Chevron Stock Dips as Earnings Miss Highlights Merger Uncertainty

Using an Olympics reference, Chevron Corporation (NYSE: CVX) failed to stick the landing when it reported second-quarter earnings before the market opened on August 2. The company delivered a mixed report, with revenue coming in slightly higher than expected but earnings coming in lighter due to lower refining margins and natural gas prices.

As is frequently the case with energy stocks, there’s more nuance to the headline number when you look at the details. For example, profits in the United States production segment were up 31% year-over-year to $2.16 billion due to higher sales volumes and oil prices. But international production was down by approximately 30% YoY, leading to the earnings miss.

The results back up the company’s prior announcement that it generated domestic production growth of 35% through its assets in the Permian and Denver-Julesburg (DJ) basins. Furthermore, the company estimates production to increase by 10% in the Permian in FY25.

However, macroeconomic information is also likely at play here. The July jobs number came in much weaker than expected, which was perhaps foreshadowed by earnings weakness from stalwarts like McDonald’s Corp. (NYSE: MCD). That’s likely to keep pressure on crude oil prices and keep a lid on CVX stock.

The Hess Merger is Still Likely but on Hold

For much of 2024, Chevron is still on track to close its merger with Hess Co. (NYSE: HES). Shareholders have approved the merger of both companies. However, it’s being held up due to a dispute with Exxon Mobil Co. (NYSE: XOM) over the status of the Stabroek deepwater field in Guyana.

Earlier this year, Chevron chief executive officer Mike Wirth announced that the two companies agreed to arbitration. However, those proceedings won’t even begin until 2025, which means it will be late into 2025 before the merger can be finalized.

Chevron's Move: Goodbye California, Hello Texas

In other news, Chevron announced it was moving its corporate headquarters to Houston, Texas from California. The company says all corporate functions will move in the next five years. However, Wirth will be relocating to Houston by the end of the year.

CVX Stock is Down, But the Investment Case Remains Intact

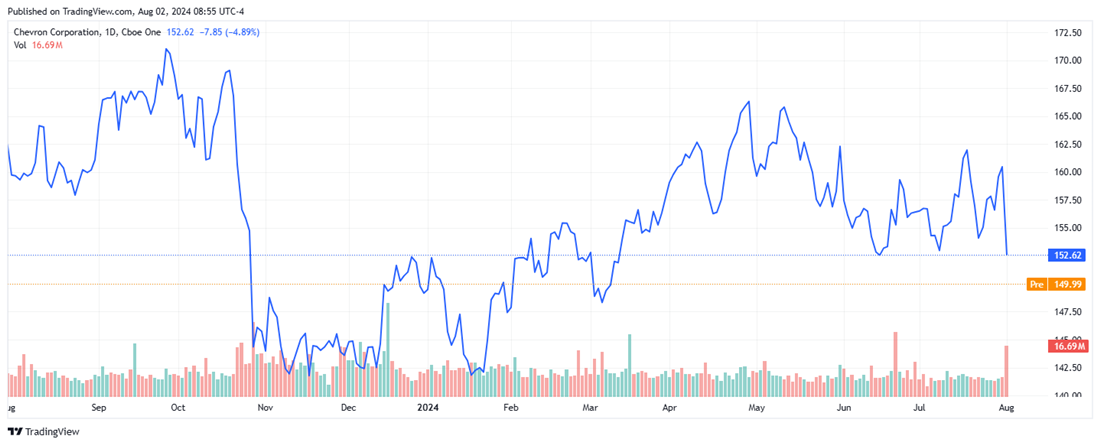

The earnings miss was foreshadowed as CVX stock dropped 5% the day before the earnings report. And with a 2.3% gain for the year, the stock trails the market badly. The August 1 sell-off is pushing the stock down to a key support level of around $150. If it breaks that level, a retesting of the company’s 52-week lows could be in play.

You can expect more volatility in CVX stock, as the short-term outlook for oil is closely tied to shifts in regulatory and economic policies. Chevron's future drilling operations could expand depending on evolving industry regulations and economic factors.

The bottom line is that traders may find better opportunities in the oil sector. But if you’re a long-term investor, Chevron continues to offer solid value. The company continues to generate significant free cash flow, which it delivers to shareholders. The company is a dividend aristocrat that has increased its dividend for 37 consecutive years. It’s also in the midst of a $75 billion share buyback program.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.