Microsoft Stock Holds Steady as AI Drives Workforce Shift

Microsoft Corporation (NASDAQ: MSFT) stock continues to be a strong performer in 2025. The company continues to deliver revenue and earnings that are higher year-over-year (YOY). However, some of the gains in the stock are due to the company’s efficiency efforts.

Microsoft Corporation (NASDAQ: MSFT) stock continues to be a strong performer in 2025. The company continues to deliver revenue and earnings that are higher year-over-year (YOY). However, some of the gains in the stock are due to the company’s efficiency efforts.

In June, Microsoft announced its third round of layoffs for 2025, with the cuts scheduled to take effect in July. This follows two earlier rounds:

- About 1,900 jobs were cut in January, primarily in the gaming division. The company attributed these layoffs to integration efforts and role overlap.

- In May, approximately 6,000 employees—roughly 4% of Microsoft’s global workforce—were let go, targeting roles in sales, support, and engineering. These cuts were linked to efficiency gains driven by artificial intelligence (AI).

The size of the recent layoffs has not been announced. However, Microsoft has said that the cuts will primarily target the sales team and other customer-facing roles.

On one hand, layoffs are generally bullish for a company’s stock because investors view them as boosting earnings. On the other hand, Microsoft is not the only company making these moves. Many leading companies in the tech sector have announced layoffs, including Meta Platforms Inc. (NASDAQ: META), Amazon.com Inc. (NASDAQ: AMZN), and Alphabet Inc. (NASDAQ: GOOGL). These companies also cite AI as a reason for the cuts. However, these layoffs have a real economic impact on consumers that may not be visible for a company like Microsoft for several quarters.

Job Cuts Frequently Have Multiple Catalysts

It’s important to look beyond what any company states when it comes to layoff announcements. The same applies to Microsoft. It's reasonable to believe that increased efficiency from AI is a key factor. However, there are two other reasons investors should consider. One is bullish, while the other could be a concern.

The bullish case is that the company is “right-sizing” itself after making several acquisitions in the past few years (e.g., Nuance, Activision). It’s common for large corporations to shed staff after the acquired company has been absorbed.

However, another reason for the cuts may be in anticipation of slower, or even declining, growth in areas such as personal computing and hardware. This has shown up in recent earnings reports even as the company continues to post strong growth from the cloud and AI.

Microsoft Stock Stuck In a Range, But the Bulls Are Still in Charge

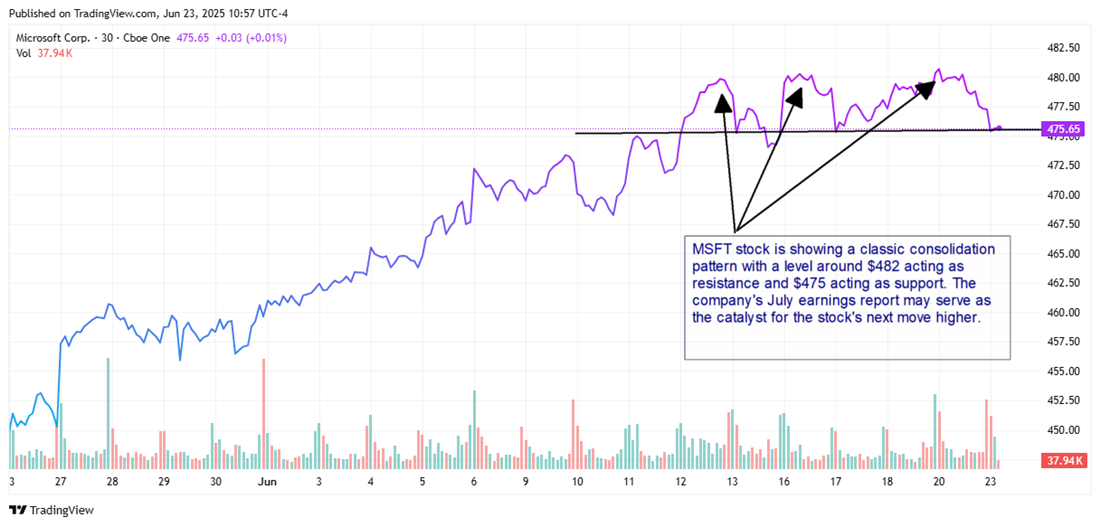

Despite some negative headlines, MSFT stock has had a strong run over the past month. It's been climbing steadily to an all-time high (ATH). However, on several occasions, the stock has faced resistance just below $482. Since then, the stock has been bouncing between that level and around $475, which is now acting as a level of support.

This consolidation pattern is common after a rally, particularly as we enter the summer months, which typically bring lower volume. In the case of Microsoft, traders and investors are likely taking this period before the company’s earnings report in late July to catch their breath before pushing the stock higher.

The Microsoft analyst forecasts on MarketBeat give MSFT stock a Moderate Buy rating with a consensus price target of $515.68. That’s a gain of around 7.8% from its June 23 price. On June 13, Wells Fargo & Co. (NYSE: WFC) reiterated its Overweight rating and raised its price target to $565 from $515.

If the company’s upcoming earnings confirm that bullish sentiment, patient investors who nibble at MSFT stock today may be rewarded with a strong upward move in the second half of 2025.

Where Should You Invest $1,000 Right Now?

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.