Why This Retail Stock Is on Track to Hit a Multiyear High

PriceSmart (NASDAQ: PSMT) has been biding its time for the last few years, growing its network and building leverage for investors. The company is well-positioned within the retail market serving Latin America and the Caribbean, a territory poised to outpace the globe regarding GDP growth. It is on track to see a prolonged upswing in its share price. The region is rapidly developing, which provides a dual tailwind for the business. On one hand, the markets are growing; on the other, consumers are becoming more affluent and spending money at PriceSmart.

Evidence of the societal change in Latin America is seen in results from names like PepsiCo (NASDAQ: PEP) and WD-40 Company (NASDAQ: WDFC), which produced strength in Q2, led by results in Latin America. Both products represent improving economic conditions that will benefit many businesses. PepsiCo signals a growing snacks market in Latin America and the ability to buy packaged snacks and drinks. WD-40 is ubiquitous in the home, professional, and industrial workshops. Both products and many more are available at PriceSmart.

PriceSmart is a Smart Play on Emerging Latin America

PriceSmart had a strong quarter in Q3, outpacing analysts' estimates for earnings and revenue and leading its peers, Costco (NYSE: COST) and Walmart (NYSE: WMT). The company produced $1.23 billion in net revenue for a gain of 12.1% over last year, more than doubling Walmart’s advance and leading Costco by 300 bps. The advance is driven by three new stores, a nearly 6% increase in count, compounded by improving comps.

Comp-store sales were robust at 7.8%, with strength in most categories aided by FX translation. FX added 2.5% to the top line; however, net FX neutral growth is still solid at 9% and aligns with the value opportunity. Trading at only 18x its earnings, it is deeply undervalued compared to retail stocks Walmart and Costco, which trade at much higher valuations. PriceSmart has a long way to go before matching either size but has ample room to grow. Investors can expect this stock price to experience a dual tailwind of earnings growth and price-multiple expansion over the coming years as its Latin American markets mature and its business grows.

The margin news is mixed but favorable to investors. Gross margin improved but was offset by increased expenses, which cut into the bottom line. The takeaway is that GAAP net income grew by 9.9% year over year, and the $1.08 in adjusted earnings is a nickel ahead of the consensus, sufficient to sustain the healthy balance sheet. Balance sheet highlights include a decreased cash position offset by increased investments, receivables, and inventory. Increased assets are offset by increased liability, which leaves equity flat. Leverage is low at roughly 0.1x equity, and the balance sheet shows net cash.

Membership is an Opportunity for PriceSmart

PriceSmart's results are underpinned by a 5% increase in membership fees. The increase represents a $5 per member increase across most territories, compounded by a new store count and a growing user base. The opportunity lies in the renewal rate, which trails peers at 88.1%. PriceSmart can improve its retention rate to help boost total growth while upselling to higher membership tiers.

The good news is that PriceSmart is already leaning toward customer satisfaction and retention efforts, as seen in the details. The company offered Platinum members bonuses to increase retention and upsells, which worked. Platinum membership grew by a faster 15.2% to take share sequentially from Q2 and compared to last year. Platinum membership is now 11% of the base.

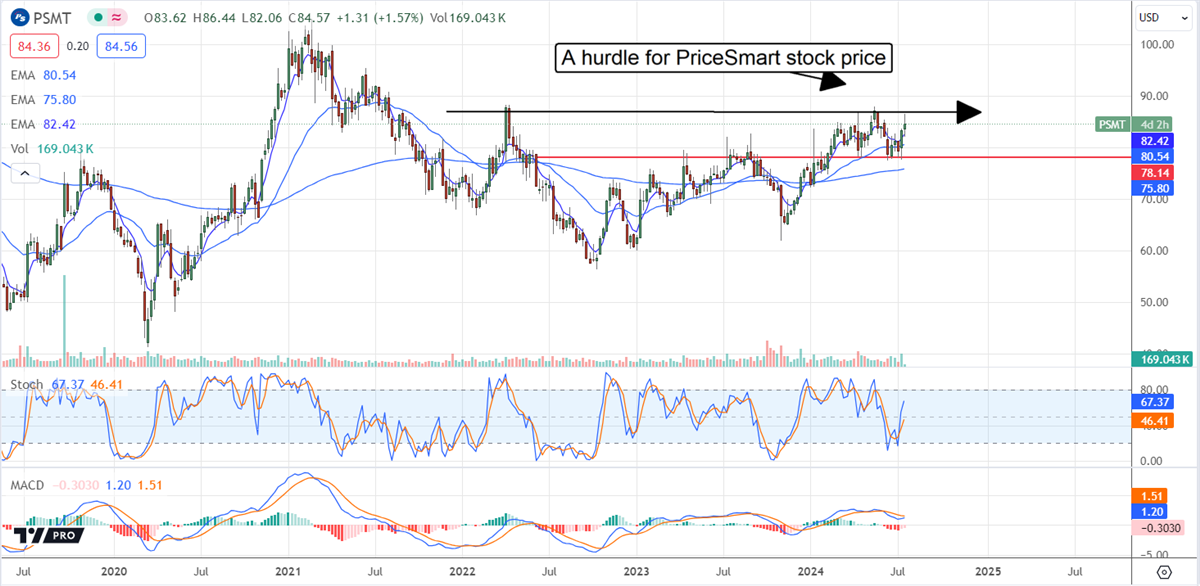

PriceSmart Confirms Support, The Trend Is Upward

PriceSmart stock prices have hurdles to overcome, but the trend is upward, and new highs are likely to be set; the question is when. The Q3 release sparked a round of buying that confirmed support at a critical level, aligning with a market reversal and budding uptrend, but resistance is already capping gains. If the market can’t rise above it, it will remain range-bound until later in 2024 or early in 2025. Analysts are another hurdle; the coverage is thin, the market is viewed as fairly valued at current levels, and no revisions have been issued.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.