J.B. Hunt: Economic Contraction And A Buying Opportunity

J.B. Hunt (NASDAQ: JBHT) didn’t have a horrible quarter, but it did miss the consensus estimates on a combination of factors, which is terrible news for the broad economy. The combination of higher prices and rising interest rates produced a larger-than-expected decline in demand that impacted pricing and leverage. This is a dual headwind for the company and the economy, suggesting a broad economic contraction.

The good news is that lower pricing for freight will help subdue inflation, lead the FOMC to cut rates and set this economy and this company up for a rebound. Until then, J.B. Hunt remains a best-in-breed among truckers, with a relatively safe dividend for income investors.

The stock doesn’t pay a large yield, about 1.0%, but the distribution is less than 25% of earnings even with the miss, and it is expected to grow. The company uses debt and is carrying about $1.25 billion, which is flat compared to last year. The company also spent more than $300 million on CAPEX while managing to build cash, if only slightly.

The takeaway is that J.B. Hunt is a well-managed blue-chip dividend payer on track for Aristocrat status. It has already increased the payout for 20 consecutive years, so it only has a few more to go. When that happens, ownership will broaden as ETFs and indices pegged to the Dividend Aristocrats index buy into the shares.

J.B. Hunt Gets A Flat On Weak Results

J.B. Hunt reported $3.23 billion in net revenue for a decline of 7.4%, missed the consensus by 5.2%. The miss is driven by volume and pricing declines, with ICS volume falling by 25%, Integrated Capacity Solutions falling by 5% and Final Mile by 17%. Pricing declines were felt heaviest in the core JBT trucking segment, with revenue per load down 17%. Four of the 5 operating segments had revenue decline for the quarter, but there is some good news.

Dedicated Contract Services grew by 13% on a 7% increase in trucks, which can be associated with demand for supply chain improvement across industry verticals.

The loss of leverage impacted the margin, resulting in weaker-than-expected earnings. The takeaway is that operating income, down 17% YOY, came in at $277.5 million and is more than sufficient to sustain operations. The GAAP earnings fell by 18% and missed by $0.11 but are sufficient to sustain capital returns, including share repurchases.

The company repurchased 183,000 shares for $31 million during the quarter and has $520 million left on its repurchase authorization. That’s worth about 2.85% of the market cap, enough to help support the price action over the next few quarters.

Analyst Reaction Is Mixed

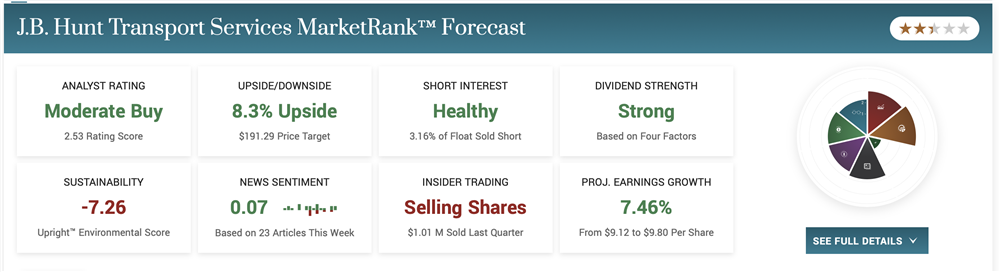

The analyst's reaction is mixed. Marketbeat.com has picked up 2 new commentaries so far, with 1 raising and 1 lowering the price target. They rate the stock a Buy with a price target above the consensus, suggesting the sentiment downtrend could be over. Until then, the sentiment and consensus price target are trending lower and may weigh on the market action until there is a definite sign of change.

The chart isn’t great, but a buying opportunity is developing. The stock is range bound and heading toward the bottom of the range with several support targets nearby. Support may be strong enough to hold at the $165 level; if not, a move to the $155 level should produce a bounce.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.