Steel Dynamics May Be At A U-Turn Rather Than A Red Light

The United States Capacity Utilization readings have been on a bouncing rally since a drastic slip in the fourth quarter of 2022. Currently, the nation is reading 79.8% capacity utilization, a still-elevated level risking ongoing inflation, which may not satisfy FED targets and could bring on further rate hikes as a result. The Steel industry caters to some sub-sectors within the economy, some of which have yet to see an increase in capacity utilization.

Some sub-sectors with still compressed capacity utilization readings are primary metals at 69.4%; fabricated metal products at 78%, showcasing quarterly declines; machinery at 84%, showcasing quarterly declines; and motor vehicle parts at 71.6%, showcasing quarterly declines.

Steel Dynamics ( NASDAQ: STLD) shares are falling by 1.8% in the after-hours trading session immediately after releasing its first quarter of 2023 results and outlook for 2023. While management points to a secure and bullish outlook, with present tailwinds in the United States steel industry and underlying demand, facts and figures show otherwise. After breaking down what matters, investors can find a more straightforward path to what today's results mean for the company.

Cyclicality Doing its Thing

Sales of the steel maker fell, on an annual basis, by 12.1% toward $4.9 billion. The decline in the top-line revenue generation came amid a 70% contraction in steel operations and an 18% decline in metals recycling operations as well. Lower revenue generation and subsequent contractions across business segments stem from reduction in demand for products along with falling steel prices throughout the year, the average external sales price per ton fell as much as 31% during 2022 for Steel Dynamics.

While the overall steel industry, as stated previously, carried an average capacity utilization rate of 75%, Steel Dynamics steel mills had a production capacity utilization rate of 94%, its highest since 2018. After 2018's high utilization reading, there was a subsequent 11.5% decline in revenues for 2019, along with high-single-digit compressions in operating and net margins topped by a 43% plunge in earnings per share, as seen in Steel Dynamics Financials.

Today, investors may be facing a repeat of what happened in 2018 regarding utilization and the subsequent reaction on profitability and volumes. Coming off a record utilization rate, Steel Dynamics has presented not only a revenue decline but also an operating and net margin reduction of 9.8% and 6.8%, respectively, followed by a 35% decline in earnings per share on an annual basis for shareholders.

History does not always repeat itself, but it sure does rhyme, and a similar 52% sell-off could follow this one poem in the stock price seen in the 2018-2019 window of Steel Dynamics stock price.

Cushioning the Blow

While management has delivered pleasant returns and value-adds to shareholders, Steel Dynamics is telling markets a different story through its balance sheet. In the first quarter of 2023, the company reduced its inventory by $141 million, or 5% lower than what levels were during the fourth quarter of 2024; a reduction in the overall inventory levels can only mean a bearish outlook for demand moving forward.

While a single piece of evidence does not make a case, an accumulation of data will do the trick; the company increased its liquidity (measured by the current ratio) to 4.2x from 3.8x just a quarter prior, increased liquidity may signal the need to quickly pivot in the face of changing market conditions.

Higher levels of free cash flow generated during the "high" of the cycle were deployed toward increased dividends and share repurchases in the company, which retired 21 million shares in 2022. Steel Dynamics has also increased its dividend by 25% in the 12-month lookback period, boosting the dividend yield to a current 1.6%. Historically, Steel Dynamics' dividend yield has hovered around the 3% mark, signaling that a possible fair or overvaluation may be at play today.

Putting it to a Vote

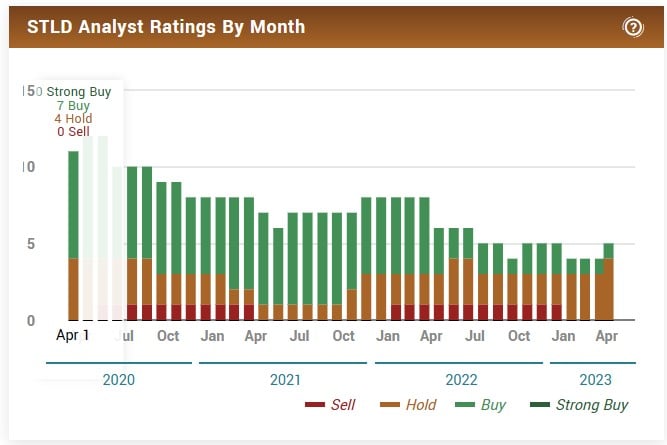

Steel Dynamics analyst ratings suggest that the stock price currently offers little upside. The rating dynamic has also changed from mostly "buy" to an overwhelming "hold" as of April 2023; perhaps investors can take all the evidence as a warning and construct a case of warning. Technically speaking, the stock seems to be showcasing some bearish divergences as it relates to weekly studies such as stochastics, RSI, and the money flow index.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.