Ruger (NYSE:RGR) Misses Q3 Revenue Estimates

American firearm manufacturing company Ruger (NYSE: RGR) missed Wall Street’s revenue expectations in Q3 CY2024 as sales only rose 1.2% year on year to $122.3 million.

Is now the time to buy Ruger? Find out by accessing our full research report, it’s free.

Ruger (RGR) Q3 CY2024 Highlights:

- Revenue: $122.3 million vs analyst estimates of $137.1 million (10.8% miss)

- EBITDA: $9.94 million vs analyst estimates of $16.96 million (41.4% miss)

- Gross Margin (GAAP): 18.5%, down from 20.5% in the same quarter last year

- Operating Margin: 3.1%, down from 5.2% in the same quarter last year

- EBITDA Margin: 8.1%, down from 11% in the same quarter last year

- Free Cash Flow was $2.62 million, up from -$11.28 million in the same quarter last year

- Market Capitalization: $693.6 million

Company Overview

Founded in 1949, Ruger (NYSE: RGR) is an American manufacturer of firearms for the commercial sporting market.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

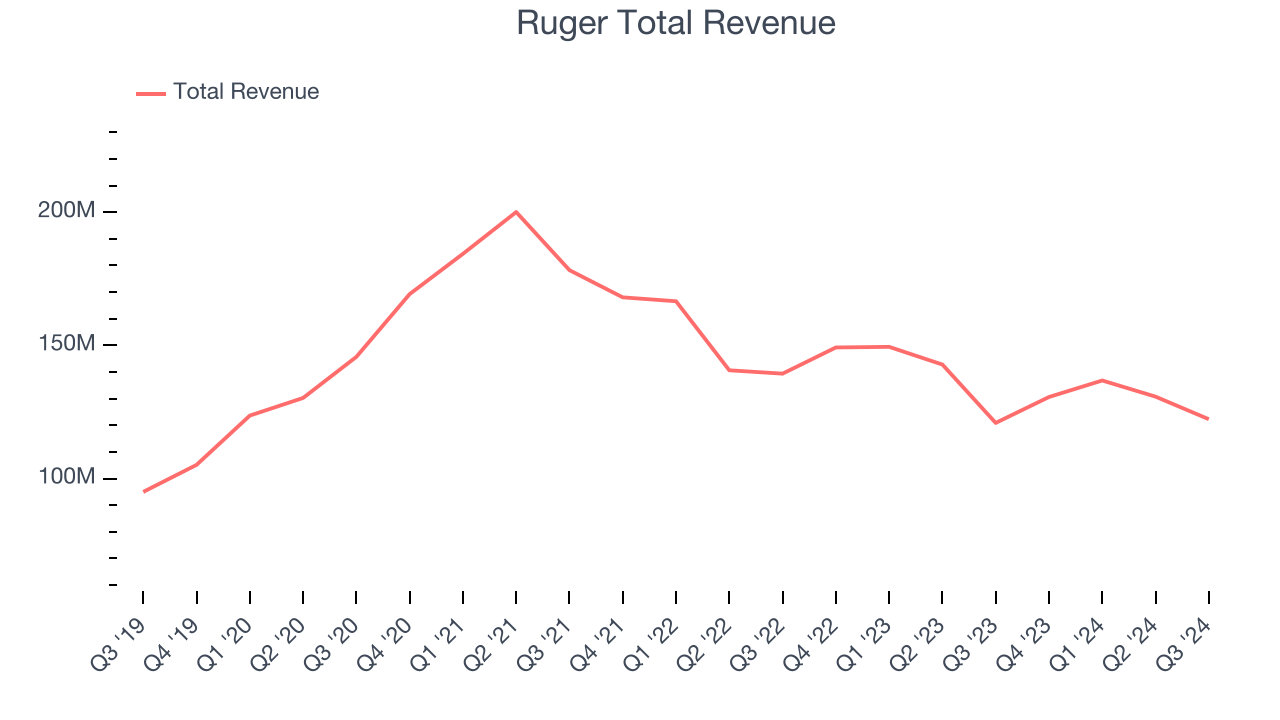

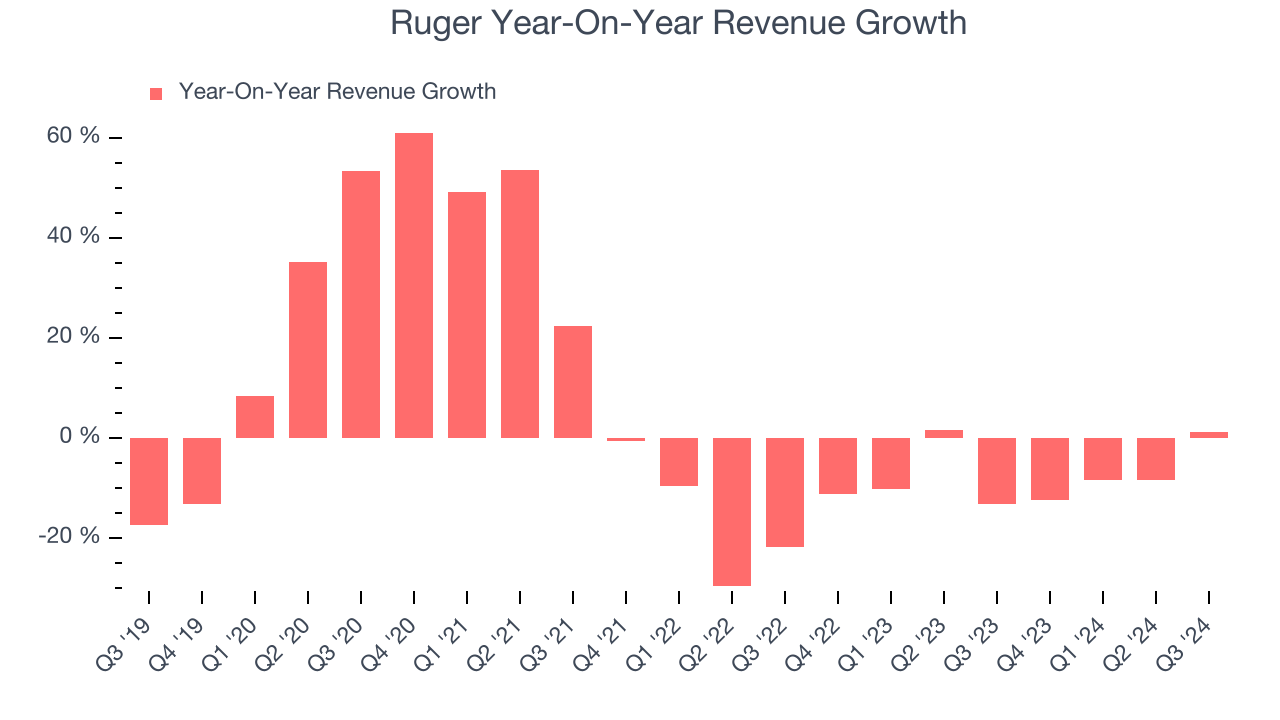

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Ruger’s sales grew at a sluggish 4.1% compounded annual growth rate over the last five years. This shows it failed to expand in any major way, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. Ruger’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 8% annually.

This quarter, Ruger’s revenue grew 1.2% year on year to $122.3 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 7.8% over the next 12 months, an improvement versus the last two years. Although this projection shows the market thinks its newer products and services will spur better performance, it is still below the sector average.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

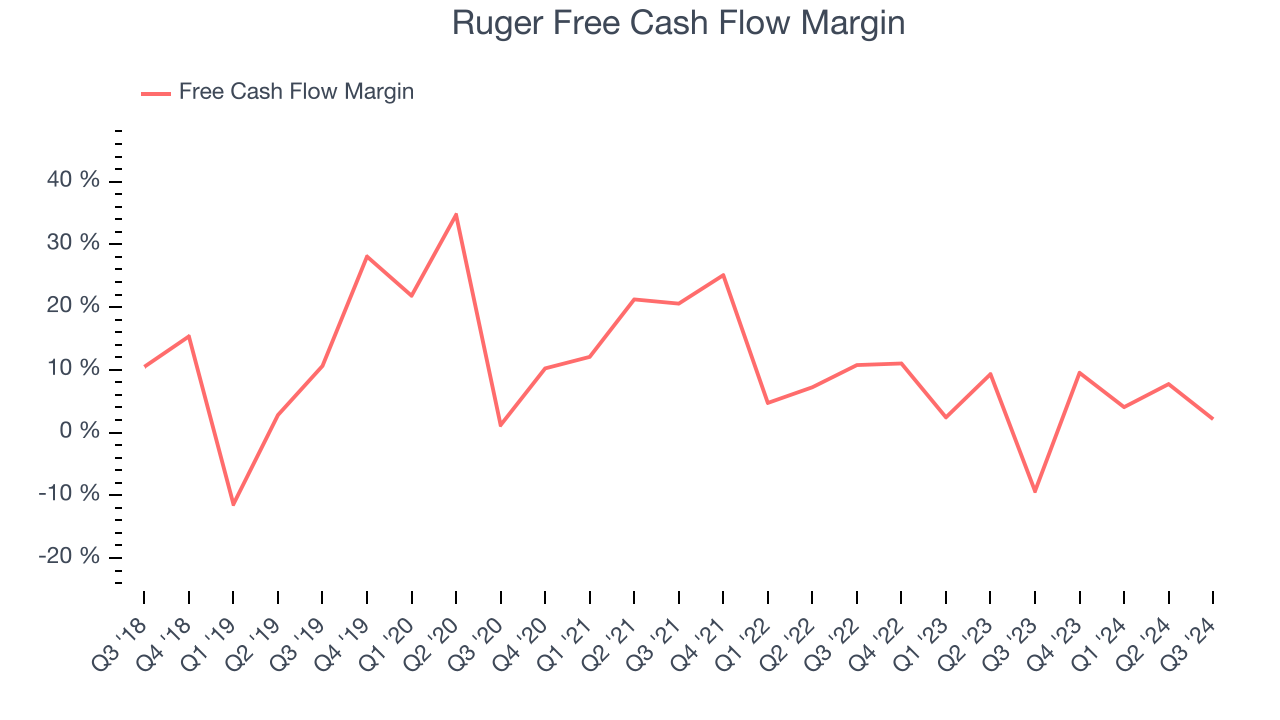

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Ruger has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.9%, lousy for a consumer discretionary business.

Ruger’s free cash flow clocked in at $2.62 million in Q3, equivalent to a 2.1% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

Key Takeaways from Ruger’s Q3 Results

We struggled to find many strong positives in these results. Its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 1.9% to $40 immediately following the results.

Ruger’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.

More News

View MoreRecent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.