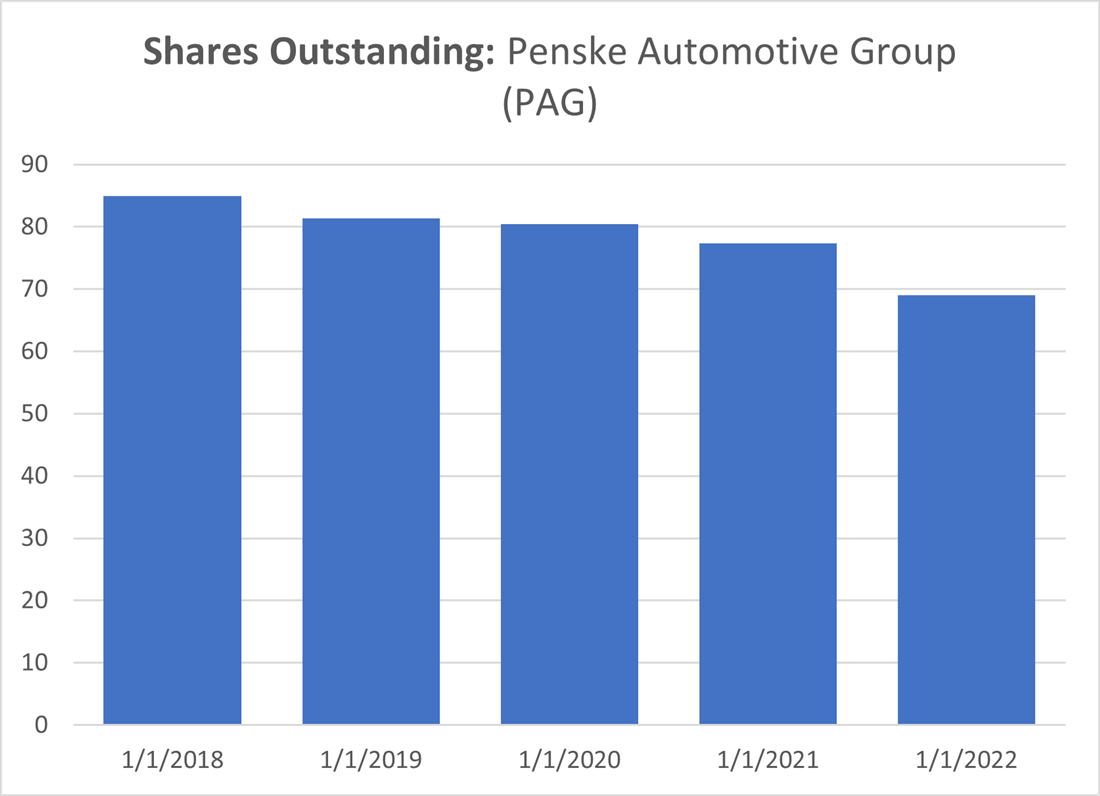

Acknowledging the risk of vehicle margins declining, Penske has been aggressively returning the excess earnings to shareholders through share buybacks. The company has reduced its outstanding shares from 85 million to 69 million between 2018 and 2022.

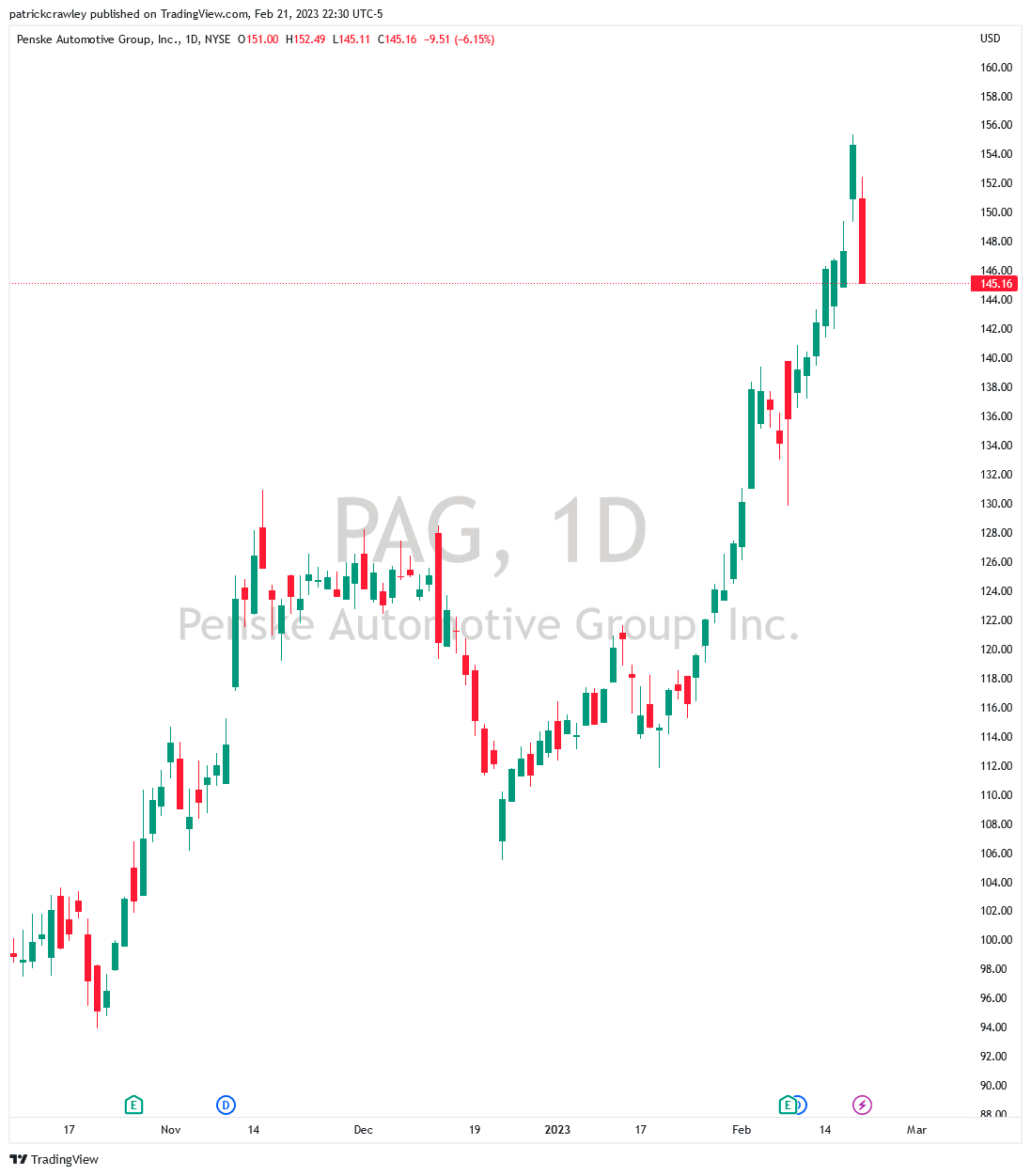

Until Tuesday’s steep decline in stocks, Penske stock has risen in a nearly straight line, returning 35% from December lows. The stock just pulled back 6% and could offer an entry point for traders looking to ride the momentum.

Threats

The landscape for auto dealers is one of the best in recent memory, and has managed to continue earning record profits long after the worst post-COVID shortage. However, a number of risks threaten the elevated margins AutoNation and Penske benefit from now.

Wholesale Prices Rising

Automakers saw new cars selling way above sticker price in 2021 and decided they wanted a piece of that action. As such, they've hiked wholesale prices, which is the price that auto dealers pay to automakers for their new cars.

As automakers continue to focus on raising their average sales price and producing fewer units, there's a real threat that rising wholesale prices can squeeze dealer margins if they fail to pass on the costs to end buyers. AutoNation alluded to this potentially hurting their margins going forward in their February earnings call.

Consumer Health

The affordability of new cars for the average American continues to get out of control. The average new car payment today sits at double 2019 levels at $777 per month, all the while auto loan delinquencies pile up and consumers turn to credit cards to pay their car payments.

While delinquencies are only occurring in subprime right now, everyone who’s watched “The Big Short” knows those are the famous last words of many investors.

Bottom Line

The COVID-driven shakeup of the auto industry has worked chiefly to the benefit of the auto industry, to the detriment of the consumer. Things have never been better for auto dealers experiencing record growth and profits. Still, the big question is whether it's sustainable.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.