Buy The World’s Largest IT Infrastructure Provider For Under $20

Global IT infrastructure company Kyndryl Holdings (NYSE: KD) isn't quite a household name. However, it is the largest IT infrastructure provider on the planet. Most investors are familiar with its parent company and sleeping giant International Business Machines Co. (NYSE: IBM), which spun off Kyndryl in 2021, peaking at $52.00 before the collapse to $8.02 lows by October 2022. Kyndryl is a managed IT infrastructure company with over 4,000 clients throughout more than 60 countries.

Its services include data center design, modernization and operations, cybersecurity, artificial intelligence (AI), cloud transitions and IT support. Kyndryl has implemented a successful strategy that brought the company to break even in its latest quarter. It is positioned to grow profits and margins by implementing its triple-A strategy comprised of Alliances, Advanced Delivery and Accounts.

IBM Spin-Off

IBM spun off its IT infrastructure unit under the name Kyndryl in 2021. IBM shareholders received one share of Kyndryl for every five shares of IBM they owned. Kyndryl joined the S&P 500 Midcap 400 on Nov. 5, 2021. Kyndryl was the legacy portion of IBM, formerly comprised of IBM Global Technology Services, which designed and managed large data centers for enterprises and governments. Nearly 75% of the Fortune 100 companies rely on Kyndryl IT infrastructure services.

Single and Ready to Mingle

After being spun off, Kyndryl states it's free to pursue a twice as much total addressable market (TAM) of $520 billion. Kyndryl can pursue business from IBM's global competitors as an independent company. Kyndryl has expanded its global footprint while the U.S. remains just under 30% of its revenues. Kyndryl has been expanding beyond its core enterprise business into the cloud, edge, artificial intelligence (AI), data and digital workplace.

Kyndryl is also free to partner with IBM competitors, which they have done, forging business alliances with Microsoft Co. (NASDAQ: MSFT) Azure, Alphabet Inc. (NASDAQ: GOOGL) Google Cloud, Amazon.com Inc. (NASDAQ: AMZN) AWS and Cisco Inc. (NASDAQ: CSCO). The company is free to recommend services and products beyond IBM’s.

Triple As

Alliances was one of its three A strategy to turn Kyndryl profitable. The company came in ahead of schedule on each of the As in its fiscal Q1 2024 earnings report. Under Alliances, it grew hyperscaler revenues over $80 million. Under Advanced Delivery, it recorded $375 million in annualized savings from automation. Under Account, it achieved over $300 million in annualized profit improvement. The company is strategically positioned to grow in intelligent automation, hybrid cloud services, 5G technology and artificial intelligence (AI).

Reaching the Tipping Point

On Aug. 7, 2023, Kyndryl reported its fiscal Q1 2024 earnings with net breakeven, a 95-cent beat as consensus analyst estimates call for a loss of 95 cents. Revenues fell 2.2% YoY to $4.19 billion, beating the $4.09 billion analyst estimates. Year-to-date signing rose 9% to $3.6 billion. EBITDA rose 24.6%, indicating a 310 bps margin or 14.6% increase.

Raised Guidance

Kyndryl pleasantly surprised investors, raising its adjusted EBITA margin to 14%, up from 12-13%. The company expects adjusted pretax income of at least $100 million. It expects fiscal 2024 adjusted free cash flow to be positive.

Kyndryl CEO Martin Schroeter said, “We’re relentlessly transforming our business, and this past quarter represented an important turning point. We now expect to generate adjusted pretax profit this fiscal year and going forward. This return to profit, driven by our strong execution, positions us well to deliver the significant margin expansion we’ve targeted.”

Kyndryl analyst ratings and price targets are at MarketBeat. Kyndryl peers and competitor stocks can be found with the MarketBeat stock screener.

Weekly Ascending Triangle

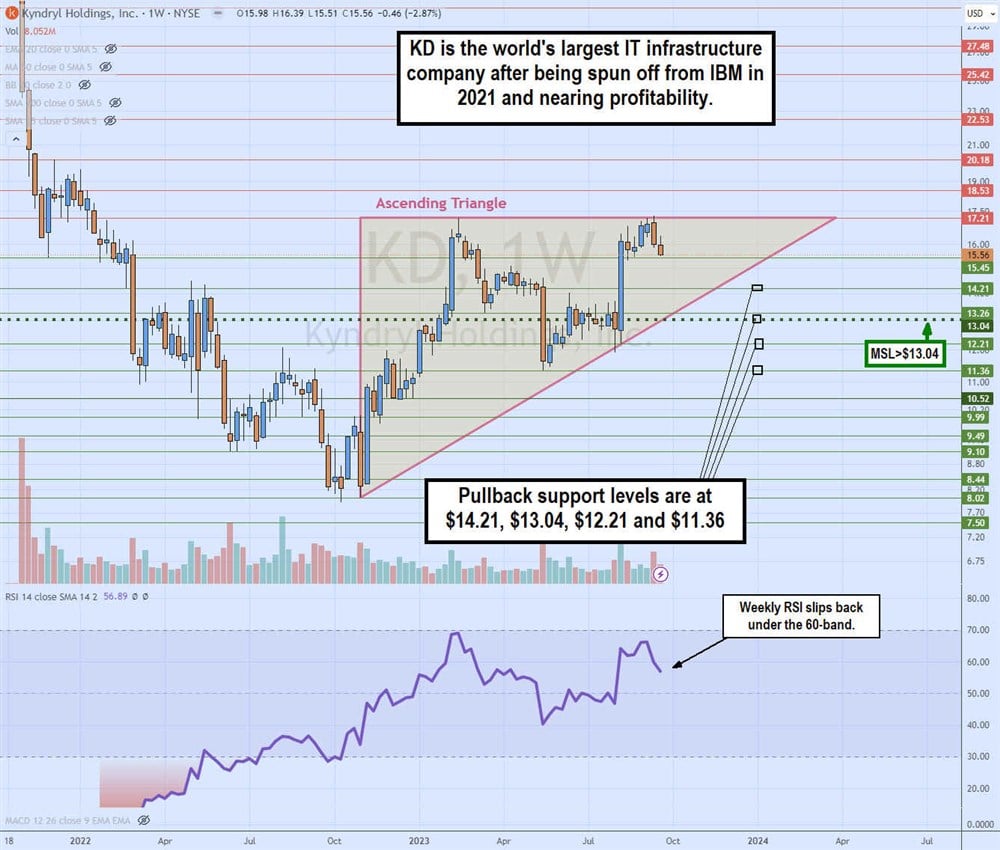

The weekly candlestick chart on KD depicts an ascending triangle pattern comprised of a flat-top horizontal trendline and an ascending trendline. This flat high and higher low pattern consist of an immovable object resistance and unstoppable force rising support. The weekly triangle commenced after reaching $8.02 in October 2022, recovering to $17.21 by February 2023. Each major pullback was met with higher lows, indicating rising support and forming the diagonal ascending trendline.

KD triggered a weekly market structure low (MSL) breakout through the $13.04 trigger on its fiscal Q1 2024 earnings report to retest the $17.21 flat-top trendline. The weekly relative strength index (RSI) turned down through the 60-band. Pullback supports are at $14.21, $13.04 weekly MSL trigger, $12.21 and $11.36.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.