Analysts Forecast Big Upside for Western Digital—Don’t Miss Out

As a leading provider of data storage solutions, Western Digital Co. (NASDAQ: WDC) stands at the forefront as a key benefactor of the artificial intelligence (AI) data cycle. AI requires processing power from GPUs, low latency networking from optical controllers, and massive storage capacity and performance for processing, analyzing, generating, and storing oceans of data. The latter is where Western Digital thrives.

The computer and technology sector giant competes with Seagate Technology Holdings plc (NASDAQ: STX), Pure Storage Inc. (NYSE: PSTG), and Dell Technologies Inc. (NYSE: DELL).

Despite the AI boom boosting shares of AI benefactors, Western Digital's stock has fallen 19.5% off the 52-week highs. Its softer guidance for fiscal Q1 2025 is attributed to the sell-off after a solid fourth-quarter EPS beat on 41% YoY revenue growth. Here are four reasons to consider buying the pullback.

1) Western Digital Gains From the AI Data Cycle

It's no surprise that the AI boom is bolstering Western Digital's business. Revenues for its fiscal Q4 2024 surged 41% YoY to $3.76 billion, beating $3.75 billion consensus estimates. Western Digital produces both hard disk drives (HDD) and flash solid-state drives (SSDs). While AI applications require fast memory from flash arrays, they also require HDDs to store massive amounts of data. The two major segments of its business benefit:

- Flash storage is most useful for AI inference, training AI models, and running AI applications due to flash speed. Processing, analyzing, and generating new data is a continuous active cycle that relies on the speed of access to new data. Flash storage is more expensive, but not all the data needs to be quickly accessed all the time. This is why HDD storage is necessary.

- HDD storage is most useful for storing the massive ocean of data that AI models need for training. It's also critical to store the results of AI applications. HDDs provide much more bang for the buck with lots of storage capacity for a lower cost than flash. HDD also carries wider margins for Western Digital.

2) Western Digital’s Flash Business Spin-Off Enhances Shareholder Value

Western Digital has already announced plans to separate its businesses into two standalone public companies. Western Digital will keep the name for its HDD business. The flash NAND/SSD business will be spun off into a separate public company in late 2024. There is speculation of a merger with Japanese flash memory manufacturer Kioxia. Western Digital uses Kioxia fabs to manufacture NAND devices. However, South Korean giant SK Hynix opposes the merger. The rumors are the split of the newly merged company would be owned 43% by Kioxia and 37% by Western Digital, with the rest owned by existing shareholders of both companies.

3) Western Digital Stock is Cheap Trading at 7.51x Forward Earnings

Competing HDD giant Seagate Technology's stock trades at 14.81x forward earnings. Western Digital's stock trades at half at just 7.51x forward earnings. Western Digital's debt-to-equity ratio is 0.53, and the current ratio is 1.32. It's trading at just 1.65 price-to-sales (P/S), compared to Seagate trading at 3.19 P/S.

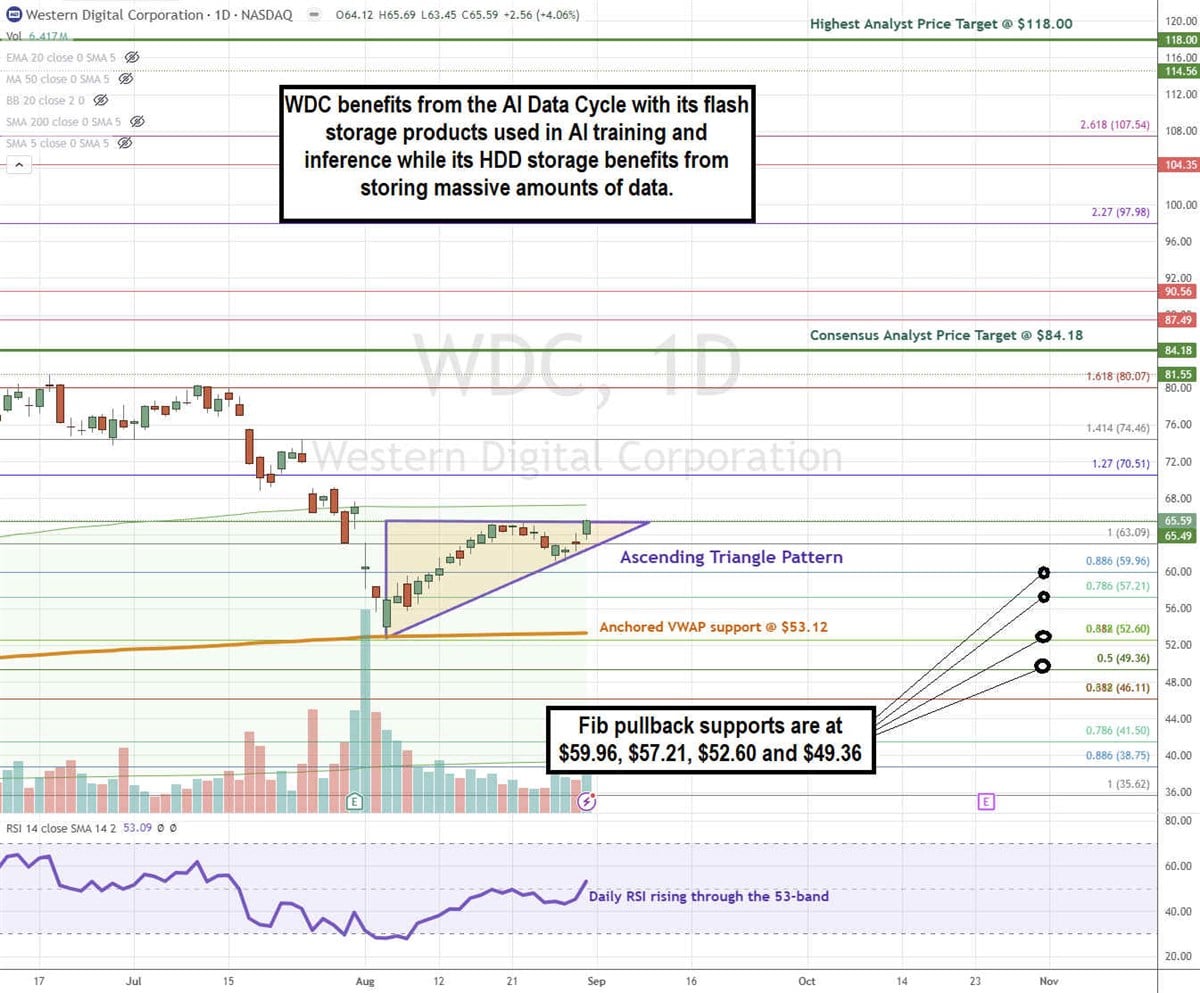

4) WDC stock is Attempting an Ascending Triangle Breakout

An ascending triangle pattern consists of a flat-top upper trendline resistance connected at the apex to the ascending lower trendline, indicating higher lows.

WDC commenced its ascending trendline off the $52.60 swing low, which was also a Fibonacci (fib) support overlapping with the anchored VWAP support. Shares rose to the flat-top upper trendline resistance at $65.59. The ascending lower trendline continues to rise as it nears the apex point. WDC will break through the upper or lower trendline as it nears the apex point. The daily RSI is rising through the 53-band. Fib pullback support levels are at $59.96, $57.21, $52.60 and $49.36.

Western Digital’s average consensus price target is $84.16, and its highest analyst price target sits at $118.00. The daily anchored VWAP support sits at $53.12.

Actionable Options Strategies

WDC bulls can enter on pullbacks using cash-secured puts with trail stops under the anchored VWAP. A wheel strategy can be implemented upon being assigned shares and writing covered calls to generate income.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.