Generac Powers Ahead on the Electrification Mega-Trend

Generac Holdings Inc. (NYSE: GNRC) is attempting to recover from its Q1 2024 earnings selloff. The computer and technology sector company is a leader in manufacturing backup power generators with a 70% market share. It has expanded its offerings to include a range of clean energy, battery and monitoring products. Like many companies in the post-pandemic era, Generac is dealing with an inventory glut as normalization sets in. However, the company is also a major benefactor of the electrification trend, the aging electrical grid, and the growth of mission-critical data centers.

Generac Holdings Inc. (NYSE: GNRC) is attempting to recover from its Q1 2024 earnings selloff. The computer and technology sector company is a leader in manufacturing backup power generators with a 70% market share. It has expanded its offerings to include a range of clean energy, battery and monitoring products. Like many companies in the post-pandemic era, Generac is dealing with an inventory glut as normalization sets in. However, the company is also a major benefactor of the electrification trend, the aging electrical grid, and the growth of mission-critical data centers.

Generac's main competitors include Briggs & Stratton Co. (NYSE: BGG), Cummins Inc. (NYSE: CMI) and Terex Co. (NYSE: TEX).

Normalization Gains Footing

The company provides energy solutions in all shapes, sizes, and price points, from portable generators to systems as large as a room. Its business is known to be cyclical and reliant on consumer confidence. High interest rates, a weak housing market, rising materials costs, and low consumer discretionary spending took a major toll on its revenues from 2022 to 2023. However, all the indications point toward a turnaround as inflation continues to fall and the hope of interest rate cuts.

Benefitting from Grid 2.0

Generac cites several significant mega-trends from which the company will benefit. One of them, Grid 2.0, is the evolution of the traditional electrical utility model. The supply and demand imbalances call for the adoption of renewable energy generation and the “electrification of everything." This includes grid decarbonization, decentralization, migration towards distributed energy resources, and digitization.

Generac CEO Aaron Jagdfeld explained, “Power security concerns have never been more apparent as the electrification of everything, deployment of energy-intensive data centers and rising long-term trend of severe weather events pressure the aging electrical grid that is increasingly reliant on intermittent renewable power generation."

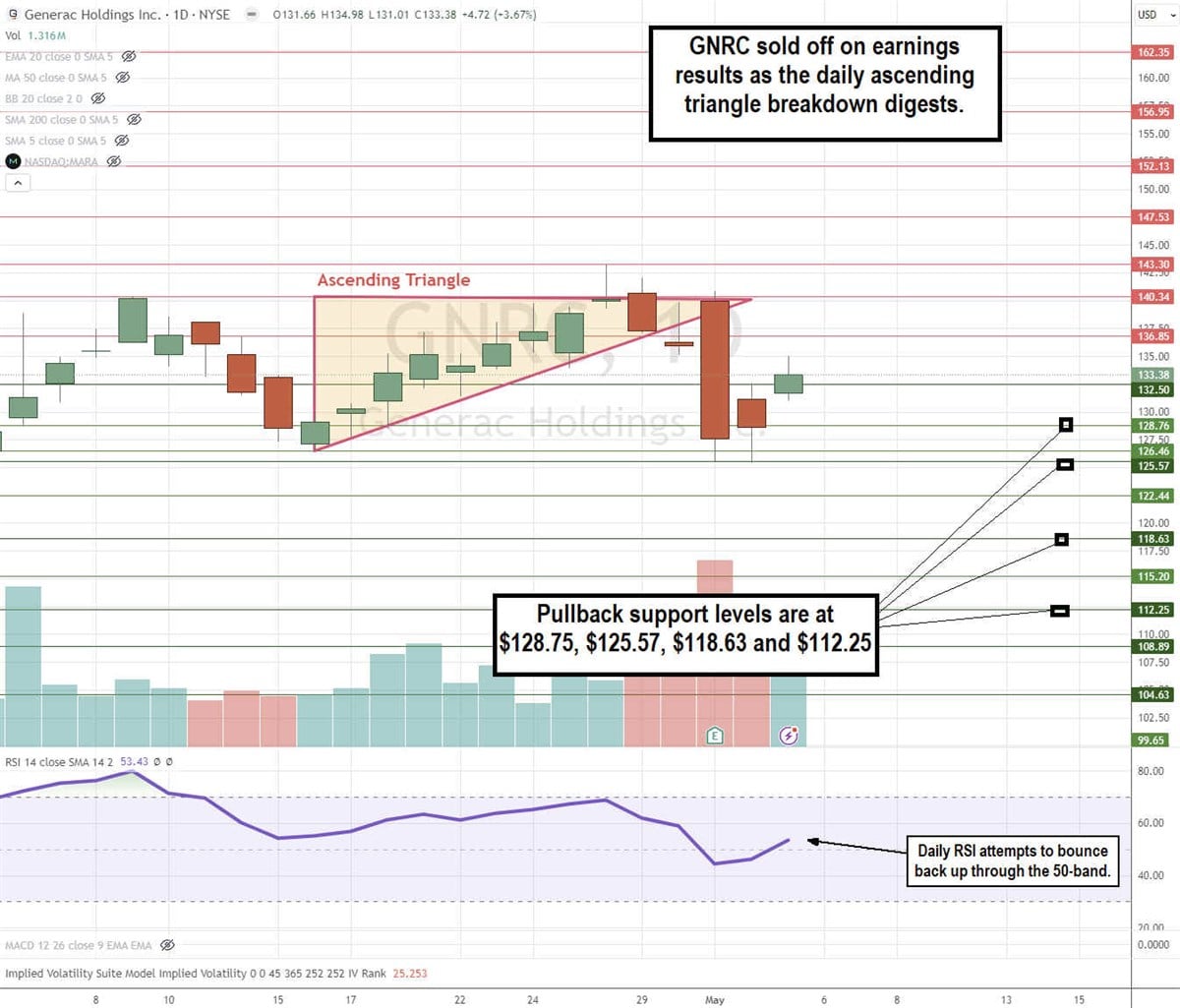

Daily Ascending Triangle

GNRC formed a daily ascending triangle breakdown pattern. The ascending trendline formed at the $126.46 support on April 16, 2024, and rose with higher lows for nine consecutive days to the flat-top resistance at $140.34. The Q1 2024 earnings results caused shares to collapse through the ascending trendline, falling to a double-bottom support near $125.57. The daily relative strength index (RSI) bounced through the 50-band. Pullback support levels are at $128.75, $125.57, $118.63 and $112.25.

Solid Q1 2024 Results

Generac reported Q1 2024 EPS of 88 cents, beating analyst estimates of 76 cents by 12 cents. Net income was $26 million. Revenues ticked 0.2% YoY to $889.27 million, beating $886.6 million consensus estimates. Gross profit margin rose to 35.6% versus $30.7% in the year-ago period due to lower cost inputs, favorable product mix and production efficiencies. Residential product sales rose 2% YoY to $429 million. Commercial & Industrial sales fell 2% to $354 million.

Reaffirms Guidance

Generac reaffirmed guidance for full year 2024, with revenues of 3% to 7% revenue growth. This equates to $4.14 billion to $4.30 billion versus $4.21 billion consensus estimates. Generac anticipates a slightly favorable impact from forex and acquisitions. Net income margin is expected to be around 6% to 7%. The corresponding adjusted EBITDA margin is expected to be around 16.5% to 17.5%, unchanged. Strong operating and free cash flow is expected as the conversion of free cash flow generated will be nearly equal to adjusted net income.

CEO Insights

CEO Jagdfeld pointed out that shipments and activations were aligned at the end of Q1 2024. This signals that field inventory levels are reaching normalized levels. The removal of excess field inventory will amount to strong YoY growth in home generator sales this year. Power outage activity in the United States was in line historically. Home consultations rose more than 3.5X Q1 2019 pre-COVID levels. Close rates improved moderately on a sequential basis.

Generac ended the quarter with 8,800 residential dealers, up 100 in the quarter. Jagdfeld concluded that the recent acceleration in data center construction activity driven by the artificial intelligence AI trend has increased supply/demand imbalances, which lends to the electrification mega-trend.

Generac analyst ratings and price targets can be found at MarketBeat.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.