Personal Care Stocks Q3 Results: Benchmarking USANA (NYSE:USNA)

As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the personal care industry, including USANA (NYSE: USNA) and its peers.

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

The 13 personal care stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 0.5% while next quarter’s revenue guidance was 16.1% below.

Thankfully, share prices of the companies have been resilient as they are up 7% on average since the latest earnings results.

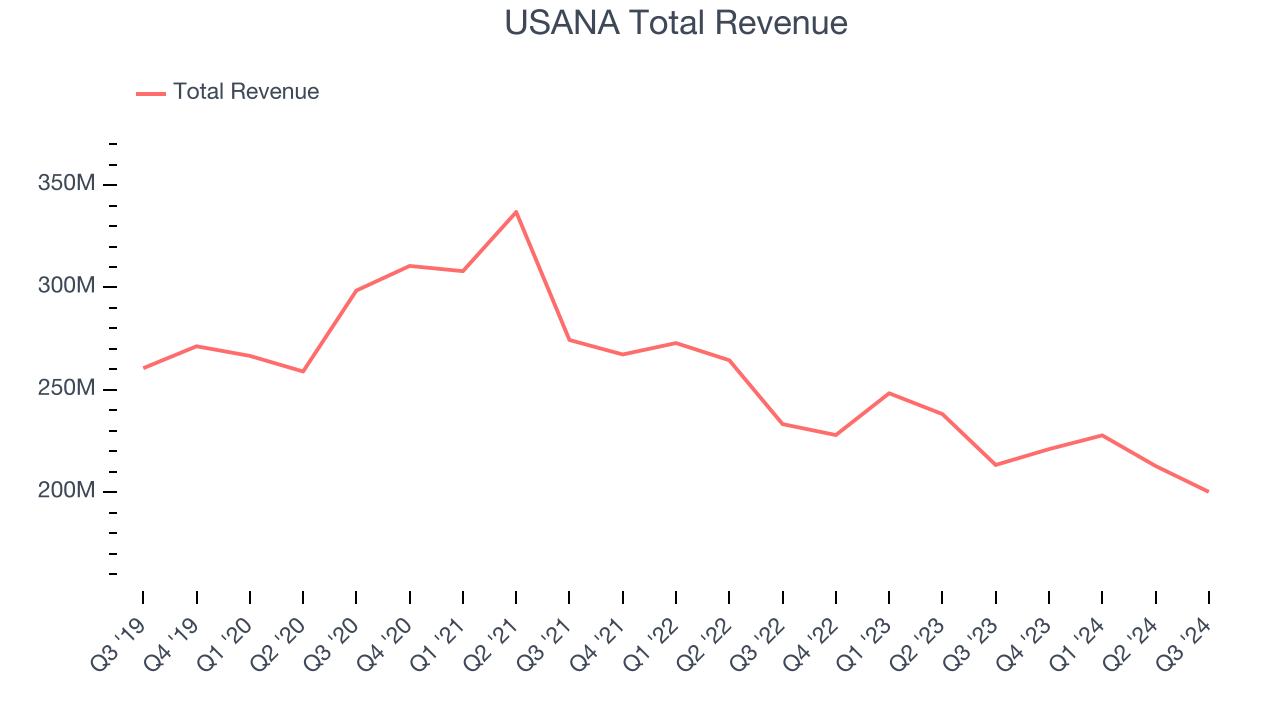

USANA (NYSE: USNA)

Going to market with a direct selling model rather than through traditional retailers, USANA Health Sciences (NYSE: USNA) manufactures and sells nutritional, personal care, and skincare products.

USANA reported revenues of $200.2 million, down 6.2% year on year. This print fell short of analysts’ expectations by 2.7%. Overall, it was a slower quarter for the company with full-year revenue guidance slightly missing analysts’ expectations and a slight miss of analysts’ gross margin estimates.

“Third quarter operating results reflected continued top line headwinds across many of our key markets,” said Jim Brown, President and Chief Executive Officer.

Interestingly, the stock is up 15.3% since reporting and currently trades at $39.70.

Read our full report on USANA here, it’s free.

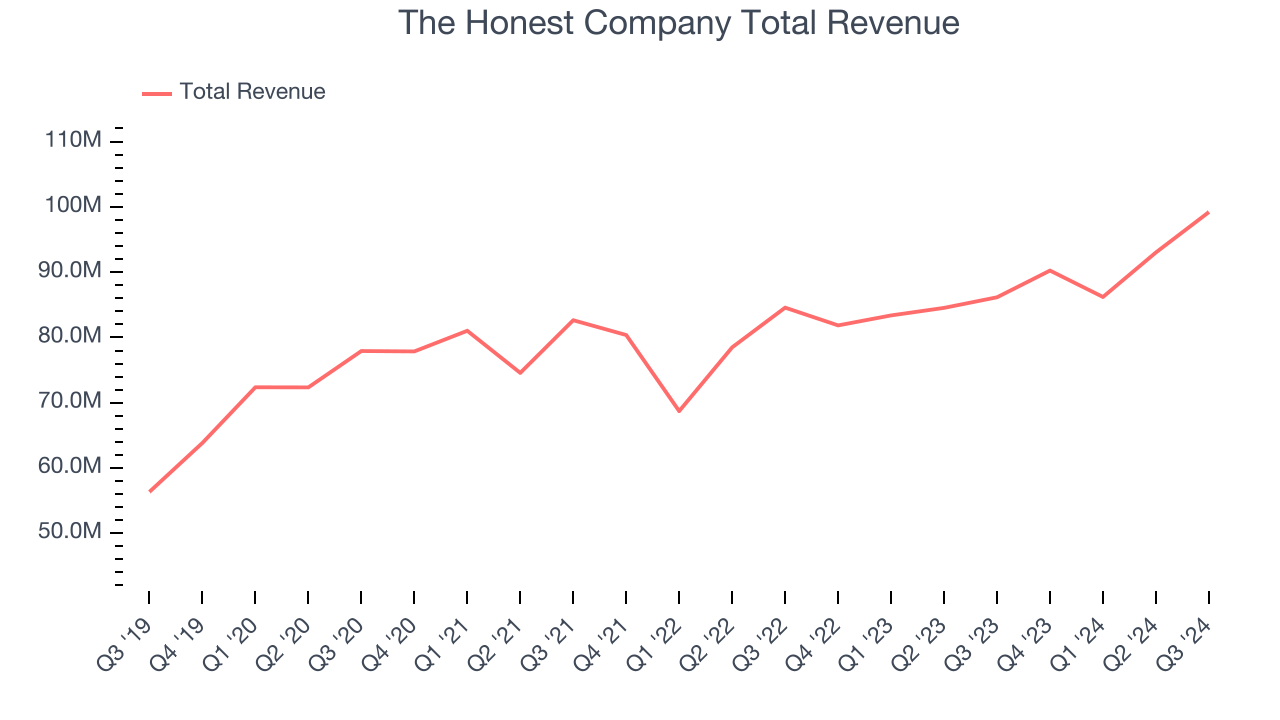

Best Q3: The Honest Company (NASDAQ: HNST)

Co-founded by actress Jessica Alba, The Honest Company (NASDAQ: HNST) sells diapers and wipes, skin care products, and household cleaning products.

The Honest Company reported revenues of $99.24 million, up 15.2% year on year, outperforming analysts’ expectations by 6.9%. The business had an incredible quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The Honest Company pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 58.1% since reporting. It currently trades at $7.59.

Is now the time to buy The Honest Company? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Nu Skin (NYSE: NUS)

With person-to-person marketing and sales rather than selling through retail stores, Nu Skin (NYSE: NUS) is a personal care and dietary supplements company that engages in direct selling.

Nu Skin reported revenues of $430.1 million, down 13.8% year on year, falling short of analysts’ expectations by 2.5%. It was a softer quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

Interestingly, the stock is up 17.9% since the results and currently trades at $7.59.

Read our full analysis of Nu Skin’s results here.

Inter Parfums (NASDAQ: IPAR)

With licenses to produce colognes and perfumes under brands such as Kate Spade, Van Cleef & Arpels, and Abercrombie & Fitch, Inter Parfums (NASDAQ: IPAR) manufactures and distributes fragrances worldwide.

Inter Parfums reported revenues of $424.6 million, up 15.4% year on year. This print surpassed analysts’ expectations by 2.7%. Aside from that, it was a satisfactory quarter as it also recorded a solid beat of analysts’ EBITDA estimates.

The stock is down 1.1% since reporting and currently trades at $126.74.

Read our full, actionable report on Inter Parfums here, it’s free.

Herbalife (NYSE: HLF)

With the first products sold out of the trunk of the founder’s car, Herbalife (NYSE: HLF) today offers a portfolio of shakes, supplements, personal care products, and weight management programs to help customers reach their nutritional and fitness goals.

Herbalife reported revenues of $1.24 billion, down 3.2% year on year. This number came in 1% below analysts' expectations. More broadly, it was actually a strong quarter as it recorded a solid beat of analysts’ EPS and EBITDA estimates.

The stock is up 30.1% since reporting and currently trades at $8.90.

Read our full, actionable report on Herbalife here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September, a quarter in November) have kept 2024 stock markets frothy, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there's still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.