Mortgage Lock Activity Fell in November as Interest Rates Hit Their Highest Levels Since July

News Source: Optimal Blue

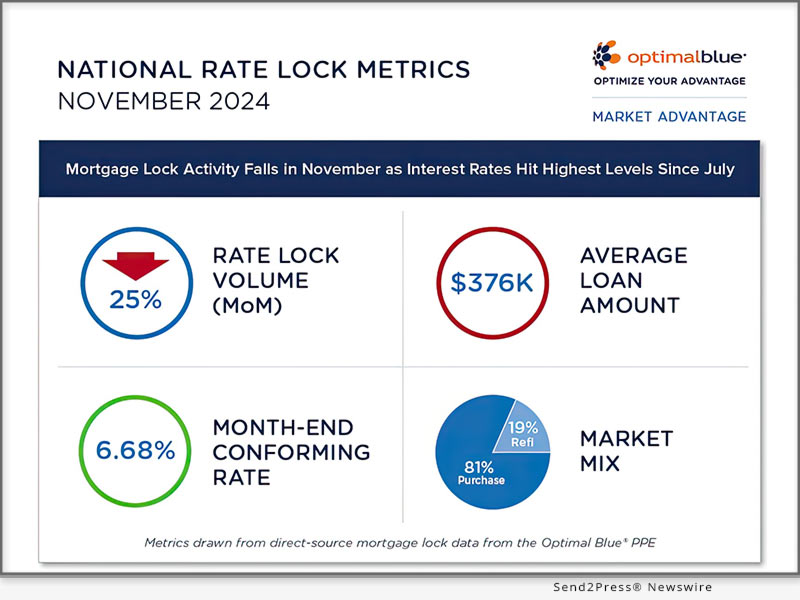

Optimal Blue's November 2024 Market Advantage mortgage data report finds overall rate lock volume down 25% month over month, yet 12% higher year over year, providing some reason for optimism

PLANO, Texas, Dec. 10, 2024 (SEND2PRESS NEWSWIRE) — Optimal Blue today released its November 2024 Market Advantage mortgage data report, highlighting a 25% decrease in month-over-month (MoM) lock volume as interest rates hit their highest levels since early July, creating headwinds for affordability.

Image caption: Optimal Blue November 2024 Market Advantage mortgage data report.

Purchase lock volume was down 21% MoM, while cash-out and rate-and-term refinance volumes fell 20% and 50%, respectively. However, year-over-year (YoY) metrics show resilience in the market, with total rate lock volume up 12% from November 2023, purchase volume up a modest 5%, and cash-out and rate-and-term refinances increasing 35% and 95%, respectively, sparking optimism among market watchers.

While high rates prevailed for much of the month, they dropped slightly in the week leading up to the Thanksgiving holiday. The OBMMI 30-year conforming fixed rate index, the benchmark that will be used as the underlying price for CME Group’s new Mortgage Rate futures, finished the month down 11 bps from October. FHA and VA 30-year rates fell as well, closing the month down 7 bps and 20 bps, respectively. The 30-year jumbo rate showed a slight increase to close the month, up 16 bps from the end of October.

Product mix changes mirrored the month’s affordability concerns. FHA loans, which offer as little as 3.5% down and more lenient credit requirements, gained share at the expense of all other loan types, notching up another three-quarters of a point to account for 20% of total production. That puts FHA market share back near its peak of just over 22% of total production in November 2023. VA loan volume fell in November, but is up YoY at 11% of total volume. Government production in total accounted for nearly one-third of loan volume in November.

“The rising percentage of FHA loans indicates affordability continues to be a concern among homebuyers as we move into year-end,” said Brennan O’Connell, director of data solutions at Optimal Blue. “In spite of the recent dip in purchase and refinance activity, we see the YoY improvements in purchase volume, cash-out and rate-and-term refinances as a bright spot.”

Key findings from the Market Advantage report, which are drawn from direct-source mortgage lock data, include:

- Rates dip slightly for conforming and government-backed loans: The OBMMI 30-year conforming averaged 30 bps higher in November, though it ended the month at 6.68%, an 11-bps decrease from October. FHA rates dropped by 7 bps to 6.36%, while VA rates dropped 20 bps to 6.16%. The OBMMI jumbo index rate rose a more moderate 16 bps, ending the month at 6.98%.

- Purchase lock volume softens: Purchase lock volume was down 21% MoM. Also significant, purchase lock counts – which are a key measure for market health that excludes the impact of HPA and volatile refi activity – were down 3% YoY, breaking a two-month trend of positive YoY momentum.

- Conforming loan share continues to fall: Conforming share ended the month below 53%, roughly 20% lower than the peak levels seen in 2020. Non-conforming lending – including both non-QM and jumbo – fell slightly in November. Nevertheless, non-conforming loans remained near their recent market share high at just under 15% – a nearly five-percentage-point increase in market share over the same period last year.

- Refinance demand softens: Cash-out and rate-and-term refinance volumes fell 20% and 50%, respectively. However, YoY metrics provide reason for optimism with cash-out and rate-and-term refinances gaining 35% and 95% YoY, respectively.

- Credit quality holds steady: Average credit scores for purchase loans were flat at 739, while average scores on refinance locks dropped slightly. Cash-out average credit fell 2 points to 695, and rate-and-term average credit dropped 1 point to 730.

- Home prices and average loan amounts dip: In November, the average loan amount dropped from $380.1K to $376.4K. Average home purchase prices ticked down as well, falling from $482.4K to $477.4K.

The full November 2024 Market Advantage report, which provides more detailed findings and additional insights into U.S. mortgage market trends, can be viewed at: https://www2.optimalblue.com/wp-content/uploads/2024/12/OB_MarketAdvantage_MortgageDataReport_Nov2024.pdf.

This month’s Market Advantage podcast features Agha Mirza, CME Group managing director and global head of rates and OTC products, a guest commentator. The podcast can be accessed at: https://market-advantage.captivate.fm/listen.

About the Market Advantage Report:

Optimal Blue issues the Market Advantage mortgage data report each month to provide early insight into U.S. mortgage trends. Leveraging lender rate lock data from the Optimal Blue PPE – the mortgage industry’s most widely used product, pricing, and eligibility engine – the Market Advantage provides a view of early-stage origination activity. Unlike self-reported survey data, mortgage lock data is direct-source data that accurately reflects the in-process loans in lenders’ pipelines.

Nothing herein shall be construed as, nor is Optimal Blue providing, any legal, trading, hedging, or financial advice.

About Optimal Blue:

Optimal Blue effectively bridges the primary and secondary mortgage markets to deliver the industry’s only end-to-end capital markets platform. The company helps lenders of all sizes and scopes maximize profitability and operate efficiently so they can help American borrowers achieve the dream of homeownership. Through innovative technology, a network of interconnectivity, rich data insights, and expertise gathered over more than 20 years, Optimal Blue is an experienced partner that, in any market environment, allows lenders to optimize their advantage from pricing accuracy to margin protection, and every step in between. To learn more, visit OptimalBlue.com.

MULTIMEDIA:

Image link for media: https://www.Send2Press.com/300dpi/24-1210-s2p-opbluenovreport-300dpi.jpg

This press release was issued on behalf of the news source (Optimal Blue), who is solely responsible for its accuracy, by Send2Press Newswire.

To view the original story, visit: https://www.send2press.com/wire/mortgage-lock-activity-fell-in-november-as-interest-rates-hit-their-highest-levels-since-july/

Copr. © 2024 Send2Press® Newswire, Calif., USA. -- REF: S2P STORY ID: S2P122703 FCN24-3B

INFORMATION BELOW THIS PAGE, IF ANY, IS UNRELATED TO THIS PRESS RELEASE.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.