Bel Fuse (BELFA) Post Q3 Earnings: Buy, Sell, or Hold?

Bel Fuse currently trades at $90.01 and has been a dream stock for shareholders. It’s returned 548% since November 2019, blowing past the S&P 500’s 87.8% gain. The company has also beaten the index over the past six months as its stock price is up 20.3%. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Bel Fuse, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.Despite the momentum, we're cautious about Bel Fuse. Here are three reasons why you should be careful with BELFA and one stock we like more.

Why Is Bel Fuse Not Exciting?

Founded by 26-year-old Elliot Bernstein during the electronics boom after WW2, Bel Fuse (NASDAQ: BELF.A) provides electronic systems and devices to the telecommunications, networking, transportation, and industrial sectors.

1. Long-Term Revenue Growth Flatter Than a Pancake

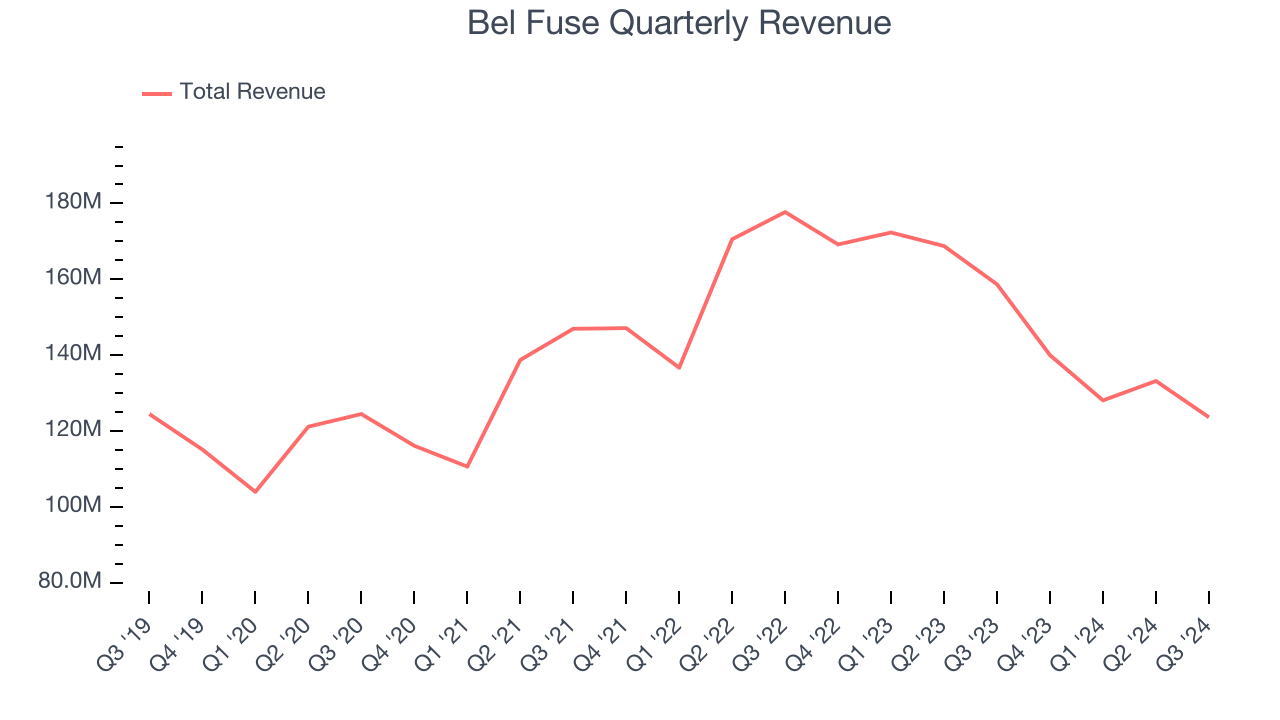

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Bel Fuse struggled to consistently increase demand as its $524.9 million of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a sign of lacking business quality.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Bel Fuse’s management team is currently guiding for a 13.6% year-on-year decline in sales next quarter. Looking further ahead, sell-side analysts expect Bel Fuse’s revenue to grow 2.7% over the next 12 months, an improvement versus its 8.9% annual drops for the last two years. Although this projection implies its newer products and services will catalyze better performance, it is still below the sector average.

3. Low Gross Margin Hinders Flexibility

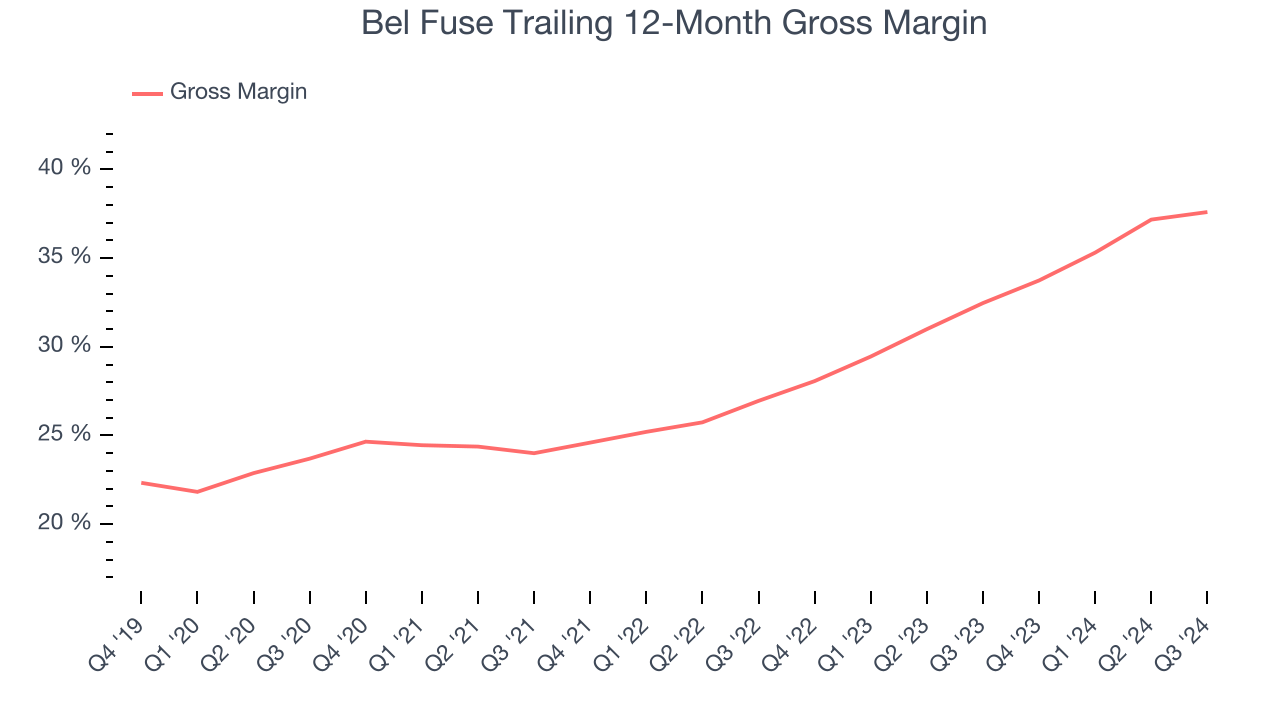

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products and commands stronger pricing power.

Bel Fuse’s mediocre gross margin makes it harder to invest in areas such as research and development. As you can see below, it averaged a 29.2% gross margin over the last five years. Said differently, Bel Fuse had to pay a chunky $70.82 to its suppliers for every $100 in revenue.

Final Judgment

Bel Fuse isn’t a terrible business, but it doesn’t pass our quality test. With its shares topping the market in recent months, the stock trades at 20x forward price-to-earnings (or $90.01 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. Let us point you towards Uber, whose profitability just reached an inflection point.

Stocks We Like More Than Bel Fuse

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.