4 Reasons to Consider Adding General Mills to Your Portfolio

General Mills Inc. (NYSE: GIS) is a global branded consumer and pet food product manufacturer. The consumer staples sector leader has a portfolio of over 100 brands that range from cereals, snacks, ice cream, and yogurt to baking mixes, pet foods, and frozen and shelf-stable foods and meals. The company competes with Kraft Heinz Co. (NASDAQ: KHC), Hormel Foods Co. (NYSE: HRL), PepsiCo Inc. (NASDAQ: PEP), and Post Holdings Inc. (NYSE: POST). With so many choices of stocks, here are four reasons to consider adding GIS to your portfolio.

1) General Mills Has an Iconic Brand Portfolio

Chances are you were introduced to Generals as a child eating your cereal in the mornings. Its brands cater to the whole consumer lifecycle. Its iconic cereal brands include Cheerios, Cooke Crisp, Cocoa Puffs, Dunkaroos, Kix, Wheaties, Lucky Charms, and Cinnamon Toast Crunch. You may have had Bisquick pancakes, Yoplait, or Oui yogurt as part of your breakfast routine. You may find yourself snacking on Nature's Valley granola bars, Fiber One, or Lara bars throughout the day. For dessert, you treated yourself to Haagen-Dazs ice cream or baked Betty Crocker cupcakes. These are just a fraction of the over 100 brands in General Mill's portfolio. Don't forget to feed your puppies their Blue Buffalo kibble and snacks.

2) General Mills’ Resilient Business Model Has Stood the Test of Time

General Mills has been producing foods since 1866, even before the stock market existed, as a flour mill. The merger of Washburn Crosby Co. and several flour mills created General Mills in 1928. It went public on the New York Stock Exchange on November 30, 1928, and has paid a dividend every single year since then, making it one of the original Dividend Aristocrats. The company has lasted through every economic boom and bust cycle, bull and bear market, economic expansion, and recession and continues to thrive.

The company recently affirmed its fiscal full-year 2025 guidance of flat to 1% growth in organic sales and adjusted EPS between -1 and 1%. Its fiscal first quarter of 2025 earnings are due pre-market on September 18, 2024. Goldman Sachs started its coverage with a Buy rating and a $76 price target.

3) General Mills Continues to Innovate

To survive 96 years on the NYSE requires innovation to stay on top of trends. General Mills is actively innovating and expanding its brand and product portfolio, catering to ever-evolving consumer preferences. General Mills recently launched Cheerios Veggie Blends, which are made with a quarter cup of fruit and veggies per serving, exclusively available at Walmart Inc. (NYSE: WMT) stores. Nature Valley Protein Smoothie Bars make for a great morning smoothie alternative. Nature Valley French Vanilla Protein Granola offers 13 grams of protein per serving.

The company has also invested in artificial intelligence (AI) to analyze and leverage customer data for targeted marketing campaigns and product and recipe innovations. AI is also used to predict consumer demand and optimize inventory and supply chain management to grow efficiencies. The company has a generative AI internal assistant, MillsChat, to aid employees in writing, summarizing, and enhancing productivity.

4) The Valuation and Dividend Are Attractive

General Mills is a dividend aristocrat paying out a 3.20% annual dividend yield. As a consumer staples sector leader, the stock is a resilient defensive hedge during economic downturns and falling stock markets, as evidenced by its 52-week highs being hit during the market sell-off in September 2024. The stock trades at a modest 19.49x forward earnings, price-book at 1.84x, and price-sales at 0.89x. The stock has proven to be historically resilient in bear markets, generating a 9% return during the real estate crisis and financial meltdown of 2008.

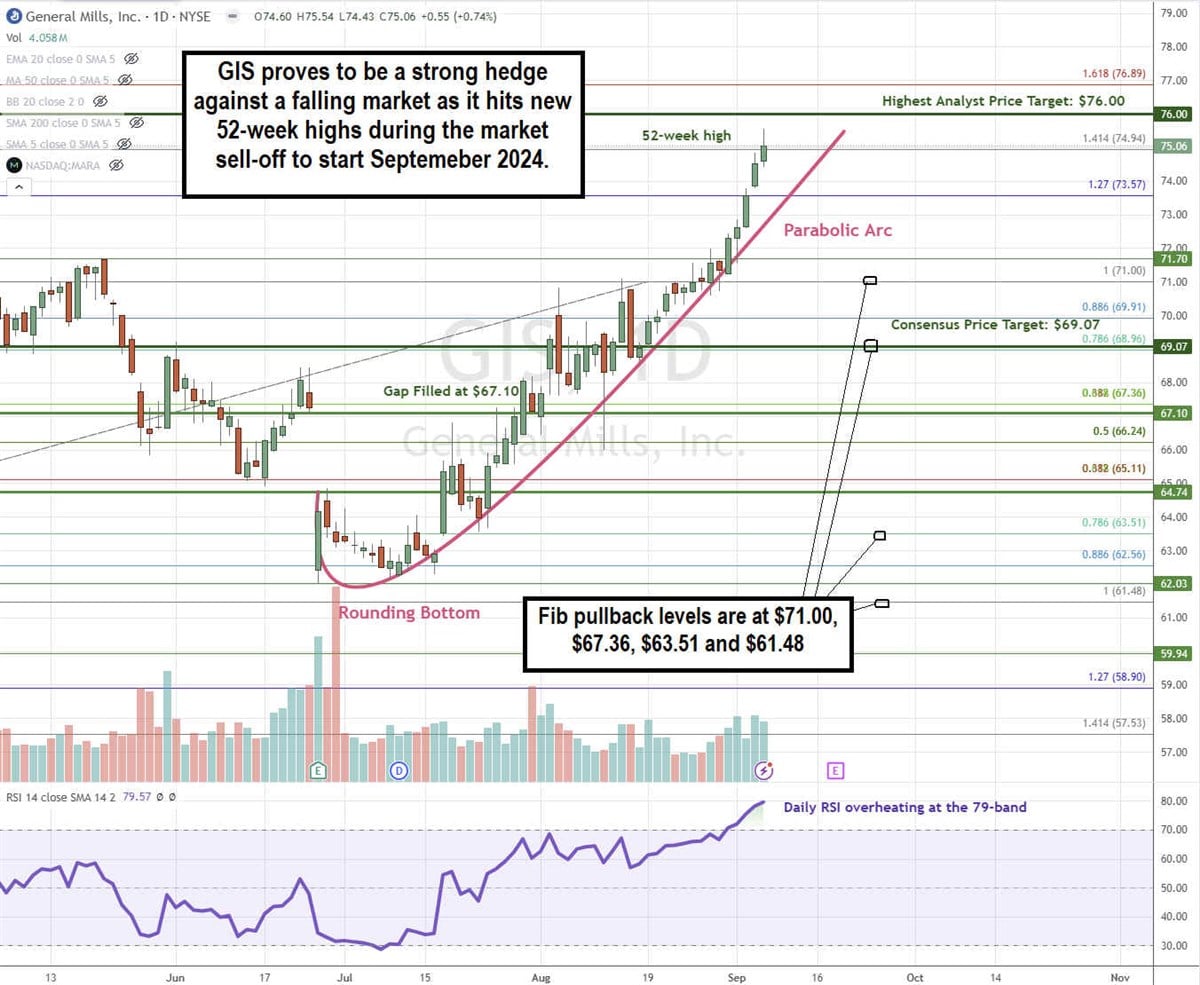

GIS Stock is in a Parabolic Arc Pattern

A parabolic arc usually precedes a price peak. The stock forms a rounding bottom and then gathers momentum as it surges past previous resistance levels and continues to gain momentum until hitting new highs.

GIS formed a parabolic arc after bottoming out on its fiscal Q4 2024 earnings gap to $61.48 on June 26, 2024. GIS formed a rounding bottom and lifted to complete the upside gap fill at $67.10. GIS gained momentum and accelerated to new 52-week highs at $75.54, just shy of its highest analyst price target. The daily relative strength index (RSI) is overheating at the 79-band. Fibonacci (Fib) pullback support levels are at $71.00, $67.36, $63.51, and $61.48.

General Mill’s average consensus price target is $69.07, and its highest analyst price target sits at $106.00.

Actionable Options Strategies: GIS’s parabolic arc runup ahead of earnings suggests a potential sell-the-news reaction. Bullish investors should wait until after they report earnings pre-market on September 18, 2024, to selectively enter on pullbacks using cash-secured puts at the fib pullback support levels to buy the dip and write covered calls to execute a wheel strategy for income on top of the 3.20% annual dividend yield. Remember that if GIS falls to the lower fib levels, the annual dividend rate will rise.

A Poor Man’s Covered Call (PWCC) strategy is a less capital-intensive way to collect income. It involves buying deep-in-the-money (ITM) back-month calls or even LEAPS and selling out-of-the-money (OTM) front-month calls. The Theta erosion on the back-month calls is slower than the front-month calls to enable premium income. Don't use margin on the options contracts, as you'll be paying margin interest, which eats into your premiums.

More News

View MoreRecent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.