Be Cautious of Valens Semiconductor Analyst Estimates

![]()

The semiconductor industry has become a breeding ground for political battles and market share domination across the globe. The United States and China have entered into a cold war-like scenario over who gets to make the most advanced chips and who gets to make the most in volume.

Companies like Taiwan Semiconductor Manufacturing (NYSE: TSM) and Intel (NASDAQ: INTC) have been forced to make a choice as to which of the two giant nations - and markets - they will support via production, shipping and sales. Intel is already undergoing a major turnaround in which the company will decouple itself from East Asian manufacturers and focus its chip production in Ohio and Arizona through a multi-billion dollar expenditure plan, using foundries as they are referred to in the industry.

Similarly, Taiwan Semiconductor Manufacturing is shifting similarly as most of the firm's assets have been moved to the United States. They also invest heavily in new foundries to maintain production and reduce dependency on the APAC region.

While all the action seems to be between the U.S. and China, how is it that a little-known - and sized - semiconductor firm out of Israel gets to have analysts assigning such massive upside in its stock price?

Acceptance does not mean adoption

Perhaps Valens Semiconductor (NYSE: VLN) gained some air time by landing a few deals to deploy its audio-video and automotive chip technologies. However, investors would do well by taking analyst estimates and management pitches with a grain of salt.

While it is true that Valens was awarded the opportunity to implement its chips within Logitech International (NASDAQ: LOGI) cameras throughout the fourth largest school district in Florida, this was made possible through the Elementary and Secondary School Emergency Relief (ESSER) fund program. These initiatives allow students in overcrowded and/or hybrid school environments to access education through seamless audio-visual programs, made possible by the Valens and Logitech collaboration.

Valens also makes headlines in their automotive segment by winning contracts with car manufacturer Mercedes Benz Group (OTCMKTS: MBGAF). Reportedly, they are integrating VA6000 Valens chips into most of their vehicle series. This ambition to expand into additional brands is further accelerated by participating in several automotive OEM bids to win contracts and place their chips in those vehicles.

These developments and achievements surely speak to the quality of the chips being made and are also a driver to explain the company's 20% three-year average sales growth. However, as they say in financial product prospectuses, past performance is not indicative of future performance.

Slowing tempo

Every industry and sector has its own key performance indicators (KPIs) that describe a level of quality or point toward shifting trends. A commonly used metric in the semiconductor industry is the Book-to-Bill ratio, computed as orders received divided by revenues for the same period. Essentially, a higher ratio implies increased demand for products, while a lower ratio signifies slowing demand.

Valens had a book-to-bill ratio of 1.1x in 2020, 1.69x in 2021, and ended 2022 with a ratio of 0.84x. The 51% decrease in the ratio, while sales grew by 28.3% in the same period, suggests that orders for Valens products have decreased by that amount. This paints a dismal picture for the months to come and serves as a warning for investors.

This realization has led management to provide 2023 guidance indicating 7% revenue growth and a 7% contraction in gross margins. Despite these modest figures, management expects to achieve EBITDA breakeven by the end of 2023 and a positive free cash flow position. Those with accounting and financial analysis backgrounds can agree that a year with 7% revenue growth and leaner margins is the opposite of a path to digging out from a -30.5% net income loss margin.

On a cautious note, investors should consider that a single customer represented over a third (35%) of revenues in 2022. Considering the tightening credit markets and rising global interest rates that many industries are experiencing, revenue concentration is one of the last things markets will want to assign higher multiples to.

Slap a target and call it a day

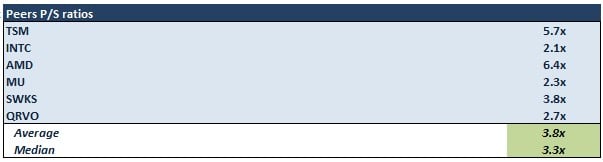

VLN stock is currently trading at 3.7x its 2022 sales and nearly 3.4x its 2023 revenue guidance. Looking at the broader chip manufacturing sector players, this multiple does not seem to stray away from what is normal market perception. A useful angle for investors to consider, however, is that these peers have diversified revenues via numerous customers, established long-term commitments with said customers, historically positive cash flow operations, and an expectation to remain profitable.

Most importantly, they are positioned in the midst of the largest asset transfer between the United States and China. All of these perceived positive characteristics can reasonably command these average multiples, closing the sale for Valens seems much harder when the competition stacks up.

Buy range off strong balance sheet?

However, for those who may have special insight and beliefs in the future of Valens, hope may not be abandoned altogether. The company had no debt in 2022 and has exemplary liquidity at hand to carry itself through another few quarters of losing operations. Additionally, management can always issue more shares.

With assets consisting of cash, accounts receivable, and property that can be acquired and used as a "turnkey" foundry for other chip manufacturing players, the company has an attractive liquidating or net-net value. When divvying up all these assets among shareholders (with no need to take out the debt), a value of $2.00 per share remains. Assuming that no more shares are issued and that the asset base keeps growing (which it must do to achieve further aggressive revenue growth rates), this price can serve as a basement of acquisition.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.